As of early October 2025, U.S. equities sit near record highs. But beneath the headline indexes, the market of 2025 is anything but ordinary. A narrow cohort of AI beneficiaries has driven most of the gains; mega‑caps dominate index level outcomes; retail traders have re‑embraced high‑octane leveraged risk; companies seen as threatened by AI are whipsawing; traditionally “quality” stocks have lagged; and everyone – from executives to day traders – is chasing the next big theme.

Return dispersion: AI winners vs. everyone else

The defining feature of 2025’s market is dispersion – the widening gulf between the small cluster of AI winners and the vast remainder of listed companies. Since the launch of ChatGPT ignited the current investment cycle, Morgan Stanley estimates that stocks linked to AI infrastructure – hyperscale cloud platforms, leading-edge chipmakers, semiconductor equipment suppliers, data‑center builders and landlords, and energy suppliers feeding compute demand – have contributed roughly three‑quarters of the S&P 500’s aggregate gains, while also accounting for about 80% of earnings growth and around 90% of capex growth associated with the rally. In plain terms: the typical stock has not been doing the heavy lifting; a very specific group has.

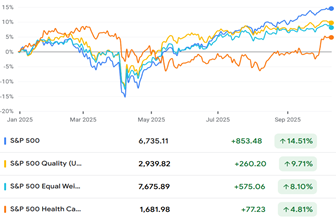

You see that clearly in breadth measures. The cap‑weighted S&P 500 – dominated by the largest AI‑adjacent names – has posted strong double‑digit gains year‑to‑date (14.5%), while the equal‑weighted S&P 500 – which treats each company the same -has been up modest 8.1% higher, slightly less than half lower return. That divergence is a shorthand for dispersion: the bigger and more AI‑exposed you are, the more your stock likely contributed to index‑level performance this year – MSCI Technology is up a whopping 26% YTD.

The Rise of Passive and Mag-7

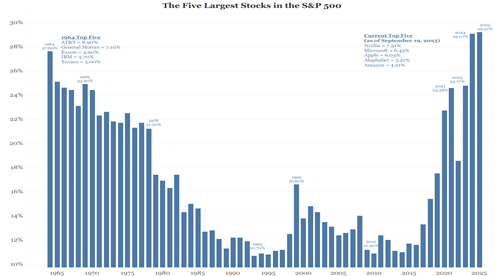

S&P 500’s market concentration has reached a historic extreme, a dynamic driven not just by investor sentiment but also by the fundamental outperformance of its largest constituents.

Figure 1: S&P 500 5 largest stocks concentration

The consequence of this is a profound concentration of earnings power – top 50 companies now contribute an astounding 69.2% of the S&P 500’s total long-term earnings growth. This figure represents a massive increase from 51.1% a decade ago, illustrating a structural shift in the market where a select group of high-growth, innovation-driven firms are responsible for the vast majority of the index’s fundamental expansion.

The data reveals a critical shift in the market’s structure. The S&P 500 is no longer a diversified proxy for the U.S. economy; it has effectively become a concentrated, actively-managed bet on the success of a handful of technology platforms. Passive investors who believe they are buying broad market exposure are, in fact, unknowingly taking on immense idiosyncratic risk tied to the fortunes of these few firms. Is this justified in the era of OpenAI disrupting everything from healthcare and hiring to showing profound ambitions in hardware (Apple beware!) and neo-clouds like Nebius and CoreWeave questioning status-quo for hyperscalers?

Entire industries in the crosshairs of LLMs

Volatility has spiked in sectors seen as facing an AI threat. For example, market-research firm Gartner, Inc. saw its shares crater 30% in one week after cutting its outlook – analysts said clients might turn to AI-driven alternatives to Gartner’s services, underscoring investor jitters about AI disruption. Traditional advertising agencies have likewise been hit: WPP Plc has shed over 50% of its value this year and Omnicom ~15%, amid talk that AI could automate ad creation. Even staffing companies are under pressure – e.g. ManpowerGroup is down ~30% and Robert Half over 50% year-to-date – as markets price in the risk that AI-driven automation will erode demand for their recruiting and temp services. In short, any company perceived as being on the wrong side of the AI revolution has experienced heightened volatility and sharp sell-offs in 2025.

The Quality Conundrum: Why Profitability Is Out of Favor

High-quality businesses – traditionally prized for steady profits, low debt, and resilience – have markedly underperformed in 2025’s risk-on market. Barclays notes that outside of the few mega-cap tech leaders, the broader “Quality” factor has underperformed – firms with strong balance sheets and durable earnings have posted “steady results, but in a market chasing near-term growth, they’ve been left behind.”

Figure 2: DifferentS&P 500 Performances

Traditionally defensive sectors illustrate this quality drag. For instance, healthcare stocks (often viewed as high-quality and recession-resistant) struggled for most of 2025, significantly underperforming the market. The sector only began to rebound at the very end of Q3 (leading an early Q4 rally after languishing much of the year). Consumer staple giants and other reliable earners similarly lagged. This underperformance of quality companies is unusual in a year with plenty of macro uncertainty and suggests that lack of “buzz” made these steady performers.

Chasing the Next Big Thing and Echoes of Dot-Com Era

On Monday, 6th of October AMD shareholders woke up in extasy – OpenAI committed to buy hundreds of thousands of company’s high-end AI chips (roughly 6 gigawatts of compute) starting in 2026 – a supply agreement expected to deliver “tens of billions of dollars” in annual revenue for AMD – while securing a warrant to purchase up to ~10% of AMD’s equity at a nominal $0.01 per share. While deal details raised some eyebrows, AMD stock quickly moved 40% in the next few trading sessions creating above $100 bn in market capitalization for the company. In other news in October Cantor Fitzgerald raised its Nvidia price target from $240 to $300 implying 56% upside and market capitalization above $7 trillion. Veteran observers (Jeff Bezos and Paul Tudor Jones recently) are increasingly comparing the current environment to the late-1990s dot-com bubble, where hype often trumped fundamentals. Bullish euphoria can prolong these manias, but eventually narratives meet reality. Officials like the IMF’s chief have warned that today’s “one-note” AI-driven rally is loaded with risk, cautioning that a mood shift or disappointment in tech earnings could “result in potentially large corrections”.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.