Fragility

Did someone open Pandora’s box in 2019? In recent years, we have witnessed an endless sequence of global black swan events, with little light at the end of the tunnel, suggesting that this “new normal” may be here to stay. Downside risks to the smooth functioning of capital markets have increased substantially, as political intervention increasingly shapes the business environment and regulatory efforts intensify – a game with no clear winners.

The predictability and visibility of corporate earnings have deteriorated markedly, leading to a significant rise in individual stock volatility1. Against this backdrop, the key question becomes: what should a resilient securities portfolio look like, the one that can withstand fragility while still delivering growth? Below, we outline our answer.

Growth engines

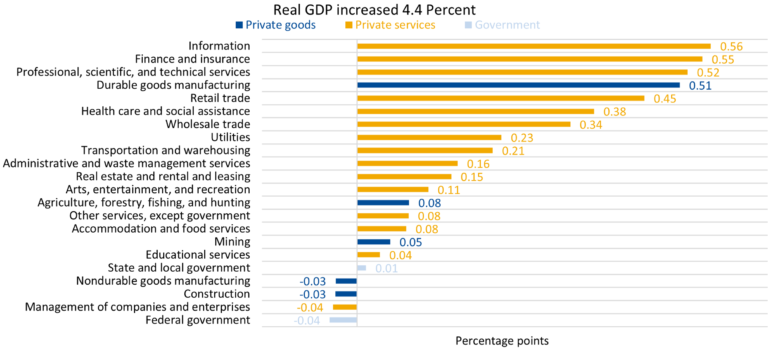

In the current environment, equity market growth is clearly concentrated in a limited number of industries: AI-related segments in the United States, defense in Europe, and the financial sector across both regions. Fig. 1 shows that the largest contributors to U.S. GDP growth in Q3 2025 were the information and financial sectors, together accounting for roughly 25% of total GDP growth. At the same time, AI-related investment remains at an early stage of its cycle. Exposure to these fast-growing sectors is therefore not just desirable, but essential.

Figure 1. Contribution to percent change in real US GDP by Industry group, 3rd Quarter 2025

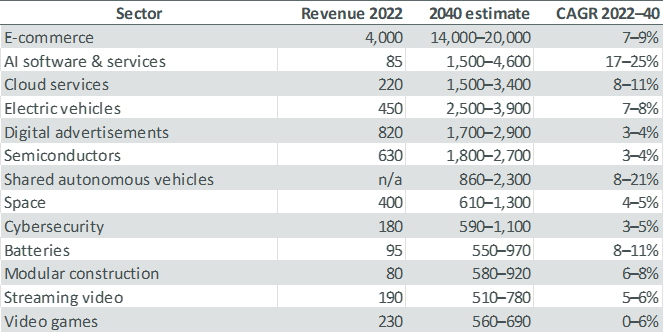

A McKinsey report (Fig. 2) highlighting future arenas of growth suggests that e-commerce will be the single largest contributor, with substantial untapped potential remaining. This expansion is expected to be driven by generational shifts in consumption patterns and increasingly personalized, AI-enabled customer experiences. AI and cloud services – sectors that already attracted significant attention in equity markets in 2025 – are projected to maintain exceptionally high growth rates over the long term.

Figure 2. Future arenas to generate scaled growth

AI as a disruptor or value-adding tool?

Eliminating exposure to disrupted industries that can no longer defend themselves against the rapid advance of AI is becoming increasingly important. Software companies, in particular, are seeing the sustainability of their competitive moats sharply questioned by investors. Disruption is also accelerating in education and legal services, raising critical questions: will companies exposed to these sectors be able to maintain their growth guidance? Can margins be preserved?

Although many of these firms have already experienced significant valuation corrections, it will soon become clear – especially as AI agents move into the mainstream – whether they can withstand this scrutiny or whether further downside lies ahead. By contrast, sectors such as financial services, retail, and logistics are likely to emerge as beneficiaries of AI integration. The adoption of AI tools promises meaningful cost savings and more efficient operations, enabling these industries to enhance productivity and unlock new revenue streams.

Is there a place for Quality stocks?

In 2025, Quality stocks significantly underperformed the broader equity market. This underperformance largely reflects their limited exposure to sectors that led returns – such as defense and financials, traditionally, financially weak sectors – as well as to emerging AI-driven themes. Many early-stage AI beneficiaries have not yet met traditional Quality criteria. At the same time, Quality portfolios have been heavily biased toward SaaS business models with strong financial fundamentals, many of which struggled to defend their competitive positions amid accelerating AI disruption.

As a result, valuations of Quality stocks compressed meaningfully over the course of 2025, increasing the likelihood of a rotation back into the style. A well-constructed Quality portfolio – one that maintains exposure to structural growth themes while remaining diversified with defensive, non-cyclical sectors – should therefore be well-positioned to outperform.

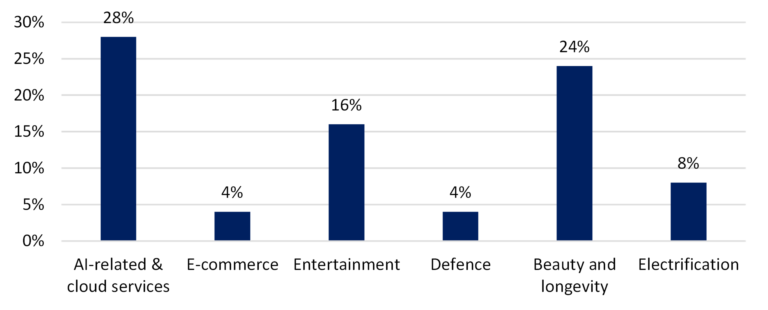

The Global Quality portfolio (Fig. 3) is particularly well exposed to AI-related themes, following the addition of several new holdings over the past year. It also benefits from exposure to the beauty and longevity theme, a secular, long-term growth trend that could accelerate further in the coming years. Additional portfolio adjustments have been made in line with global niches offering the highest growth potential over both, the short and long term.

Figure 3. Exposure of Global Quality Top 25 portfolio to global growth topics

Diversification matters

Given the extremely high volatility and rapid shifts between risk-on and risk-off sentiment, the value of portfolio diversification is higher than ever. Markets now appear to be testing former high-flyers, while future growth is likely to become less concentrated – spilling over into smaller-cap stocks and into industries exhibiting more moderate, but more sustainable, growth. In this environment, diversification across asset classes, regions, and industries becomes not just prudent, but essential.

References

- Hérens Quality AM, How the Global Equity Markets are changing, https://hqam.ch/en/how-the-global-equitymarkets-are-changing/.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.