Unlucky combination

Start of 2022 was quite rough causing stress to many investors, particularly if they had a growth tilt in their stock portfolio. It was a combination of factors that caused most significant downside since markets free fall in March 2020 due to COVID spread. First, Fed intends to start fighting inflation which jumped to 7%, which most probably will lead to 3-5 interest rates increases in 2022. Second, sector rotation, which started in 2021, continued at full speed sending Technology and Consumer discretionary sectors 7.5% and 10% down respectively since beginning of the year, while energy was 19% up. Third, COVID concerns are still there as the number of cases is on the rise. Fourth, market valuation was sitting on above average historical level making lots of market participants seeking for downside.

Overall market corrections tend to be healthy for the market to calm down a bit, providing an opportunity to invest at lower valuations. However, this time we believe the correction is overdone and here is why:

Oversold market

Technically we have a very unique situation in the markets due to high concentration in 5 major ecosystem stocks (Apple, Amazon, Alphabet, Microsoft, Meta Platforms) + Tesla that are holding the broad market from sliding into bear market, while the number of stocks that are down 50%+ are highest since 2008. Sentiment has turned extremely bearish:

- Put/Call ratio highest since March-20,

- Just 25% of S&P Index stocks are above 50-day moving average,

- AAII Bull/Bear at extreme,

- Monthly outflow from Nasdaq in January was 6th largest on record.

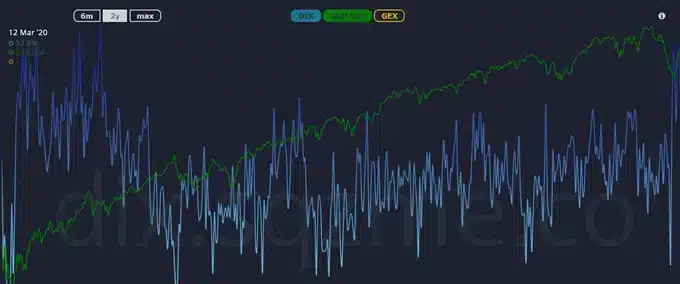

We also see that institutionals started to buy (dark pool buying at record high – DIX above 50% (fig.1 ) which might signal that we reached a point when too many companies became attractively valued if you are ready for short-term volatility and hold them long-term.

Fig.1: S&P Index and Dark pool Index

Source: SqueezeMetrics

Rate hikes, inflation and strength of the economy

After explosion in consumer spending, which was postponed due to COVID-caused restrictions, the situation starts to cool down. Consumer sentiment is on a declining trajectory and has reached lowest level since global financial crisis and the following weakness seen in 2011 (fig.2). Consumer spending drives two thirds of the US economic growth and its slowdown will also weigh on the economic growth. Therefore, Fed has the challenging task of walking on thin ice when rising interest rates to tame rising prices not to suppress economic growth.

It is being expected that there will be three to five rate hikes in 2022. However, market drawdown of 20% is consistent with eight rate increases according to our simulation that are currently priced in and we already see that Fed’s Kashkari is hinting about pausing in spring.

Fig.2: Consumer sentiment and effective rate

Source: FRED Economic Data

And this is not the groundless statement given that inflation chart appears to be inverted. Currently high inflation figure is rather a temporary phenomenon, and it is expected to go down substantially in the coming year as global supply chain problem is being resolved. Thus, the need to swiftly raise base rates fades away, which allows to make conclusion on the oversold markets especially given very cautious stance of Fed.

Envious growth metrics and quality characteristics

The eyes of fear see danger everywhere – this is the current market mood as Fear&Greed index by CNN sits in the fear zone. Investors overreact to the future rate hikes while neglecting the fundamental charactestics and not carefully assessing its potential influence on the cost of debt servicing.

