Contagion

On Monday morning of 24th of February something was brewing – S&P 500 futures were flashing red, eventually finishing the day 3.4% lower – something very unusual for this bull market, fueled by record low interest rates and retail customer enjoying zero-commission trading. What happened really? What caught our eye was that number of Google searches for “coronavirus” worldwide has tripled from Friday (we even posted about it in our Astutex Twitter account (link)), a piece of information that investors with a short-term horizon might have used to hedge their market exposure. Another worrying sign was that Booking.com dropped in Italy’s AppStore rank from being 70st most downloaded app on Friday to number 145 on Monday. Suddenly, there were much less people willing to travel to the country that would be hit worst by Covid-19 over next few weeks that followed. And that’s how the biggest market meltdown since GFC started.

Google Trends as a Magnifying Glass

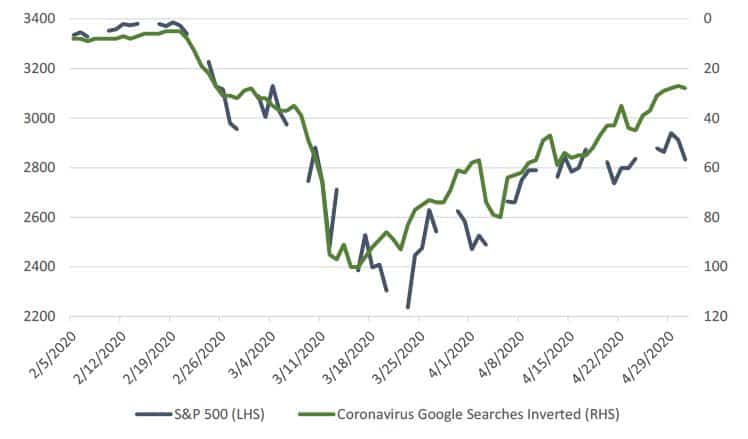

Stock market is a proxy for how well the general economy is doing and economists and stock market strategists base their forecasts on the set of leading indicators like manufacturing orders or building permits – data that is typically available on a monthly basis. The problem with the sudden external shocks, like one we’ve experienced in March 2020, is that no one had a clue how bad the situation really was. For example Bridgewater, the biggest hedge fund in the world, explained their losses with the following – “we did not know how to navigate the virus and chose not to because we didn’t think we had an edge in trading it”. Look no further than Google Trends – still the single most powerful dataset that is available for any analyst for free. ‘Coronavirus’ search volumes was an excellent leading indicator for assessing Covid-19 impact with a correlation of 93%.

Fig. 1: ‘Coronavirus’ Google Searches vs S&P 500

Source: Google Trends, Reuters

Search data was also very helpful in predicting US unemployment claims – brief analysis suggested there was approximately 13 times increase, pretty consistent with 3.3 million weekly claims released by Department of Labor on 26th of March.

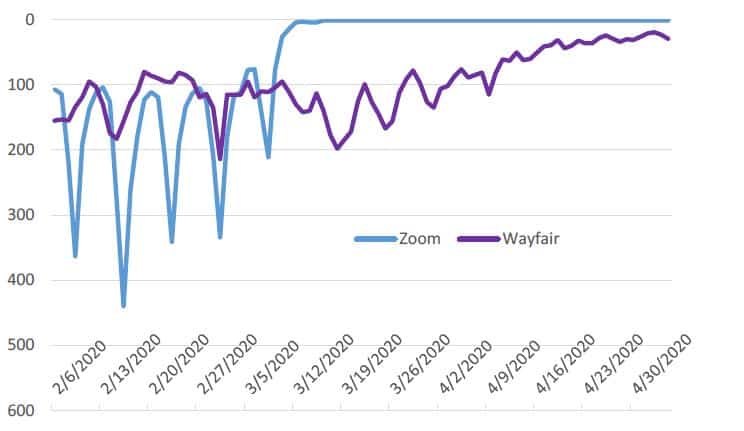

Zoom, Wayfair

There were a lot of obvious losers in transportation, travel, restaurants and brick and-mortar retail – sectors having huge fixed costs with virtually zero revenue during lockdown. Bet there were also few big winners – mostly online based business models that managed to attract new customers and are to benefit from newly formed consumer habits. Probably the most talked about is Zoom, a video conferencing app which most of us got to know during the last few weeks. Just recently company published news release claiming it had 300 million daily active users (up from 10 million in December 2019) or ‘daily meeting participants’ to be accurate. Its progress could be well tracked in US App Store.

It shot up to #1 most downloaded app on 16 th March and is still there. Not that obvious case, but much more rewarding is Wayfair. Company sells furniture and home goods online and naturally benefited from competitor store closures –quite a move from #120 on average in March to #20 in April. Wayfair stock rose a whopping 660% from its 52-week low as company gained “millions new customers”and revenue invcreased 90% from the same period last year.

Fig. 2: Zoom and Wayfair App Store Rank in the US

MSCI USA, Median

Source: SensorTurm

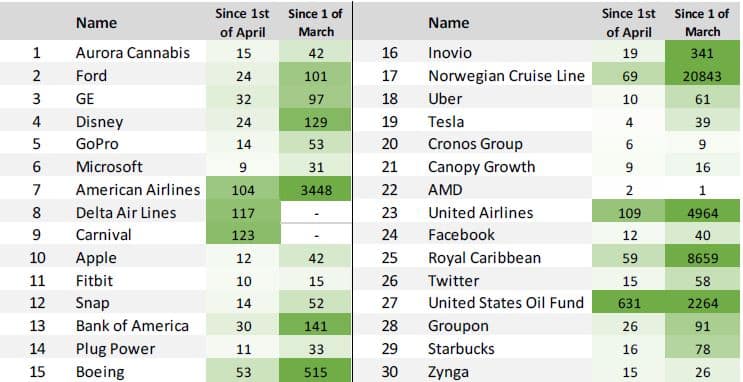

Retail investor response

Robinhood – a zero-commission stock trading app that targets millennials – recently announced that its trading revenue tripled in March as company added 3 million customers and existing ones poured more money to take advantage of lower market prices. It also offered some valuable insights into what new and young investors are buying. Apart of cannabis stocks and popular brands like Disney, GoPro and Apple, millennials were adding companies that suffered the most during pandemics –airlines, cruise ship operators and oil funds. Most likely, new investors are not familiar with financial terms of operating leverage/fixed costs and were simply buying what fell the most, hoping it will recover. But there is also one title that clearly stands out – Inovio – which announced possession of a COVID-19 vaccine candidate after only three hours of effort. However, a renowned short-seller Citron calls its management ‘a group of charlatans’ and compares the company with Theranos.

Fig. 3: Robinhood accounts stock popularity changes

Source: Robinhood, Hérens Quality Asset Management

Brave new world of alternative data

Turbulent times create huge dislocations in value, sometimes purely driven by negative sentiment or liquidity concerns of institutional investors. This is when alternative data is increasingly valuable in identifying winners and losers – aggregated search, website traffic and app download rankings can provide a low-latency insights into global trends. And investment industry is shifting towards ‘now-casting’ based on real-time trends instead of forecasting the future.