Should you invest in companies and funds with high ESG ratings?

Wannabe good investors

It is a basic psychological need to ‘be good’ and to receive praise, especially when effort is involved. This trend is further reinforced by regulators who formally define who is considered ‘good.’ This phenomenon is evident in the field of investing, particularly with respect to Environmental, Social, and Governance (ESG) criteria, which has also become a fantastic marketing pillar for many companies. Many investment firms include sustainable ETFs in their client portfolios, and asset managers pick companies with high ESG ratings for their portfolios. Portfolios with higher average ESG ratings are likely to attract more attention from investors and consultants.

However, a crucial question remains: Can we truly effect change by investing only in companies with very high ESG ratings, i.e., those already considered very good companies?

ESG rating and real impact

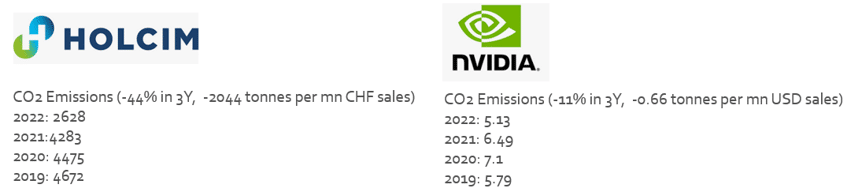

We have an iconic example of ESG improving vs ESG excellent companies. We compare environmental impact of industry-heavy cement maker, Holcim, and chip designer company, Nvidia. Surely, the industry specifics matters as well. The latter already plays in the top league according to ESG standards, but still continues to decrease it CO2 emissions. However, in this case the contribution to the effort of slowing down the global warming is minimal. At the same time, every effort to limit CO2 emissions by Holcim counts and though it is not yet among the companies with the best ratings (MSCI ESG rating has just increased to AA from BBB vs. Nvidia’s longtime AAA), it has substantial take in environmental impact.

Figure 1: Scope 1 and 2 CO2 emissions

Common sense would obviously dictate supporting the commitment made by companies like Holcim. The irony, however, lies in the fact that they are typically not the type of companies found in ESG funds, which tend to favor those with ratings of AAA and AA. Therefore, we believe it is important to commend those that are not perfect yet but are on their way to becoming exemplary.

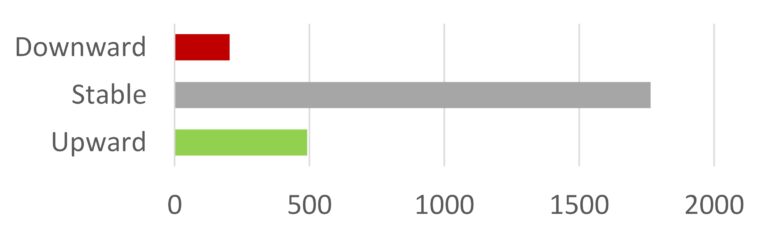

To give you a flavour of how many companies improved their ESG ratings in 2023 basedon MSCI methodology, we made a summary of rating change. Basically, a fifth of MSCI All Countries universe managed to improve their ESG rating, while only 8% of firms were downgraded.

Figure 2: Industry rating based on dynamics of ESG KPIs

Answering the question

To recognize the best companies in terms of improving their ESG status on both quantitative and qualitative dimensions, this year, we are launching the Incremental Excellence Award (IEA), which aims to recognize the best companies in terms of improving their ESG status on both quantitative and qualitative dimensions. We compare companies’ progress in terms of E, S, and G with their industry peers worldwide, including emerging market companies. The first step involves a quantitative analysis focusing on the dynamics of KPIs that describe corporate commitment to E, S, and G. The second step involves a thorough qualitative analysis, which includes industry-specific KPIs, possible greenwashing detection, ESG goal plausibility assessment, and controversy analysis. The top five companies, after rigorous filters, are presented to the jury for determining the ultimate ESG improvement winner (well-deserved winners can be found here).

By the way, over the last 2 years, 11 companies-winners from 11 different industry sectors collectively decreased CO2 emissions by 80 million tonnes, which is equivalent to the annual emissions from 18 million cars.

