A bumpy ride

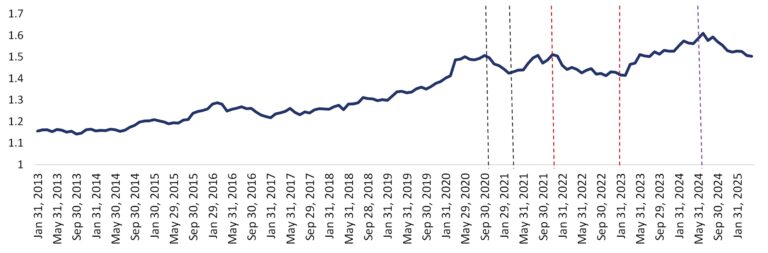

Quality stands out as one of the most consistently rewarding styles. However, its post-pandemic outperformance has been more modest. As shown in Fig. 1, the Quality factor has seen three notable periods of underperformance in the 2020s: 1) Late 2020–early 2021, during the early recovery, when Value stocks outpaced Quality; 2) 2022, when rate hikes pressured Quality due to its elevated relative valuations; 3) Since mid-2024, initially due to a rally in non-Quality Growth names (e.g., Tesla, Palantir) while Quality-heavy semiconductors lagged, and later, in 2025, as markets turned risk-off.

Figure Relative performance MSCI World Quality vs. MSCI World (Gross Return, USD, as of 04/2025)

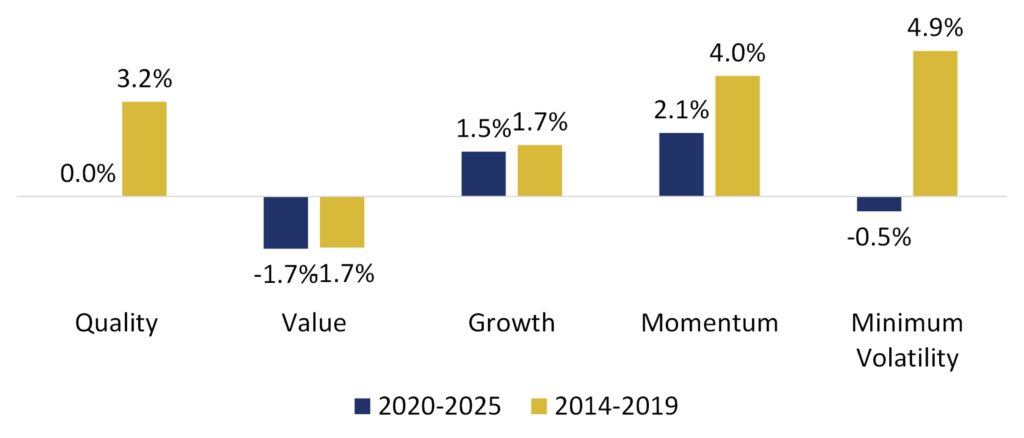

Despite recent challenges, Quality has still remained one of the best-performing factors on a risk-adjusted basis over this 5+ year period, second only to Momentum. Still, the ride has been bumpier than in the past, with more frequent bouts of underperformance and slightly slimmer long-term alpha (Fig. 2).

Figure 2. Alpha of different investment factors (Gross Return, USD, as of 04/2025)

This calls for a closer examination of the underlying drivers. Since 2020, the investment landscape has shifted dramatically — an era defined by ultra-low rates, subdued macro volatility, stable growth, and abundant liquidity gave way to a significantly more uncertain environment on fiscal, monetary, geopolitical, and even technological fronts. Understanding how this shift has impacted Quality is essential for investors to refine their Quality approach.

Where Quality faltered

Analyzing the entire post-2020 period, several factors have weighed on Quality performance. A few are purely technical.

For example, as index concentration increased, Quality missed out on Tesla and Amazon. However, this only partly explains the underperformance, as Quality maintained higher exposure to other Mag-7 names, such as Nvidia — which delivered unmatched returns — as well as Meta, Alphabet, and Microsoft. Another drag stemmed from poorly timed Energy sector additions to the Quality index. Names like Exxon Mobil, ConocoPhillips, Total, and others, which briefly fell out of the index as fundamentals deteriorated in 2020, were added back near the peak — missing the rally but capturing the subsequent decline as energy prices normalized. This underscores the risks of relying solely on a quant-based Quality strategy. Lastly, Quality also missed the sustained rally in certain Value sectors, such as Banks and Industrials.

