IPE D.A.CH Editor-in-Chief Frank Schnattinger spoke with Diego Föllmi, Managing Partner at Hérens Quality Asset Management, about the factors of corporate quality and the Corporate Excellence Award recently presented by Hérens Quality Asset Management to companies for their business performance for the 11th time.

IPE D.A.CH: Mr. Föllmi, Wirecard is probably not a good example of corporate excellence, what do you look for in your analysis and selection?

Föllmi: In the shadow of scandals such as Wirecard, there are many companies that operate well and sustainably. The idea at the start of the award in 2009 was to take an in-depth look at precisely these companies, identify the best and honor them accordingly within the framework of an award. The universe and the approach have of course evolved, but the core of the process has remained stable over the years.

IPE D.A.CH: In addition to quantitative analysis, this also includes a scientific jury. What does this look like?

Föllmi: The jury currently consists of Prof. Dr. Dieter Pfaff from the University of Zurich, Prof. Dr. Max Ringlstetter from the University of Eichstätt-Ingolstadt as well as Hérens Quality Asset Management representatives Markus P. Hepp, Dr. Philipp Weckherlin, Dmitry Baulin and myself.

IPE D.A.CH: What does the process then continue to look like?

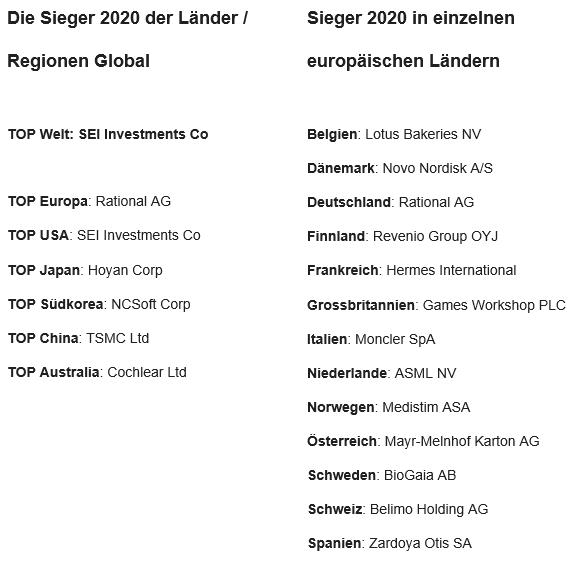

Föllmi: The whole process is initially based on the annual corporate reporting. Accordingly, we start around the end of March with an initial screening and, as a first step, analyze the key figures and corresponding changes with our research team in Riga. We perform these rankings for different countries and also regions. The proposal is finally discussed and approved by the jury at the beginning of May. Based on the overall data, a global winner is also chosen, this year the US company SEI Investments.

IPE D.A.CH: Do ESG criteria also play a role in this framework?

Föllmi: We come here from the classic key figure analysis and thus from a completely different direction than ESG analyses. Nevertheless, we naturally also see the influence of ESG factors on companies and thus ultimately also on their key figures. From our observation, companies that are doing very well in terms of business management rarely take a back seat when it comes to ESG criteria – on the contrary.

IPE D.A.CH: The German company Rational AG, an industrial kitchen manufacturer, has been ranked number one by you for years, not only in Germany, but often for the European region as well. How consistent are the analyzed companies?

Föllmi: There is definitely movement in the top group of countries, but overall the good companies are still very consistent. Ultimately, this is what investors want to see. Accordingly, we also look for consistency in the key figures we analyze.

IPE D.A.CH: Is there an industry bias to be seen?

Föllmi: There is indeed a certain bias towards companies like sectors or industries like healthcare, pharma & IT. These sectors have been convincing in recent years. At the lower end, on the other hand, you tend to find the financial sector.

IPE D.A.CH: What other trends do you see over the past few years?

Föllmi: A look at the regions is quite interesting. European companies tend to be underrepresented in terms of corporate excellence compared with their share in the MSCI World. In the last two years in particular, the number of “good” companies from Europe has declined significantly. On the other hand, companies from the emerging markets, and Japan in particular, have made gains.

IPE D.A.CH: How big are the differences within Europe then?

Föllmi: The differences are quite massive, even among the winners. For example, the winner in Belgium – Lotus Bakeries NV – is only 123rd in the European evaluation. There are huge differences in the quality tectonics from country to country.

IPE D.A.CH: Thank you very much for these insights!