2021 was another peculiar year, not nearly as wild as its predecessor, but it nevertheless required investors to stay alert, sharp, and sometimes sleepless at night. Although the world is still far away from being Covid-free, global vaccine roll-out has somewhat restored life as we know it, which brought another problem to the table – capacity bottlenecks, component shortages, and supply-chain disruptions.

What initially started in the automotive sector that suddenly found itself lacking chips, has then gradually spread to other sectors and now construction, agriculture and even household goods are struggling to get their hands on shipping containers, secure warehouse capacity and find drivers to move their products around. In October, which is a peak month for Q3 earnings season in US, executives of S&P 500 companies have mentioned the “supply chain” phrase the record number of times. As firms moved closer to the holiday season, the number one question that occupies everyone’s mind is if those bottlenecks will eventually become the “Grinch that stole Christmas”.

Across the ocean, Europe has seen an enormous rise in natural gas prices, causing knock-on effect and exacerbating supply side shock to some businesses. China has shocked the world more than once over the course of last year, with its massive and in a way unprecedented wave of regulatory crackdowns across multiple sectors, followed by worries over real estate crisis as a result of Evergrande default. All that has caused massive spikes in market volatility, especially in September and November.

2021 was clearly another Growth year in Europe and Switzerland, although growth investment style stayed marginally behind Value in US. On the global scale, however, Value managed to beat Growth by a little less than percent. Quality has had a strong run in 2021, especially in Switzerland and Europe, where another year of substantial outperformance was recorded, while Global portfolios trailed respective benchmark weighted down by the USA. In MSCI World, Financials (+29%) and Energy (+42%) sectors made a strong come-back, while Information Technology had another stellar year (+30%). On the other hand, more defensive sectors, like Utilities (+10%), Staples (+14%) and Communications (+15%) trailed general market by a wide margin. Despite rather massive dispersion of returns, every sector finished 2021 in positive territory – both in USA and in EU, as well as in MSCI World.

In Focus – Asia

Trying times

As markets in developed countries continued the bull run, Asian equities remained on the side lines and closed 2021 in red, with MSCI All Country Asia-Pacific down by 1.2%. Spotting the major culprit for the underperformance was not a challenging task – China, which makes up a large chunk of Asia-focused indices, had an eventful year, and not in a good way. Like bullets from a gun, a slew of bad news hit Chinese equities one after another, from regulatory crackdowns to property crisis, to growth slowdown.

The market environment in China echoed throughout the rest of Asia, putting more obstacles on an already challenging path towards recovery. Expected to grow 6.5% in 2021, Asia-Pacific’s economic rebound may seem robust on surface, but the progress was uneven and bumpy, with recurring spikes of COVID-19 infections and initially slow vaccination pace dragging on the economy and limiting equity market gains.

Bearing the brunt of regulatory reforms, Consumer Discretionary sector was the heaviest underperformer, while scrutiny over digital health platforms and drug pricing weighed on Health Care, on top of already waning allure for many pandemic beneficiaries in the sector. Energy stood out as the largest gainer amid red-hot demand for oil and gas to fuel economic recovery.

