Last few years were difficult for buy and hold investors for a simple reason – a lot of change and disruption is going on under the hood. And it is not just AI – there is a bunch of high-flying stocks that both institutional and retail investors like – Eli Lilly, Constellation Energy, Philip Morris, Hims&Hers, AppLovin etc. And leaders change all the time.

There is, however, one HQAM product – Alt-Data Portfolio – designed to benefit from trend following – both- mid and long-term.

A little bit of history

It all started back in 2016 when we realized there is a whole new set of data on the internet available to analyze companies – Google Trends, website traffic, app downloads data, social media followers and engagement, Wikipedia article viewership, Reddit discussions, Glassdoor reviews and many others. There was also a whole cohort of alternative data providers appearing – Yipit, AlphaSense, Second Measure, Sentieo – that capitalized on investment managers thirst for data to feed their models. Large hedge funds were paying millions to gain competitive advantage and generate alpha. As a small, but technology driven asset manager, we decided to build our own tools for data collection, storage, and analysis – which resulted in creating Astutex database and Trendspotting weekly report that serves as an idea generation instrument.

Figure 1: Alternative data sources used for company analysis

Anime, hyper-luxury and running shoes

So, what were the trends that drove Alt-data portfolio performance recently? One trend to mention is certainly anime. Asian content is a hot topic worldwide – K-Pop is dominating music charts, Genshin Impact, Marvel Rivals and Naraka – Steam best sellers and anime series break streaming viewership records. Several companies caught our eye from this sector. First, Toei Animation, owner of famous Dragon Ball and Slam Dunk manga (Japanese comics books) franchises performed strongly after One Piece (more than 500 million manga copies sold) live action series broke Netflix record being #1 in 86 countries, better than famous Stranger Things. Then, IG Port, a smaller version of Toei, had a nice ride after success of Spy x Family and Haikyu! movies in global box office. Netlfix was so thrilled about One Piece live action series performance and announced that also anime re-make is in the works and IG port will produce it. And finally, Sanrio – which is not exactly anime, but Hello Kitty intellectual property (IP) owner that created a licensing powerhouse diversifying from famous kawaii cat to other characters like Cinnamoroll, Kuromi and Pompompourin.

Another big trend in consumer space is hyper luxury – products with extremely high price points and enormous pricing power (like Ferrari that delivered 10x return since its IPO in 2016). It is fueled by rising wealth inequality as the rich get richer amid booming equity markets. Luckily, we had two of those companies in portfolio – Hermès, the famous maker of Birkin bags, and Richemont, maker of Cartier and Van Cleef & Arpels jewelry. Both companies were under pressure in 2024 as China demand stagnated but reached new highs after broad-based recovery in 2025.

And finally, the running shoes phenomenon. For quite a while there was a growing trend for athleisure – consumers ditching suits and classic shoes in favor of comfortable footwear. Covid-19 pandemic was Crocs and Heydudes finest hour, but as economy normalized people increasingly started to pay attention to health and well-being. And running is one of the sports activities that is easily accessible to everyone and needs little investment.

Strava shot up in app downloads as people piled into running clubs, searching for like-minded buddies and dating partners. As Strava put it in its year review – “run club is the new nightclub”. There was a 59% increase in running club participation globally in 2024. Also half of running shoes buyers are actually not runners but simply wear them everyday. Two companies stood out recently in terms of performance – one is On, which is very well-known to our Swiss readers, but is rather pricey, and the other one is Deckers, owner of Hoka, that we bought for our Alt-Data portfolio and which turned out to be a great success. We sold it relatively quickly after it delivered more than 60% in 6 months, also avoiding recent drawdown as tides turned, which often happens with high-flying consumer stocks.

Future trends – or who are the next winners

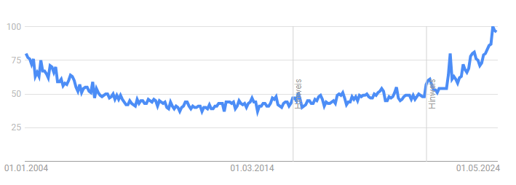

Have you heard of Bryan Johnson and his ‘Don’t Die’ documentary? A creepy guy that spends few million per year for supplements and medical procedures (both tested and not so much) and hopes to extend his life span to 150 years? He is a poster child of healthy longevity trend – consumers’ increased focus on healthy and protein-rich foods, mental health, exercise, sleep quality and other tools and routines to improve their well-being. In every Trendspotting weekly report, we see how high the interest for new healthy snack and energy drink brands, infrared sauna benefits, calorie counter apps, nicotinamide supplements, Hyrox gym searches and ceremonial matcha recipes is. And our choice in this space is Technogym – “Ferrari of gym equipment”. Company built a premium brand in connected fitness sector – its equipment is present in 41 of top 50 luxury hotels. 70 million people exercise daily with Technogym and company is increasingly using its extensive data to provide hyper-personalized training programs with the help of AI.

Figure 2: Historical Google searches for ‘longevity’

Here is a list of trends we are seeing at the moment and companies that might benefit from those:

- Healthy longevity (Technogym, Life Time Holding, Garmin,Sprouts)

- New gaming hardware/software cycle – another leg up after covid boom and bust (Sony, Nintendo, Take-Two, Netease, Logitech)

- Great wealth transfer/Gen X finance – $85 trillion assets will be transfered from baby boomers and silent generation to millenials and Gen X during the next 20 years (RobinHood, Coinbase, SoFi, Block)

- Corporate AI – first phase of AI boom (hardware and energy infrastructure) is over and next beneficiaries will be companies that has access to corporate customers data that they could use to train their models and digital tools (Microsoft, SAP, Datadog, Snowflake Atlassian, Twilio)

- Content/IP hyperscalers – amount of consumed content will increase as people will work less and have more time for entertainment (Netflix, Spotify, Disney, Sanrio, TKO (WWE/UFC))

Trendy Quality

Identifying the trend is easy – finding the right company is much harder. As a Quality investor we only select the ones that have solid fundamentals, sustainable competitive advantage and pricing power, which is difficult, because every successful product attracts competition and barriers for entry are usually low. Most popular high-flyer consumer brands end up in drawdowns – let it be Celsius energy drink, e.l.f. beauty cosmetics, Crocs clogs sooner or later go out of fashion and growth inevitably slowes and then turns negative.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.