Years of dominance

Over the past decade, the MSCI USA Index has delivered a total return of 240%, significantly outperforming the European market’s 70% gain (both in local currencies) and surpassing its counterpart in all but two years. Additionally, only 31 stocks in the European index managed to exceed the return of the MSCI USA during this period. The influence of U.S. equities has grown substantially since 2014, and the share of American companies in the MSCI World benchmark has expanded from 58% to 73%. Last year further highlighted the dominance of the U.S. market: not only was the American economy far more resilient, but U.S. companies also emerged as the primary enablers of AI adoption. The year concluded with a “Red Sweep” across the Atlantic, intensifying concerns about the competitiveness of European companies.

A tale of two markets

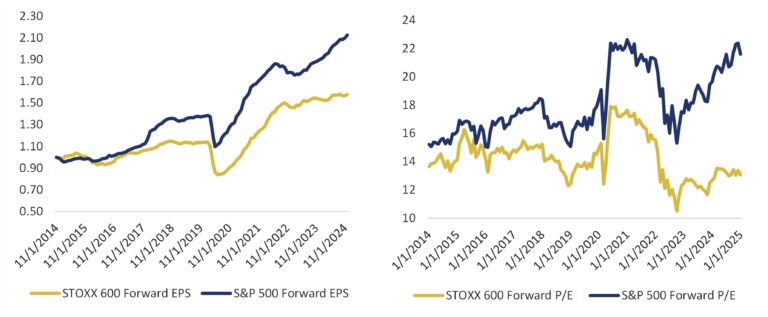

The long-term outperformance of the U.S. market has been driven by both significantly faster earnings growth and expanding earnings multiples, as illustrated in Fig. 1. The US market has achieved an 8% EPS CAGR over the last ten years, compared to just 5% for Europe. Further, U.S. valuation currently stands near a decade high, while multiples in Europe have been shrinking. The valuation gap has widened notably in recent years, as the European economy struggled with inflation and interest rate shocks, whereas the U.S. economy navigated similar headwinds almost unscathed.

Figure 1: S&P 500 and STOXX 600 forward EPS (left, indexed growth) and forward P/E (right)

The magnificent 7 effect

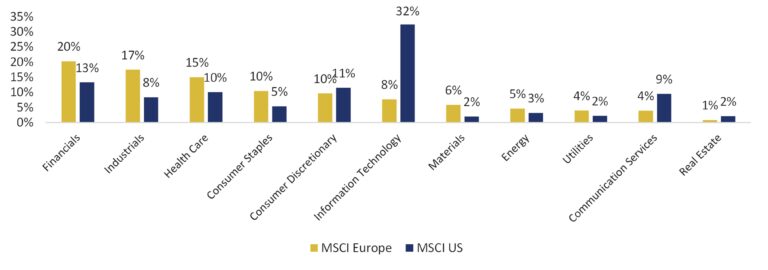

Structural differences between the two markets are a key reason behind the performance gap. The European market remains heavily skewed toward old-economy sectors. For instance, as shown on Fig.2, IT accounts for just 8% of the MSCI Europe benchmark, compared to 32% for the MSCI USA.

Figure 2: Sector composition of the U.S. and European equity markets

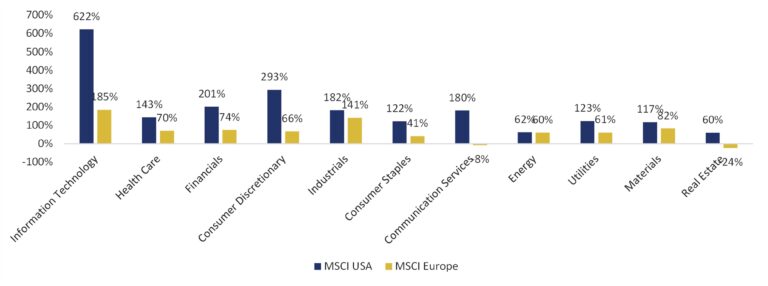

The emergence of large-cap technology leaders and their growing dominance in U.S. equity indices has been a significant driver of the U.S. market’s exceptional performance, both fundamentally and share price-wise, making it a heaven for passive investors. In contrast, the European market requires a more selective approach. European “heavyweights” are still predominantly stable, cash-cow companies, such as Nestle and AstraZeneca, which cannot match the return potential of digital economy leaders. Excluding the “Magnificent 7,” the ten-year total return of the U.S. market drops to approximately 160% (in USD), which is nevertheless still double that of Europe. Notably, performance of European companies lags behind their U.S. counterparts across all sectors, without exception, as illustrated in Fig. 3.

Figure 3: Performance by sector in MSCI USA and MSCI Europe (2014-2024)

The root causes of the divide

The divide between the two regions stems from both cultural and economic factors. Europe has been grappling with stagnating population growth, while the U.S. has benefited from immigration. Energy independence has allowed the U.S. to limit inflation shocks, whereas Europe has had to contend with an energy crisis. As central banks began raising interest rates, the European economy was hit harder due to its greater reliance on variable-rate financing and less generous fiscal spending. Furthermore, the economic challenges Europe has been facing have deepened political fragmentation across the region. Finally, over the years, stricter regulations, a more conservative and relaxed business culture, and fewer venture capital investments have hindered Europe’s ability to foster global tech leaders, which are increasingly becoming the driving force of the U.S. economy.

Quality in Europe

U.S. exceptionalism has already led some investors to question whether geographical diversification still makes sense. However, the structure of the European market can also be viewed as a feature, not a bug. The underperformance of the European market is not due to a lack of quality but rather a combination of external factors and market specifics. While the U.S. offers a broad selection of high-quality new economy companies, Europe offers some balance, and is home to many high-quality attractively valued leaders from traditional sectors of the economy. For example, the old-school nature of the European market proved advantageous for global portfolios in 2022, when shifting macroeconomic tides favored value stocks. As we remain in a high-interest-rate environment with elevated inflation risks, and as U.S. valuation levels push against former highs, diversification remains essential.

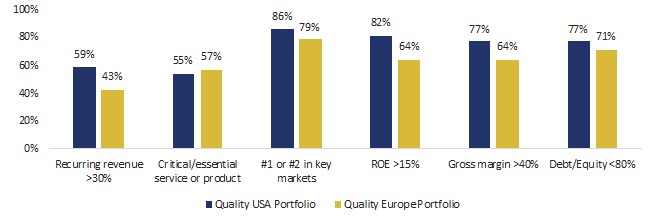

In our view, the European market offers an attractive ground for identifying attractively valued high-quality businesses. As shown in Fig. 4, the Quality profile of our European portfolio is quite comparable to that of the U.S. portfolio. The main differences arise from a higher concentration of software companies in the U.S. portfolio, which contributes to higher recurring revenue and margins.

Figure 4: Quality characteristics of Quality USA Portfolio and Quality Europe Portfolio

While Quality companies like ASML and Hermès are well-known, there are many less prominent quality European firms that have successfully capitalized on global secular trends, effectively decoupling from domestic macroeconomic challenges. Through investments in innovation and agility, these companies are able to deliver above-market growth and returns. For example, Atlas Copco serves as a key supplier of vacuum technology to the semiconductor sector; software provider Sage has successfully transitioned to Cloud; while information services Wolters Kluwer has leveraged its deep domain expertise to drive growth through digital transformation and AI-powered solutions.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.