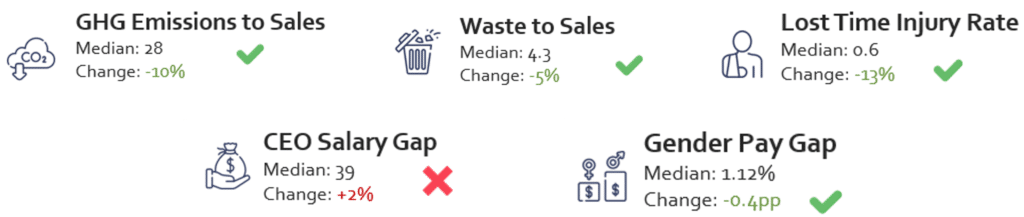

Global progress in terms of ESG

What is the cumulative effect of ESG improvement among the world’s 2,800 largest companies over the last 2 years? Undoubtedly, the most significant attention has been garnered by the reduction of CO2 emissions, which decreased by an average of 10%. Labour safety was also a priority for many companies, with the lost time injury rate decreasing by 13%. The most cherished letter out of the three was ‘E’, as essentially all selected environmental KPIs improved. However, only half of the social KPIs improved. This area seems to have received the least attention from executives, and increase in the CEO pay gap is an illustration to this.

Figure 3: 2Y progress in selected ESG KPIs

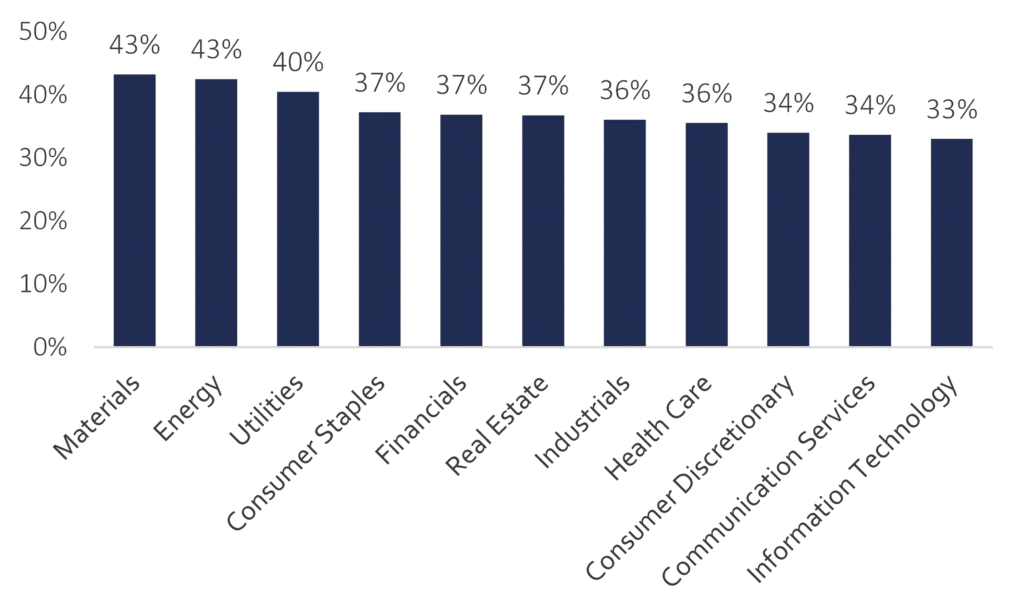

Industries – leaders and laggards

When examining the industry dimension through the Incremental Excellence Award (IEA) evaluation process, we were pleasantly surprised to find that among the improvement leaders were industries typically associated with pollution, disasters, injury rate, and climate warming. Companies in the materials, energy, and utilities sectors demonstrated leadership in terms of improving their ESG standards. Presumably, regulations, pressure from capital holders, and public scrutiny played a role in driving these positive changes. The least improving companies were from the IT, communications, and consumer discretionary industries. This may be explained by a lesser room for improvement given the specifics of these industries.

Figure 4: Industry rating based on dynamics of ESG KPIs

Answering the question

Returning to the question posed in the title, our belief is that, indeed, we should reward companies with capital flows that are already performing well, thereby setting a high bar for ESG commitment aspirations. Interestingly, based on our experience, we observe that high-quality companies qualifying for premium portfolios generally excel in terms of ESG standards.

However, we also strongly believe that the corporate goal of making diligent improvements every year should be at the core of corporate ESG initiatives, and real progress must be demonstrated. Ultimately, improving companies on ESG side is exactly what is needed to preserve our precious environment, to make employees happy and to take the company to the most profitable league. While it is true that finding quality companies with excellent financials in universe of not yet perfect ESG standards is challenging, it is not impossible.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.