HQAM Review 2023 – AI Beats Forecasters

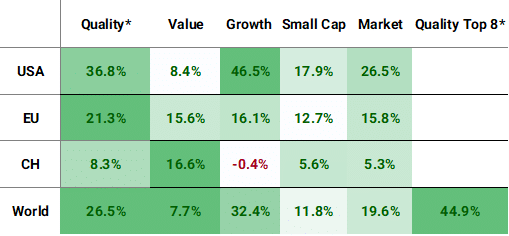

We hope everyone has enjoyed a nice rebound after the painful downside of 2022. The development of AI has helped out technology stocks, primarily the Magnificent 7 (Apple, Amazon, Alphabet, Nvidia, Meta Platforms, Microsoft, and Tesla), in regaining their ground. The weight of the top 7 stocks has reached over 25% of the S&P 500 Index total market cap, significantly influencing the index performance. The anticipation of rates decline next year has positively impacted growth stocks. The growth style clearly dominated this year, returning 46% in the USA, in stark contrast to value stocks, which only grew by 8%. Value stocks experienced additional pressure during a banking crisis in the spring and due to lower oil prices. It is worth noting that the difference in returns between value and growth styles was not as pronounced in European stock markets: 16.1% (Growth) vs. 15.6% (Value).

The quality style performed exceptionally well this year, outperforming market indices in all regions. The most outstanding portfolio was the Top 8, which returned 41%, surpassing its benchmark by more than 20%. Almost all companies in this portfolio, with the exception of one, outperformed their benchmark, MSCI World Index.

Despite an increase in investors’ risk appetite observed across the markets, small caps were unable to keep pace with large caps in 2023. Both in Europe and the USA, they lagged behind the market.

Among the best-performing sectors in the US were Communication Services and IT. IT also performed excellently in Europe, followed by Industrials. The only decliners in the US were defensive sectors – Utilities, Energy, and Consumer Staples. Consumer Staples struggled in Europe as well. Health Care companies, with few exceptions like Novo Nordisk, were the worst performers in Europe last year.

FY 2023 was also characterized as the year of failed forecasting. Traders were mistaken regarding the market movement. It was unexpectedly positive. Macroeconomists and monetary policymakers were not correct regarding inflation and economic growth. The former was slowing down too fast, while the economy and consumer spending (primarily in the USA) remained resilient. The latest US inflation figures indicate that it has calmed down to 3.1%. This has provided a substantial boost to the stock market, giving rise to discussions about cutting rates next year.

Fig.1 Performance (TR) 1H 2023 by regions based on MSCI regional indices (Currencies: USA – in USD, EU – in EUR, CH – in CHF, World – in EUR); * – Hérens Quality Portfolios

You can access the entire annual report via the link below.