There is a good chance that first half of 2022 has turned out not to be what majority of investors have expected in the beginning of the year. And it would be safe to say that Russia’s “special military operation” in Ukraine has become one of those seldom exogenous events that few could have foreseen, but that have long-term, broad-based cascading consequences on the global scale. After two years under pandemic rule, with vaccines finally available and safety measures removed, global markets were looking forward for things “to get normal again” only to get brutally disappointed. If you want to make God laugh, tell him about your plans, right?

With inflation spiralling out of control both in US and Europe, with gasoline prices skyrocketing and European Union on the verge of energy crisis because of its overreliance on Russian gas, no wonder global growth prospects have become slimmer and slimmer with every passing month. Just in June World Bank has slashed its GDP forecast for 2022 to 2.9% (from 4.1% in January) and warned of 1790s-style stagflation. The world got disrupted once again, not only economically, but politically as well. Countries are expanding their defence budgets, Germany is militarising again, while Sweden and Finland are on the cusp of joining NATO. The question many are thinking is will China be next in claiming Taiwan? The world is on the verge of being divided again, and risks of rising protectionism and economic divergence have never been higher.

No wonder that in these trying times investors have fled Value stocks for safety, with the style outperforming both respective benchmarks and Growth stocks in every market. As quality companies do have Growth tilt, the first half of the year has been difficult, especially for more concentrated portfolios, like Top 8. In MSCI World, Energy (+36%) was the absolute winner in H1’22, especially oil and gas stocks, like Occidental Petroleum, Exxon Mobil or Equinor. At the same time, more defensive sectors, such as Utilities (+2.4%), Consumer Staples (-1.5%) and Healthcare (-2.2%) also managed to outperform broader market by a wide margin. On the other hand, sensitive to consumer spending Discretionary (-25.8%), high-flying IT (-23.5%) and tech-heavy Communications Services (-21.4%) have been sold off the most over first six months of the year.

In Focus – ESG Greenwashing

Don’t judge a book by its cover

Sustainable investments have been experiencing a strong inflow of investor funds for over several years now. These investments are usually referred to as “ESG”- a term that covers three subject matters, namely that of Environment, Social, and Corporate Governance. In a narrow sense, according to Duden, sustainability stands for “a long-lasting effect” – or to put it another way, it means durability. From an economic point of view, ESG can be described as a long-term, solid management. Which, by all means, sounds like a very positive thing.

However, where a lot of money goes, there is a great incentive to present yourself to the outside world in such a way that the greatest possible appeal is generated. And unfortunately, “outside” doesn’t always match the “inside” and this is exactly what “greenwashing” stands for. Originally, the term was used by the environmentalist Jay Westerveld back in 1986 to describe a “save the towel” practice adopted by the hospitality industry. This practice encouraged guests to believe that by reusing their towels they are helping to reduce water consumption and, therefore, aiding the environment. However, the truth was more prosaic – by endorsing this practice, hotels were simply trying to reduce their dry-cleaning expenses and deployed ESG as a fancy cover to do so and get away with it.

Unfortunately, since then “greenwashing” not only did not seize to exist, but it also scaled rather massively. Nowadays, more and more scandalous details are made public, when well-known multinational companies that push ESG narrative turn out to be not green and sustainable at all. And if one looks at ESG-branded funds, the issue becomes even more acute, because in the composition of some such companies can be found that should have never made the cut. Like a mining company that spilled radioactive waste into French and Belgian landfills, which caused cancer, has killed pets and made residents sick. Yes, now they claim to be committed to the recycling of industrial metals, but is it really enough? The root of all problems is that ESG criteria are so broad, blurred and heterogeneous that it does not take a mastermind to find a loophole for a “green” label. Thus, when more than half of the Americans surveyed in 2021 stated that they either hardly believed or did not believe the sustainability statements made by companies, it really did not come out as a surprise.

There are greenlights too

It’s not all bad though and good things happen as we speak. There are companies that are really making a difference or are honestly committed to change, and we are great believers that Quality and Sustainability go hand in hand. First, companies that manage to remain robust over long-term thanks to solid business model, competent management and financial strength – all of which are critical attributes of quality companies- are also sustainable from a business point of view. As a rule, such firms use the input factors (personnel, capital, energy, and other resources) “economically” to achieve as consistent and as high returns as possible.

Moreover, in quality approach Governance is also regarded as an essential element of durable, albeit sustainable, development. As a Chinese proverb says -the fish rots from the head – and it is very applicable to the business world. Diversity, experience, commitment, and independence – these are essential qualities of governing bodies to ensure sustainable, long-term corporate development that would benefit the entire system. When the core is strong, the chances to succeed are much higher, and when things are good, companies have more capacity and resources to dedicate to ESG.Moreover, in quality approach Governance is also regarded as an essential element of durable, albeit sustainable, development. As a Chinese proverb says -the fish rots from the head – and it is very applicable to the business world. Diversity, experience, commitment, and independence – these are essential qualities of governing bodies to ensure sustainable, long-term corporate development that would benefit the entire system. When the core is strong, the chances to succeed are much higher, and when things are good, companies have more capacity and resources to dedicate to ESG.

