In a nutshell: A truer picture of a country’s “net worth” that includes insights on national assets and liabilities would allow for better-informed policy decisions and unlock new public-sector revenue generation opportunities. It would also provide global insurers and other private-sector investors an additional yardstick to assess sovereign credit risk.

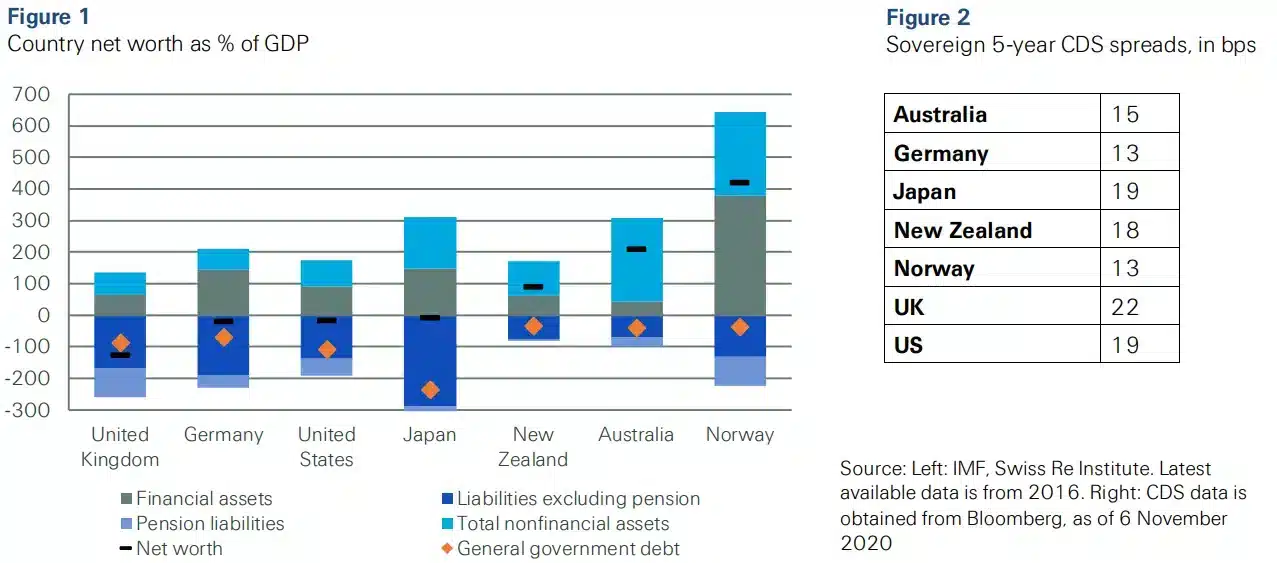

Long overdue: integrated public financial reporting that provides insights on national assets and liabilities, in addition to standard income statement details of revenue streams and spending outlays. It is something every country can, but which nearly all, do not do. The practice would help governments better manage national resources through balance sheet risk and policy analysis. The IMF estimates that governments could generate additional revenues of about 3% of GDP annually if they knew what they owned and put their assets to better use. (1) Such reporting would also give investors, including insurers, more visibility into a country’s true fiscal capacity and resilience.(2) The advanced economy sovereign bond market is liquid and transparent, but absent information on national assets and liabilities, it remains difficult to ascertain holistically a country’s true long-term creditworthiness. A consolidated view of national finances that includes net asset would offer an additional yardstick of a country’s longer-term solvency prospects beyond that priced in by financial markets through sovereign credit default swaps (CDS, see Figure 2).

Accounting for assets and liabilities exposes what can be a fundamental shortfall of simple debt-to-GDP ratios. For example, Japan, with a public debt to-GDP ratio of around 265%, is often cited as a high risk. However, its asset base is one of the largest in the world (see Figure 1), resulting in a roughly neutral “net worth” (assets – liabilities incl. pensions). Meanwhile, the UK’s government debt ratio is about 110% of GDP, below Japan and many euro area countries. (3) But with relatively high liabilities and comparatively few assets, UK net worth is negative at almost -125% of GDP. Germany has a relatively low government debt ratio of around 70%, but its net worth is also negative at around -20% of GDP. This highlights that in many cases, public balance sheets may be less resilient than usual macro variables describe.

COVID-19 may change this dynamic still further. The crisis has led to a huge expansion in government guarantees, typically backing corporate loans. (4) In many cases these dwarf the direct fiscal stimulus packages but are “off-balance-sheet” liabilities and only show on-balance when drawn. Other contingent liabilities such as pension commitments are similarly often not adequately accounted for.

An integrated approach to evaluating public finances would enable cleaner decision-making when considering trade-offs between fiscal policy choices, allowing governments to better manage their resources to meet economic and social goals. This is crucial because countries with weaker balance sheets – such as several euro area countries – experience recessions roughly twice as deep and long as those with stronger balance sheets, and recoveries only about a third as strong. (5) The IMF estimates that governments could earn about 3% of GDP more in revenue each year if they knew what they owned and how to put their assets to better use. Integrated public financial reporting would enable investors to better understand a country’s true fiscal capacity, particularly as rating agencies typically only include a qualitative assessment of the reporting principles when rating a sovereign.

New Zealand typifies international best practice in public financial reporting as it continuously reports its net worth. Importantly, every country can do so.

References:

- The Wealth of Nations: Governments Can Better Manage What They Own and Owe, IMF, 9 October 2018.

- Roughly 50% of global life insurers invest in sovereign bonds, according to the OECD Global Insurance Market Trends 2019 report.

- According to the IMF’s fiscal monitor projection of October 2020, the debt-to-GDP ratio in France and Spain is at around 120%, and at about 160% in Italy. The estimates in figure 1come from the IMF from 2016

- E.g. in Germany, direct fiscal stimulus in 2020 will be equivalent to roughly 10% of GDP, while equity, loans and guarantee provisions amount to about 30% of GDP, according to the IMF’s October 2020 Fiscal Monitor.

- Public Sector Balance Sheet Strength and the Macro Economy, IMF Working Paper, 2019.