Has the market rallied beyond reason?

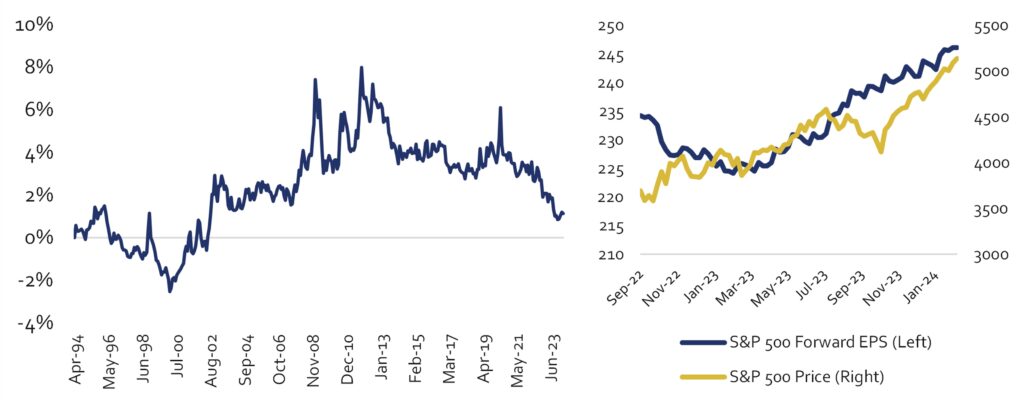

After a stellar 2023 for equity returns, some investors might feel uneasy about what to expect this year. A factor often cited as a sign of froth in equities is the spread between S&P 500 earnings yield and 10-year treasury yield, which has recently hit the lowest in years (Fig. 1), on surface suggesting that equities are overheated. However, one should also consider that the Fed guided for three cuts in 2024 – a fact which the rally of 2023 has been reflecting all along, together with improvement in earnings expectations.

Figure 1: spread between S&P 500 earnings yield and 10-year treasury yield (left); S&P 500 price and earnings expectations (right); as of 29/02/2024

On earnings front, we are already seeing signs of destocking cycle ending and of recovery emerging in sectors that suffered in 2023, such as semiconductors and manufacturing. Easing inflationary pressures are also now acting as a tailwind for many businesses in the form of lower commodity prices and transportation costs (although developments in the Middle East may jeopardize that).

Altogether, we believe the equity market’s valuation reflects improved earnings outlook, as well as reduced macro uncertainty amid evidence that inflation has not become entrenched.

The valuation aspect of Quality

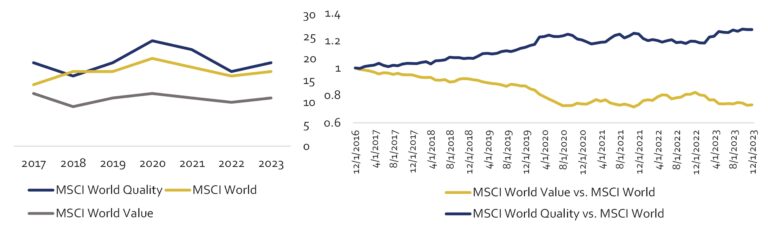

For Quality, 2023 was also a strong year with solid outperformance, while valuation of Quality has expanded after suffering disproportionately in 2022 (Fig. 2). But does it mean that now is a bad entry point into Quality?

Figure 2: Forward P/E (left); price return of Quality and Value vs. MSCI World (right), as of 29/02/2024

Experience of the last two years is a vivid highlight that changes in valuation multiples can cause volatility of returns in the short horizon, but consistently predicting such swings is a futile endeavor. Over the long-run, however, fundamentals trump the short-term noise, leading to outperformance of Quality (Fig.2), despite its above-average valuation. The valuation aspect of Quality is something our clients, rightfully, challenge from time to time. Indeed, as proponents of ‘Quality at Attractive Valuation’ approach, it might come across as counterintuitive that Quality portfolios typically command a premium compared to the market. However, if ‘Quality at Attractive Valuation’ was about buying companies with solid fundamentals, durable competitive advantages and sustainable earnings power at a discount to the market – we, unfortunately, would not have many companies to invest in. While bargains within quality sometimes pop up (just look at Meta’s 11 P/E in October 2022), we typically have to accept that companies we buy will not be optically cheap.

