Investors are currently finding it difficult to find their way around because of the corona virus. Nevertheless, there are companies that offer a surprising amount of visibility.

Michael Griesdorf

Anyone who invests their money in stocks at the moment must not be a security-minded person. Most companies are riding on sight because of the coronavirus pandemic. This makes it extremely difficult to forecast profits. In rows, listed companies are foregoing a quantitative outlook for the current and coming year. Even the half-year figures will hardly clear the fog.

However, visibility is not blocked everywhere: For companies that can retain their customers and offer goods that need to be consumed regularly, visibility remains high despite the corona virus. By investing in companies with this concept – also known as the HP model, because the printer manufacturer earns more money from the color cartridges, which have to be changed regularly, than from the printers – investors can therefore continue to sleep relatively soundly.

The Market has spoken to various analysts and investors to identify companies in Switzerland with such a business model.

SIG Combibloc can count on its customers

The closest to the HP model is SIG Combibloc. It is the second largest manufacturer of filling equipment for the beverage and food industries after Tetra Pak. However, the machines are only a means to an end. SIG earns the lion’s share of its money from the sterile carton packaging required for this purpose, which accounts for a high 87% of total sales. A further 7% of revenue comes from servicing the machines.

Sales breakdown SIG Combibloc 2019

It is also beneficial that SIG Combibloc’s customers operate in a relatively cyclically resistant business. It is therefore not surprising that, despite the coronavirus pandemic in May, the company confirmed its target from the beginning of the year, at least at the lower end of the range.

SoftwareOne benefits from the market position of Office365

SoftwareOne is also regarded as a company with a distinctly predictable business model. It sells and manages software licenses to and for companies. It generated around 54% of its gross profit last year with Microsoft products such as Office365 and the Azure cloud solutions.

Once the software has been subscribed to or implemented, customers usually do not change the products or the platform on which the licenses are managed. The renewal rate is 100%. Apart from that, Microsoft’s office solutions are a “must have” virtually everywhere in the business world, and the Corona crisis has increased the need for software from the cloud.

Recent events give rise to fears that the first half of the year will be worse than expected. Last Friday, shortly before the end of the first half of the year, a number of major shareholders sold off shares. On the occasion of the annual figures in March, however, CEO Dieter Schlosser was at least very relaxed about the effects of the corona virus pandemic on SoftwareOne.

Temenos products you do not change so quickly

Another company from the IT sector with a highly predictable business model is Temenos. Around 62% of the banking software provider’s sales last year came from recurring revenue. Of this, around 90% currently comes from service and maintenance contracts, which are incurred by banks using Temenos software per annum.

However, the ratio is to shift in favor of the business with licenses that are renewed annually (subscriptions). In addition, Temenos’ products are relatively complex, despite all their advantages. Once they have been implemented in the bank’s IT infrastructure, the switching costs are high.

Schindler earns 50% of its money from service

Schindler is also considered a prime example of a company with recurring earnings. According to an estimate by ZKB analyst Martin Hüsler, the lift and escalator manufacturer earns around half of its sales from maintenance and service work. It does not disclose exact figures, even when asked.

Once installed, the lifts and escalators can only be replaced at a very high financial cost. The larger the installed base, the higher the revenue from regular service.

Burckhardt Compression products are built to last

Burckhardt Compression’s business operates in a similar way. The service division of the manufacturer of reciprocating compressors for the oil and gas industry contributes around 38% of sales. Its products have a service life of up to fifty years. Here, too, a large installed base pays off.

Regulator helps pharmaceutical suppliers

The business model of the pharmaceutical suppliers Lonza, Siegfried and Bachem is not to be neglected. They enter into long-term partnerships with their customers, because when a drug is approved, the drug manufacturers must also have their production sites certified by the regulatory authorities.

Switching to another manufacturer would incur high costs. Therefore, the clientele will not make such a switch without a good reason.

Partners Group clients are committed for many years

Partners Group does not offer quite as good visibility as the previously mentioned companies. Nevertheless, it is also worth mentioning the provider of investment solutions in the field of private equity, because it buys comparatively illiquid assets for third parties. In some cases, clients have been invested for ten to twelve years or at least enter into a relatively long mandate relationship with the asset manager.

Around 74% of assets under management at the end of 2019 came from long-term committed clients who pay annual management fees at a fixed percentage of their assets. Around 71% of Partners Group’s total revenue last year came from such flat fees. The remainder came from performance-based services.

What is special about Partners Group, however, is that shares and credit securities can fluctuate. The “installed base” can therefore quickly become larger or smaller, unlike with the companies mentioned above. If the value of the assets under management falls due to any market distortions, the management fee is also reduced in nominal terms.