Other reasons for the slowdown in Quality performance are more fundamental in nature.

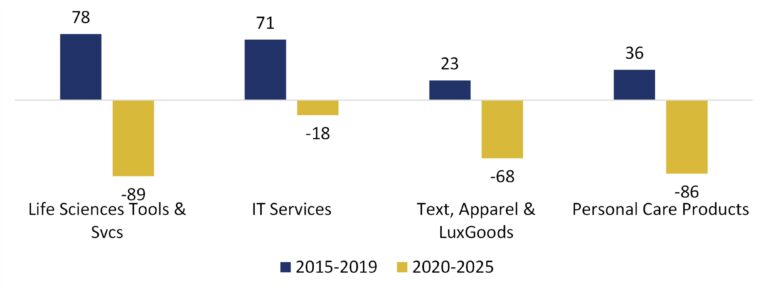

We’ve observed that several industries once rich in Quality compounders have faced notable headwinds. This includes Life Science Tools (e.g., Agilent, Mettler Toledo), which were hit by the macro slowdown — particularly in China — and declining biotech funding; IT Services (e.g., Accenture), where tighter macro conditions have pressured IT budgets; and Apparel (e.g., Lululemon, Nike) and Personal Products (e.g., L’Oréal, Estée Lauder), where consumer preferences are shifting more rapidly in a world increasingly shaped by social media. These industries have flipped from strong outperformers to significant laggards (Fig. 3).

Figure 3. Out/underperformance of select industries (Total Return, USD, as of 04/2025)

The Tech sector, where Quality is abundant, has also faced significant disruption. While Tech is still the top performer, performance across names has been highly divergent. AI is reshaping Tech more rapidly and profoundly than previous innovation waves. For Quality investors, AI’s disruptive nature presents a unique challenge. The essence of Quality lies in consistency supported by defensible moats — yet AI undermines this by accelerating business model turnover, shortening innovation cycles, and redistributing value away from incumbents. Business models of some previous Quality leaders, such as Adobe and Alphabet, are being questioned in the AI era, resulting in multiple contraction. While their financials remain strong, the market is looking decades ahead, already discounting potential disruption. Meanwhile, new AI-first leaders are emerging, such as Palantir and ServiceNow, who are not yet captured by traditional Quality models. However, the market quickly prices in their success, lifting index returns.

Evolving the Quality Playbook

Several lessons can be drawn from the analysis of Quality performance in the post-pandemic period.

First, in a higher-rate environment, paying any price for Quality no longer works. While ample liquidity and factor crowding supported elevated valuations for throughout the 2010s, the market today demands more to justify a premium. Quality at an Attractive Valuation is therefore more important than ever.

Secondly, the traditional definition of Quality — focused on metrics like high return on capital, low financial leverage, and stable earnings — no longer fully captures what makes a company truly resilient. Quality models often overlook structural shifts in the economy: intangible-heavy firms tend to score poorly on conventional metrics, while mature businesses with declining market share may still appear “quality” on paper. In a rapidly changing environment, forward-looking analysis of a company’s ability to adapt, drive innovation, and evolve its value proposition is essential.

Finally, Quality, while necessary, is not always sufficient. A company can be fundamentally excellent and still underperform if the growth engine it relies on falters. Take Agilent as a case in point. By all metrics, it’s still a textbook-quality company — yet its performance was largely driven by two macro tailwinds: Chinese demand for analytical instrumentation and robust biotech R&D funding. As these drivers weakened, Agilent’s growth stalled. Investors must therefore closely examine the sustainability and sources of performance.

Despite recent challenges, Quality is still delivering alpha — but Quality investors should remain flexible and adapt to new realities. Many of the best-performing companies still come from the Quality universe (among recent winners: Nvidia, Arista, Eli Lilly), but investors now need to be more discerning, supplementing financial analysis with fundamental insight into business models and valuation. While our approach remains consistent, we have also been enhancing it — integrating insights from alternative data sources, deepening our valuation methodologies, and refining our risk assessment frameworks, among other improvements.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.