Quality deserves a premium

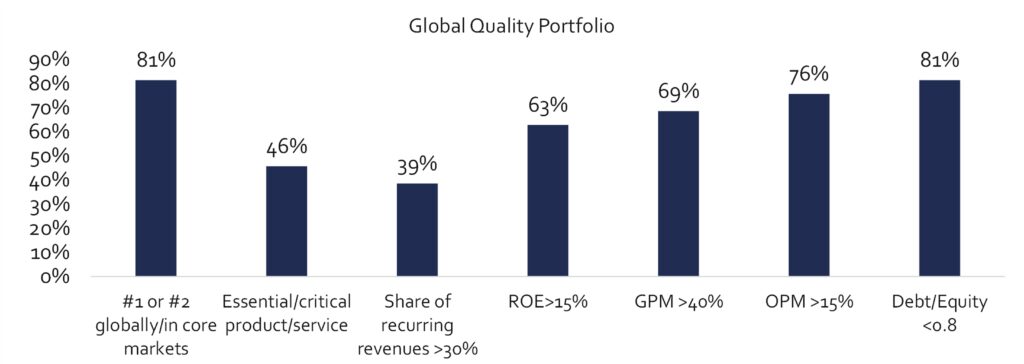

So what is it about Quality that leads to this phenomenon? It is not just about EPS growth. While we take growth into account when assessing valuation, for us, however, EPS growth does not have to necessarily be high – even more important is the question of whether it is sustainable and can at least meet the market’s expectations. This is why even Quality companies with rather modest growth profiles, especially in Consumer Staples (e.g., Costco) and Health Care (e.g., Agilent) sectors can command demanding premiums, as uncertainty about their growth outlooks is lower. Of course, characteristics of the business model also lead to differences in valuation. As Fig.3 shows, Quality companies are, in addition to being superior fundamentally, 1) market leaders with strong economic moats; 2) have high share of recurring revenue; 3) provide mission-critical products or services – all of which are factors that contribute to sustainability of their earnings power. Such companies rarely trade at a discount to the market – and it is not a bad thing.

Figure 3: Quality characteristics; as of 31/12/2023

The story behind the multiples

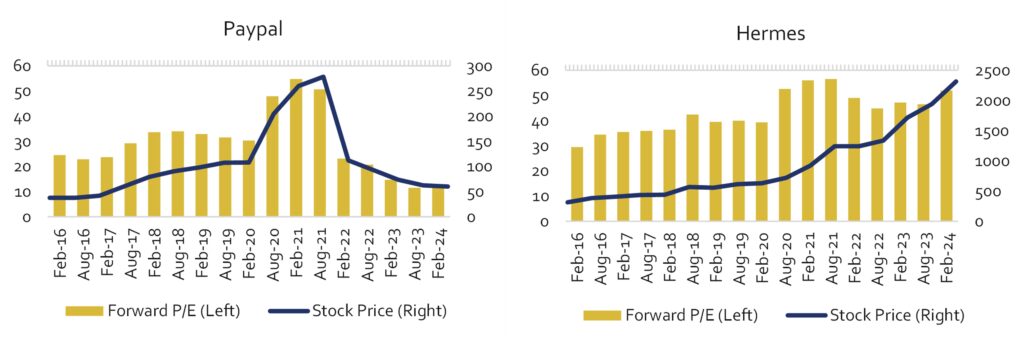

On the contrary, valuation should reflect the strength of a business model: when the story looks good, but the market is not buying it – suspicion should be raised, as it might be a signal of trouble ahead. An example is PayPal, which trades at 11 forward P/E – a bargain for a leader in payments with excellent balance sheet, right? At one point, we, too, fell for this trap, as we held the Company believing the risk-reward is compelling. However, in a price-taking industry that is being rapidly commoditized, the terminal value of the business, the biggest chunk of valuation, is under question. At the other end, some companies always look expensive, such as luxury giant Hermès, which trades at P/E of 45. Even though Hermes is not a high-growth business, the market puts high value on timeless quality and appeal of Company’s products, along with resilience of its business model, which has been proven over more than two centuries.

Such business model differences are crucial to analyze in order to judge whether valuation is fair.

Figure 4: Forward P/E multiples and stock price growth of PayPal and Hermès; as of 29/02/2024

Qualitative analysis in the context of valuation

Valuation is as much art as it is science, and there is no ultimate cheat sheet to approach the topic. However, disciplined assessment of valuation is just as important as evaluation of fundamental quality. Therefore, our assessment of what constitutes an attractive valuation is a comprehensive process that starts with analysis of a range of multiples (P/E is only the tip of an iceberg), but goes far beyond that. Equally important for us is to understand how the multiple looks in the context of the business model, compared to companies of similar quality, and taking into accounts company’s growth outlook and its sustainability.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.