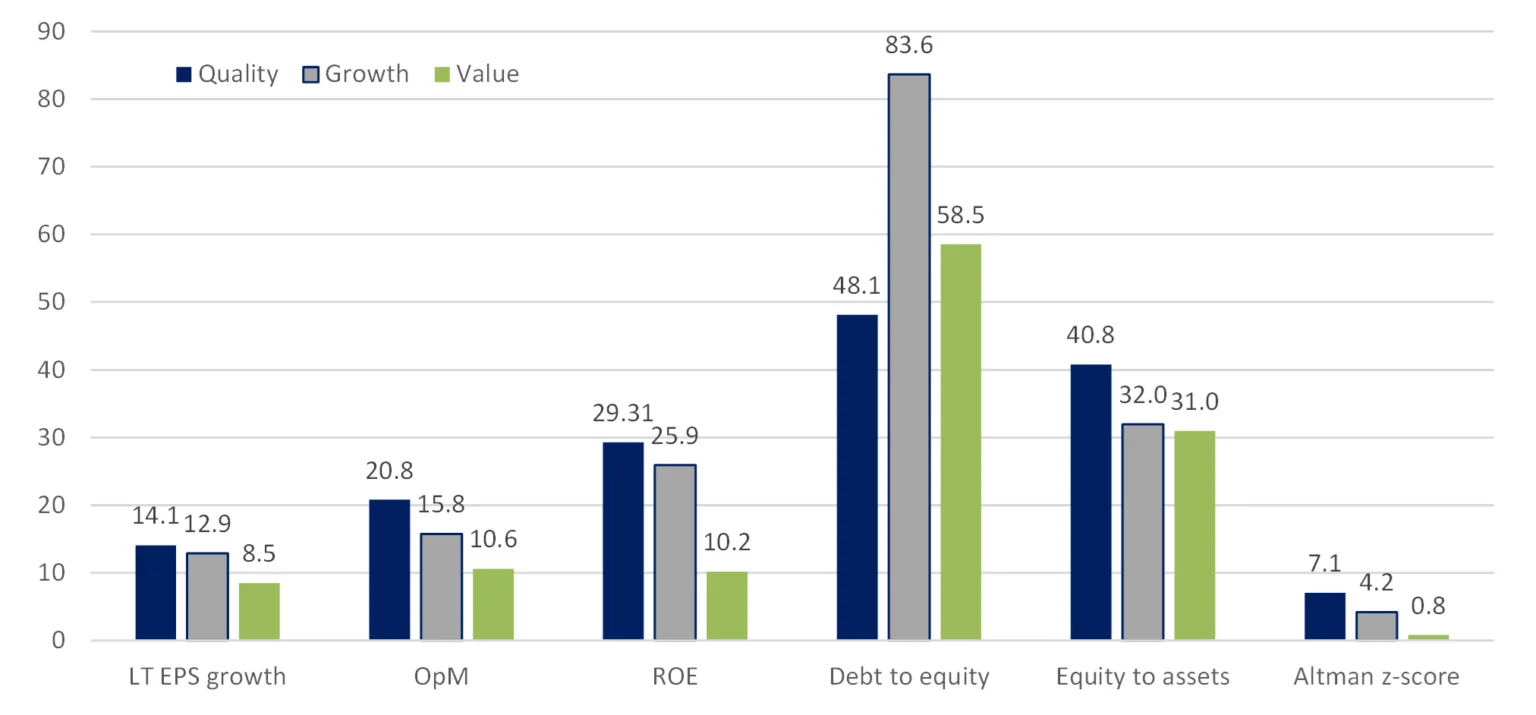

We have compared the fundamental charachteristics and long-term growth rates of value and growth stocks, classified based on PB ratio. The main concern with regards to debt burden and its servicing cost of growth companies vs. low growth or value companies can be eased as the equity ratio of both type of companies are basically on the same level. The difference in debt to equity ratio is evident but not huge. The most striking difference is in a likelihood of bankruptcy ratio, Altman z-score, which takes into account not only debt level but also earning ability of the enterprise: growth companies look 5-times better on this dimension.

Fig.3: Quality, Growth and Value fundamental characteristics (MSCI USA)

Source: Hérens Quality AM, Reuters

Profit margins and capital return as well as long-term earnigns growth rate being on much higher level justify higher valuations for growth stocks. However, one needs to constantly monitor the robustness of the economic moat and ability to grow at above average rates to judge on whether daily declines of over 20% for Facebook or Pay Pal stocks are reasonable or not.

Gradual position built-up

With Quality titles significantly down, current market environment could be an excellent entry point for a long-term investment. It is possible for volatility to stay on a high level, which in the end would benefit patient investors, reluctant to panic selling. Naturally, the rates would be increased this year but even 2% growth in capital cost for the companies in no way justifies such significant drawdown among the Quality titles. So, cost averaging strategy to build-up positions looks the most reasonable to exploit the discounts offered by the market.