Fundamentals are back in focus

Recently, a note from Morgan Stanley, which found that the gap between reported earnings and cash flow of US companies is the widest in 25 years1, has caught our attention, as it touches upon the concept of earnings quality, which has always been one of the cornerstones of our investment approach. Early this year we saw junk stocks rallying again on no fundamental ground, as short-covering and expectations for the long-awaited end of the tightening cycle provided a boost to low-quality companies. However, the experience of late 2021-2022 clearly showed that such gains are hardly sustainable over the long run, which we focus on.

As we exit the era of zero-interest-rate policy, in which even the weakest companies could prosper, investors urge companies to focus more on profitability, cash flow generation, and shareholders’ reward, rather than chasing growth at all costs. As investors become more selective and scrutinize the true earnings power of their holdings, earnings quality analysis is becoming more important to identify long-term investment opportunities. Instead of relying solely on EPS figures, cash flow analysis is a good complementary tool to assess the quality of earnings. Indeed, across all major markets, not only the US, the cash conversion ratio – the ratio of operating cash flow to EBITDA – has fallen recently from the post-pandemic peak, as shown in Fig. 1.

Figure 1: Cash conversion in the US, Europe, Switzerland, and Japan (based on current index constituents)

Source: Hérens Quality AM

Cash flow matters

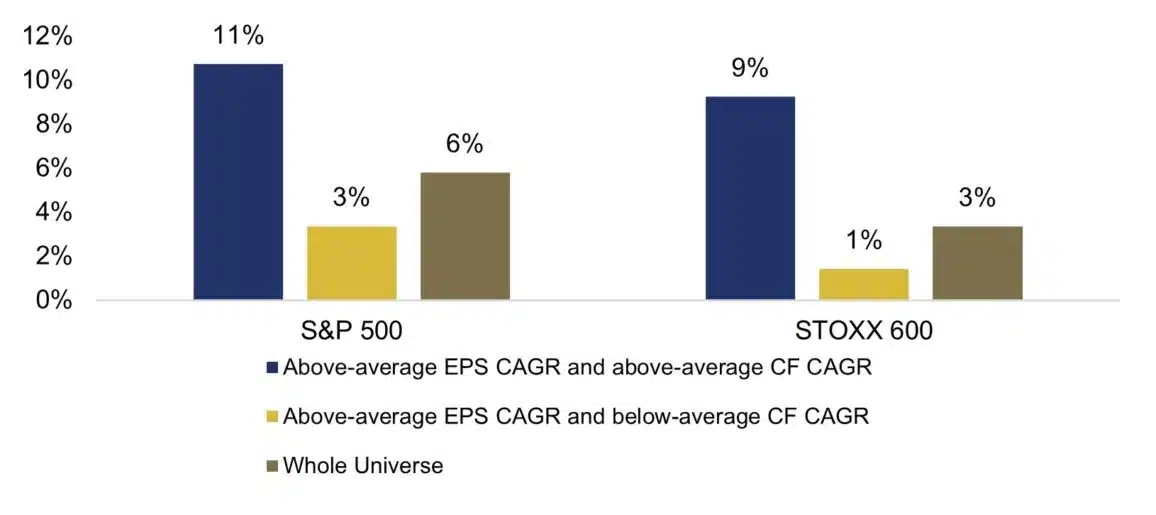

When earnings remain robust, but cash flows deteriorate, analysts should begin to raise questions. Over the long term, we notice that the market particularly rewards those companies that deliver earnings growth that is backed up by ample cash flows. As shown in Fig. 2, over the last 5 years, companies that have delivered above-average EPS growth and operating cash flow growth have also seen substantially higher price returns, as compared to those companies that have outperformed only on EPS growth, with cash flows lagging behind.

Figure 2: Annualized price return (March 2018-March 2023) in relation to EPS and cash flow growth

Source: Hérens Quality AM, Refinitiv

Adjustments jungle

Choosing the best metrics to evaluate business performance may sometimes be a challenge for analysts. It is quite common for companies to adjust their reported earnings for analysts’ convenience, but it is always a good idea to question such adjustments, as they may sometimes present a more favorable picture than reality. In fact, the SEC has recently been clashing with some companies, which take adjustments too far2.

Among the most common adjustments is adding back acquisition-related amortization expenses, which makes total sense, but when the said acquisition was dilutive, carried a sky-high multiple, did not deliver on promised synergies, and eventually resulted in goodwill write-downs – value is destroyed, and if it is not a one-time mistake, questions should be raised about executives’ capital management abilities. Another common adjustment is stock-based compensation, which is an important tool to motivate employees, more commonly in US. As a non-cash expense, certainly, companies prefer to adjust their earnings for stock-based compensation, but there is no free lunch. Shareholders should ask, if, and to which extent, they are being diluted and whether the amount of compensation is reasonable and proportional to business growth.

A plausibility check is especially required when the gap between reported and adjusted earnings is quite high. For example, Stryker, a medical device manufacturer, usually reports adjusted profits 50-70% higher than statutory net income. Company’s adjustments include, among other things, regular restructuring charges (if they occur each year, it begs to ask whether something is wrong with the business), medical device regulations costs (such as updating product labeling to comply with regulations – something we would think is a normal operating expense for a medical company) and recall-related adjustments (when they happen each year, one should dig deeper into quality control practices as they are essential for a medical company to succeed). While Stryker’s adjusted earnings have been on an upward trend recently, cash flow from operations and free cash flow have essentially remained flat over the last 5 years. Increasingly questionable earnings quality was one of the reasons we decided to part with the Company.

Figure 3: Stryker Corporation earnings and cash flow figures

Source: Hérens Quality AM, Stryker Corporation

Earnings quality within quality investing framework

To make sure companies in our portfolios possess strong and sustainable earnings power, each company that we consider as a buy candidate is subject to earnings quality analysis. For this purpose, we have a special earnings quality score that alerts us of any red flags that require scrutiny. The score considers aspects, such as cash conversion, plausibility of changes in balance sheet items in relation to sales and expense growth, efficiency metrics, accruals, profitability ratios, etc. The final assessment is a net score: the number of praise-worthy metrics is decreased by the number of red flags, and the maximum is 25 (though we currently do not see a Company with such high quality of earnings across our investment universes). According to our methodology, earnings quality is the lowest in Japan and the highest in US, although in all markets we manage to find decent companies to invest in, as shown by better scores across quality funds.

Figure 4: Earnings quality scores of HQAM quality funds, compared to the market

Source: Hérens Quality AM, Refinitiv

As investors are moving back to basics, seeking a fine balance between long-term growth, solid profitability and cash generation, we believe this trend plays well for quality companies, and premium that they command for sustainability of their earnings could only widen.

- Bloomberg (2023). Corporate America’s Earnings Quality Is the Worst in Three Decades

- Wall Street Journal (2023). SEC Expected to Raise More Questions About How Firms Calculate Non-GAAP Measures