Quality Stronghold

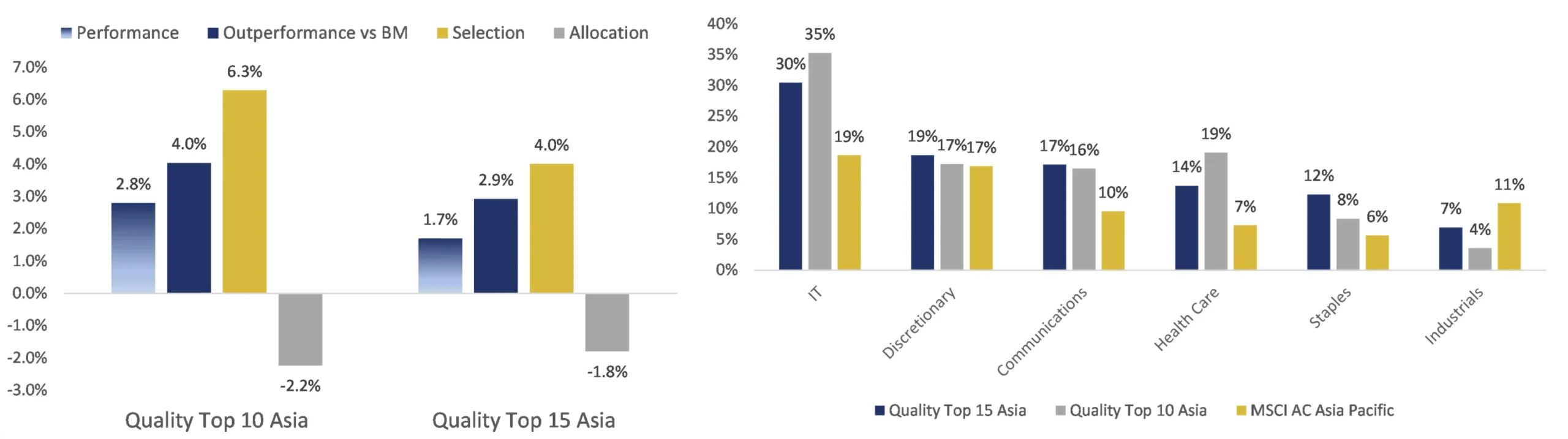

Quality remained resilient during those uneasy times, with both our Quality Top Asia Portfolios managing to close 2021 in a positive territory, driven by the strong Selection tailwind, particularly in Information Technology and Healthcare. Given that the latter was second worst performing sector in the benchmark in 2021 (-14.3%), but in our portfolios it generated return slightly over 3%, this once again underpins our philosophy that true quality company is able to deliver more than both, sector and the benchmark, regardless of the environment being friendly or not.

Fig.1. Outperformance components and Sector allocation of Quality Top Asia Portfolios versus MSCI AC Asia Pacific in 2021 (TR, USD);

Source: Thomson Reuters, Hérens Quality AM

Outlook – Carousel ahead

Quality companies as a safe harbour during inflationary times

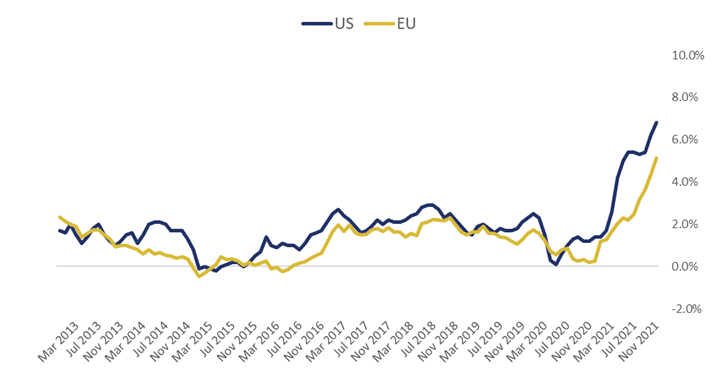

Transitory or not? That’s the main debate going on around inflation, which jumped substantially in the second half of 2021 (fig.2), forcing investors to anxiously monitor monthly announcements of the next batch of the related statistical data. In fact, there is no point in guessing how fast the inflation figures will subside. The key focus should be on making sure that one has excellent selection of the companies in the stock portfolio. In the inflationary environment, the ultimate winners are those companies that have evident economic moat and unquestionable competitive position offering high value-added products. These are the firms, having Quality style characteristics, that are able to pass cost inflation to their customers and, therefore, continue to deliver excellent financial results and grow total shareholder return. Given that there are many price-taking companies in the broader market indices, it is imperative to concentrate on the innovative and competitive price-making enterprises to earn alpha returns, especially when producer and consumer prices are on the rise.

Fig.2. Consumer prices, Y/Y change, not seasonally adjusted ; Source: Hérens Quality AM

Source: Hérens Quality AM

Quality as the Winner in Value- Growth Contest?

Growth stocks have been outperforming value stocks for each consecutive year since 2007. However, last year we saw that the throne of growth stocks was not that solid anymore and typical value industries, such as Energy and Financials, managed to outperform, although growth still succeeded in beating value in the end. The reason behind value-growth rotation, which might become more evident in the future, was that Central Banks began tapering bond purchases and considering lifting interest rates. Higher interest rates negatively influence fair values of high growth companies and, on top of that, it would mean more expensive debt servicing, which might hurt fast expansion intentions. So, we would probably see a seesaw between value and growth next year.

Flee to Value, however, should not bother quality investors even if certain part of their holdings have a Growth style tilt. Quality companies, having significant economic moat, excellent managerial talent, good cash flow generation ability and substantial amount of recurring revenue, are fundamentally robust and well-established to stick to their fast development plans.

Metaverse as a new dimension of development

Deeper digitalization and workplace revolution reinforced by the pandemic was the final step needed to make next wave of tech evolution finally possible – adoption of the metaverse. What used to be a decade-long dream of fiction writers and technologists is now virtually at the arm’s reach. The term “metaverse” has literally exploded in the second half of 2021, with Facebook even renaming itself into Meta Platforms to reflect its commitment to build this virtual world, where people can live, work and play. With consumers all over the world already being comfortable with usage of VR headsets, creation of virtual avatars, spending billions of dollars on digital clothing and accessories and purchasing NFTs, the foundation for the metaverse is laid. Of course, substantial investments are still required to perfect the technologies, but given that big players like Microsoft, Roblox, Epic Games among others have already committed to the development of their own metaverses, this future is already at our doorstep.

Digital space shift is going to be particularly relevant for the B2C companies, which have huge marketing budgets, parts of which are to be dedicated to the expansion of corporate footprint in the metaverse. For instance, Nike and Adidas are among the early birds to be present in the metaverse: Nike created Nikeland, virtual world designed for Nike fans on Roblox, while Adidas has earned $23 million selling its Adidas Originals: ‘Into the metaverse’ collection. No doubt metaverse will be the next big thing, having huge impact in the corporate space.