GDP growth vs Equity market growth

The Chinese ‘tiger’ has always attracted attention and grabbed investor’s attention. China is leading global tops in terms economic growth surpassing European and US economies. However, does the real economy translate into the returns for equity investors? And does the growth in the real economy follow the growth we witness as shareholders of the Chinese companies?

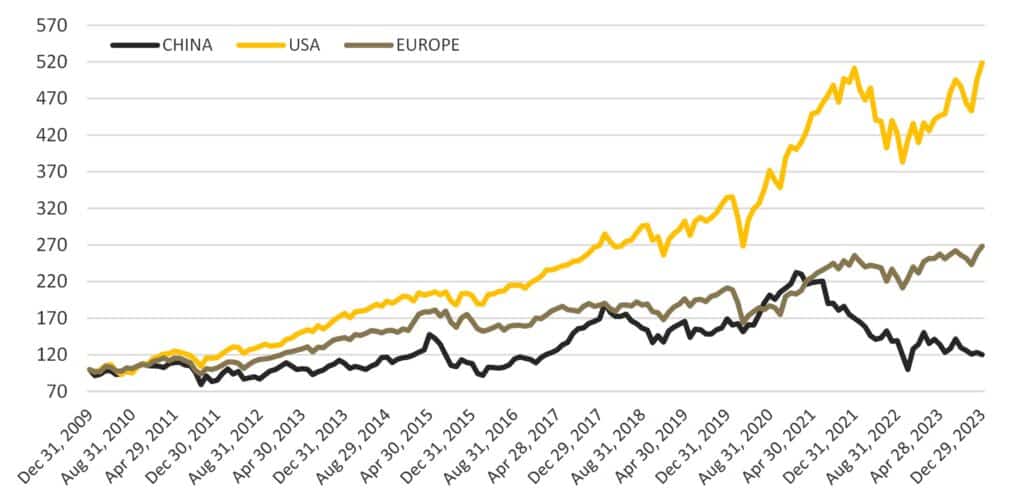

In fact, there is a significant disparity between the growth of the economy and the development of the stock market. The Chinese economy was booming, in contrast to the stock market, which made close to zero returns. In comparison, the US economy was growing at much more moderate pace than China, but the US stock market was adept at generating returns (fig. 1).

Figure 1: MSCI regional indices since 2010 in local currency annual return: MSCI China 1.9%, MSCI USA 10.7%, MSCI Europe 3.4%

One should understand that the stock market is not a representation of the country’s economy. The stock market represents the listed companies, which might have global operations and therefore having exposures to regional economies. However, given that the headquarters are located in a certain country, the company is exposed to political and regulatory risk, which might have substantial impact on the company’s performance. Furthermore, the responsible management culture is essential, as successful investing hinges on fostering trust among all involved parties.

Does valuation matter?

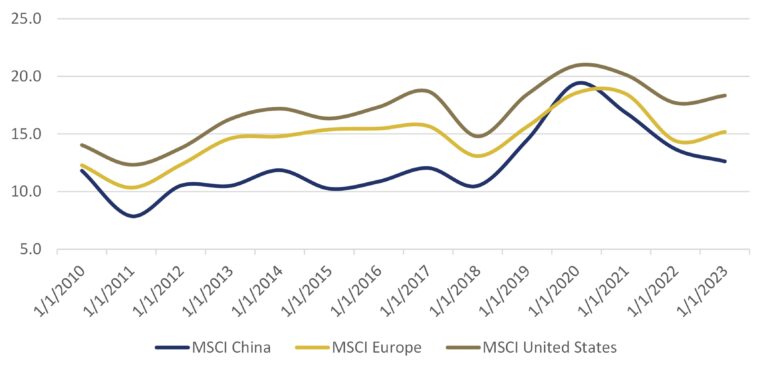

Note that Chinese equities have almost always been traded at a discount compared to US and European stocks (Fig.2). Low valuation does not always mean it is a good bargain as we have described here: ( https://hqam.ch/en/how-fair-is-fair-valuation/ ). If the share price of the company drops substantially, it does not always mean that this is the point to jump in. There is always a possibility for the stock to continue its decline.

Figure 2: Median forward PE of MSCI regional indices

The lower valuations of Chinese companies are frequently attributed to political risk and heightened degree of policy uncertainty (Yang, et al.,2019). Concerns escalating issues in the real estate sector, which accounts for 30% of China’s GDP, have also exerted downward pressure on the valuations and performance of Chinese equities. State-driven demand often leads to economic imbalances. And the real estate stands as a prominent illustration of regular state interference. More than half of China’s former 50 developers including flagship companies like Evergrande and Country Garden, have defaulted.