Management must not become sluggish

Not all companies with recurring business are therefore immune to any eventualities. For example, many industrial companies were unable to send their service technicians to customers in recent months due to travel restrictions. In addition, many machines were at a standstill, which is why no maintenance was necessary.

However, with the relaxations, the demand for service technicians is likely to increase again. “The service business offers potential to quickly make up some of the sales of new machines lost during the lockdown,” says ZKB analyst Armin Rechberger.

Despite all the advantages: Recurring income also harbors dangers – at least in the long term. Diego Föllmi, a partner at Swiss asset manager Hérens Quality Asset Management, points out: “As nice as the high revenue share of recurring business sounds, it should not make you sluggish. The installed base can also crumble over time if there is too little effort in research and development.”

Schindler, Lonza, Bachem and Temenos convince

Of the companies mentioned above, Schindler, Lonza, Bachem and Temenos are particularly convincing. Not only do they all have a highly predictable business. The quality is also right.

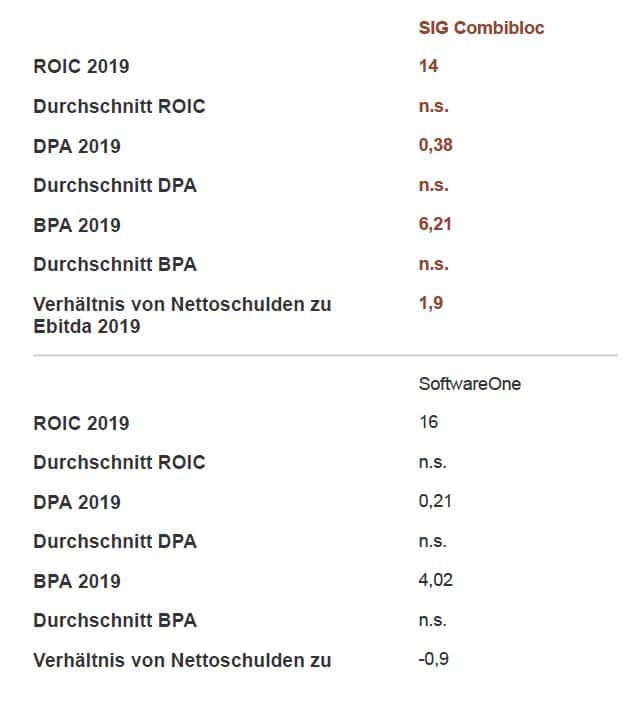

The return on invested capital is higher than or equal to 8% for all of them. Moreover, based on data covering the last business cycle (fifteen years), it is above average.

The four companies also meet other quality criteria, such as a balance sheet that is at least average (ratio of net debt to Ebitda not above 3), a sustainable dividend policy (dividend per share, or DPA for short, currently above average) and an increasing book value per share (BPA currently above average).

Quality characteristics of the companies mentioned in the text

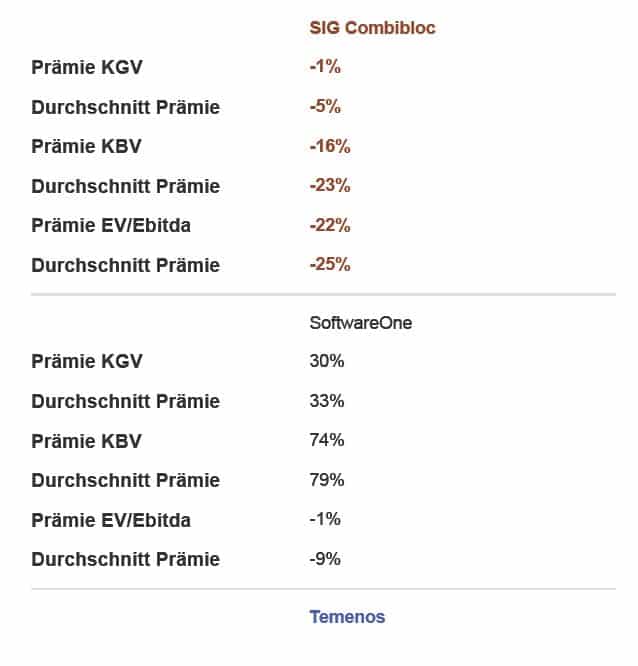

The only downside is that the shares of these companies are all no longer cheap relative to the market when measured by the premium of the common valuation ratios.

For all of them, it is above the five-year average. Somewhat more courageous investors are therefore eyeing Burckhardt Compression. The company does not play in the top league in terms of quality. At the current price level, however, the shares appear attractive.

Evaluation of the companies mentioned in the text

SIG Combibloc is also on the watch list. The company has an extremely stable business, but has not been on the stock exchange for long enough to make a reliable statement about its quality. The IPO took place in 2018. Moreover, its shares are no longer cheap either.