Outlook – How bad should it get before it becomes better?

More clouds on the horizon

On July 11th, physical gas flow through Nord Stream 1 pipeline that brings Russian gas into Germany has essentially fallen to zero. Officially – due to a scheduled annual maintenance that will last for twelve days, while unofficial message is loud and clear – you imposed sanctions, and we cut you off the vital energy artery. Officials in the sector have already estimated that household energy costs in the country are likely to triple as a result. In the remaining parts of Europe, situation is not much rosier either. According to OECD, already in the 12 months leading to March 2022, average home energy costs in EU jumped by 41%.

On the other side of the Atlantic, market participants are getting vocal about the potential housing bubble. Strong pandemic-induced demand, coupled with slow construction, material inflation, and supply chain constraints, have caused historic housing shortage in US, while supply-demand imbalance resulted in the soaring market prices. In 2022, the demand was so fierce that real estate agents were pitting buyers against each other, while builders were artificially limiting sales and were adding escalation clauses into contracts, allowing them to lift prices as costs increase. According to Realtor.com, the median listing price in US hit another record high in June and stood at $450,000, up almost 17% year-over-year. However, as country grapples with record high inflation and Federal Reserve is accelerating key interest rate hikes, rising mortgage rates most likely will push breaks on the demand. Market softening is already seen throughout the entire country – U.S. homebuilding plunged by 14.4% to a 13-month low in May, permits tumbled and sentiment among the nation’s homebuilders has also fallen for the sixth straight month in June.

Figure 1 Impact of the increase in energy prices on households’ budget for rural and urban households (as a % of total spending) (Source: OECD, Eurostat)

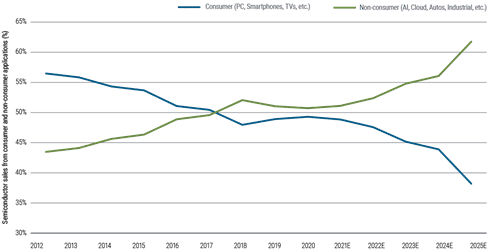

Another uncertainty is brough by semiconductor industry. Since the last downcycle, the rhetoric has been rather straightforward – because chip industry nowadays powers almost every aspect of global economy, it has been gradually transitioning from being cyclical to secular. What used to be a “boom and bust” sector, whose growth was tightly correlated with GDP growth, nowadays is regarded as omni-present, hence different. Whether this theory holds true or not is to be seen and quite soon – with earnings season unfolding, there are already first signs of broader weakness in the chip sector after nearly two years of strong demand. Because of subdued consumer spending and supply chain disruptions, global PC shipments have already declined by 12.6% in Q2 according to Gartner – the sharpest drop in nine years. Smartphone market has also shown signs of weakness, with global sales down by 4% MoM and by 10% YoY in May. However, if non-consumer market remains strong, semiconductor sector will find itself in a turnaround after all.

Figure 2 Share of semiconductor sales by application – demand continues to diversify beyond the consumer (Source: Bank of America, IDC, HIS)

Quality companies are well positioned

As already highlighted multiple times throughout this Review, environment of the first six months of 2022 was beset by many uncertainties and, so far, many risks remain. Given tough global macroeconomic and political developments it was not a surprise that investors exhibited tendency to abandon growth and turn to value within equity, as well as favour other, lower risk asset classes.

What was surprising was that the importance of being invested in fundamentally sound companies has been largely neglected. As a result, highly profitable companies with continuing good growth figures and, in the opinion of HQAM, attractively valued, were sold off as much as, or even more than companies with a lot of rightful speculation about their future. We have been consistently highlighting that sustainable fundamental quality remains an attractive long-term investment even in these trying times because, among other things, they can withstand different headwinds, let it be inflation or rising interest rates. And there is a number of factors that contribute to this remarkable durability.

Quality companies are highly profitable and, as a rule, have lower operating leverage; therefore, their profits are less sensitive to revenue fluctuations. Moreover, quality companies are mostly leaders in their industry or niche and they retain this leadership position by, among other levers, remaining innovative. Thus, investments in research and development are one of the top priorities for such firms, and this is an activity they can easily afford thanks to above mentioned high level of profitability.

Being a market leader in a particular field also makes it possible for a company to dictate the price for the products or services it sells, thus keeping the profit margins at a high and stable level. Even if the input prices (like raw materials, wages) fluctuate or rise, which is an especially acute problem nowadays.

Also, one of the key features of Quality companies is strong Balance Sheet and significantly lower financial indebtedness than an average company in the benchmark has; thus, these companies would be less affected by looming hikes in key rates. Capital intensity, which measures the need for capital to earn certain profit, is another criterion in which quality companies enjoy a good position in a climate of rising interest rates and inflation. Quality business are usually less capital-intensive than the benchmark average, meaning they are less affected by rising input costs and can react to the fast-changing realities with more flexibility.

Given all the above mentioned, although we can’t see into the future, history can teach us a good lesson. And this lesson is that Quality companies have a very good track record of showing resilience, fundamental strength, and the ability to navigate through tough waters.

f you would like to have further information about our current positioning and outlook, you can access our latest Quality White Paper.