How fundamentally good are Chinese companies?

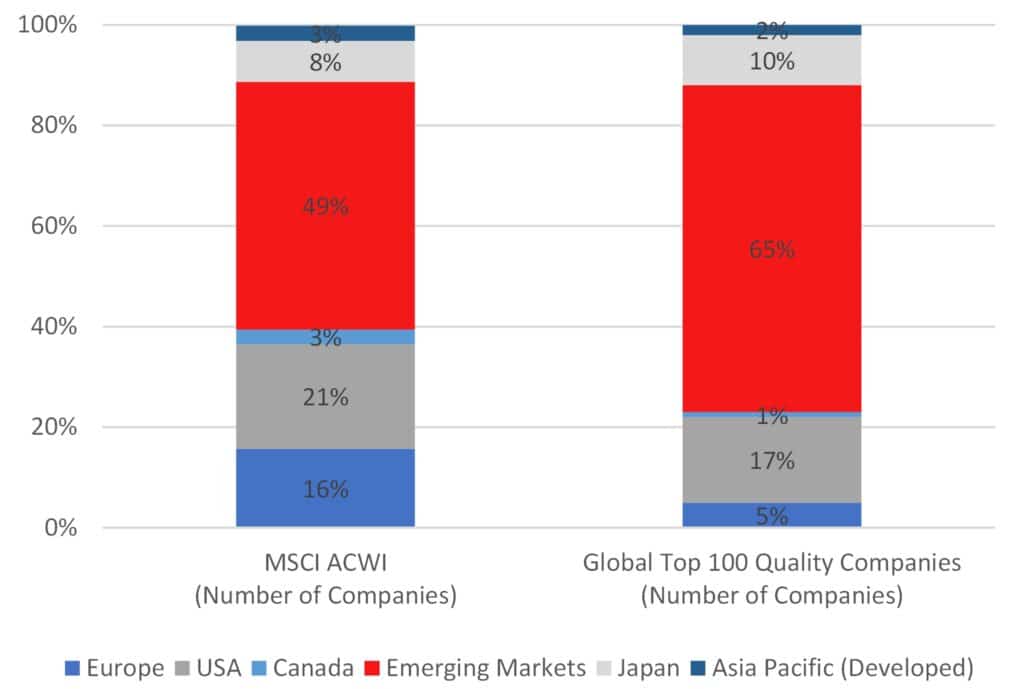

You would be surprised but the quantitative financial assessment of Chinese firms beats all expectations as seen in Fig 3, showcasing the results of our global corporate excellence award evaluation. In the global stock index MSCI World AC emerging markets part, where the vast majority is represented by Chinese companies, accounts for 49%. Contrasting this with the breakdown by regions within the best 100 companies according to financial quality, emerging markets hold 65% share of the global top quality universe.

Figure 3: MSCI All Country World Index Distribution / Global Top 100 Quality Companies

Financial health of the Chinese universe surpasses that of its global corporate peers. Capital returns are at high level, while debt levels are enviably low.

Qualitative Analysis as major value-adding element

While financial figures and traditional ratios of Chinese companies seem impressive, it is crucial to carefully consider all aspects of the business model and the competitiveness of firms. There have been multiple cases of ‘creative accounting’ among Chinese companies, which led to huge losses in investment portfolios. Insufficient control from watchdogs and weak corporate governance control lead to cooking books cases: inflated profits, understated leverage, boosted receivables.

To detect possible fraud, qualitative analysis is extremely important, especially when investing in emerging markets, which are usually undercovered. These markets often lack scrutiny from market participants and have a limited number of analysts.

A notice to investors – main takeaways

- The stock market does not represent the entire economy;

- The degree of political interference into the corporate sector is a crucial factor to consider, and past developments can provide hints;

- Corporate governance is extremely important when investing in markets with limited history and experience in the investor relations area;

- Formal financial figures of the company are just one constituent when making investment decisions;

- One should be able to read between the lines and make a thorough assessment of potential risk factors and future growth.

Summing up our view on Chinese equities, we can admit that it is possible to find corporate quality there. However, the significant uncertainty in the market and in politics reduces the trust and hope for the smooth development of firms that might suffer from unexpected external interference.

References

- Yang, Z., Yu, Y., Zhang, Y., & Zhou, S. (2019). Policy uncertainty exposure and market value: Evidence from China. Pacific-Basin Finance Journal, 57, 101178.

- Gordon (2023), Chinese real estate may be the world economy’s ‘most important single sector,’ says Fitch. But don’t expect Beijing to save it from crisis. Fortune. fortune.com/2023/08/17/china-real-estate-fitch-james-mccormack-downgrade-warning/

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.