The year of AI

On February 14th 2023 we published our first CE insight devoted to AI and potential winners from the ongoing revolution – an equally weighted basket of stock picks mentioned in this article delivered a whopping 124% return (USD) as of end of March 2024, we also correctly mentioned the 2 biggest winners – Nvidia and Meta. We heard a lot of new buzzwords during earnings calls and equity market returns were largely attributed to Magnificent 7 gains that are natural winners as they provide infrastructure, have access to many clients, have data to build the models and capital to deploy these models at scale. Easy gains are over.

Who are the next winners?

In March 2024 Goldman Sachs published their framework dividing the winners into 4 stages – 1) Nvidia (for obvious reasons), 2) AI infrastructure 3) AI-enabled sales and 4) AI Productivity. We are somewhere in the middle of Stage 2 – capex investments into infrastructure – we see semiconductor design (ARM, AMD, Broadcom), memory (MU) and manufacturing equipment (Applied Materials, ASML) benefitting. Plus, there are data centers (Equinox), utility companies to power those data centers (Vistra, NRG Energy and Duke) and cloud providers (Amazon, Microsoft) that enjoy AI momentum.

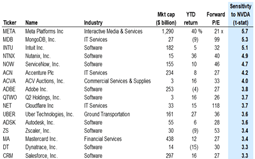

But we think that it already makes sense to concentrate on Phase 3 and 4. Many software and IT services companies have already outlined their strategies for leveraging AI. Goldman conducted a survey of the industry to identify firms with high beta that have been tracking with Nvidia’s performance. They focused on companies whose leaders explicitly discussed AI during their most recent quarterly earnings calls with investors. This approach produced a lengthy list of businesses, of which the top 15 are highlighted here.

We have 5 out of 15 titles in our portfolios – Meta that invested $10 bn in 2022 in their AI infrastructure to better target ads, Accenture which has around $2 bn run rate in GenAI consulting projects, Adobe that rolled out its Firefly product to creative professionals, Autodesk which says that skilled engineers spend 40% of their time on low-value-added tasks and Salesforce that have has the ability to apply AI to reaching better sales outcomes which is crucial and immediately boosts business results.

AI Productivity

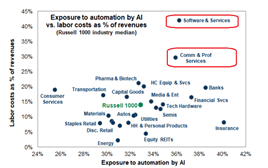

Eventually, the AI trade will focus on companies that are using AI to improve productivity – across a wide range of industries – with the biggest potential likely to be in more labor-intensive industries. Goldman analyzed the data and concluded that companies in the software and IT services, as well as commercial and professional services sectors, stand to gain significantly. This is largely because many of their highly paid employees work in positions that could be automated by AI, potentially slashing labor costs for these firms.

As an example of such businesses one can mention Automatic Data Processing and Paychex – HR management and payroll services, SAP – ERP software, IBM – at the center of software and business processes and outsourcing companies like Cognizant, Infosys and Tata.

Anyone could be a winner

There are few important points to bear in mind for the future – large language models (LLMs) like ChatGPT will gain massive adoption and offering will be hardly distinguishable. There will be very little difference between ChatGPT, Bard, Perplexity, Claude or Mistral so companies already having access to clients and providing corporate clients business software (Microsoft, Amazon, Google) will have the biggest chances to win this race. So, all the companies will be equipped with roughly the same tools, and it is important how these tools will be implemented in every organization. Companies with a culture of innovation and technology first-adopters will gain competitive advantage and future margin profile.

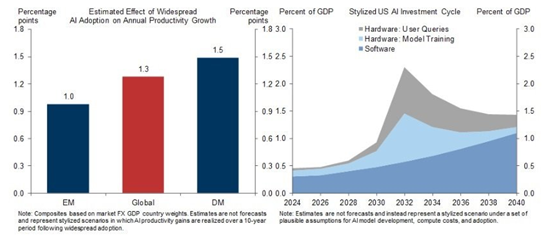

If we try to see the picture in a broader context Goldman Sachs’ latest research shows optimism for GenAI’s long-term potential. It could boost labor productivity growth by 1.5 percentage points annually over a decade, adding 0.4 percentage points to GDP growth.

Unlike the stock market, real-life adoption follows a completely different trajectory. Currently, very few companies have generated incremental revenue from AI products; therefore, everyone is observing what management has to say about its potential across various sectors of the economy. Additionally, according to some investment manager questionnaires, last year’s winners – once touted as beneficiaries – are now, in some cases, dismissed as losers. This trend is likely to persist for some time, and volatility should be expected. Buying hype stocks such as Soundhound, which have risen fivefold on the back of Nvidia’s PR alone, is highly questionable. However, solid quality companies that are exposed to the AI sector offer attractive opportunities. Because, this technology is here to stay and will change our lives – just recently, renowned hedge fund manager Steve Cohen said that he believes the four-day week could soon become the norm due to AI, and that’s why he has invested in golf. So, get your putter ready!

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.