INVESTMENT PRINCIPLES

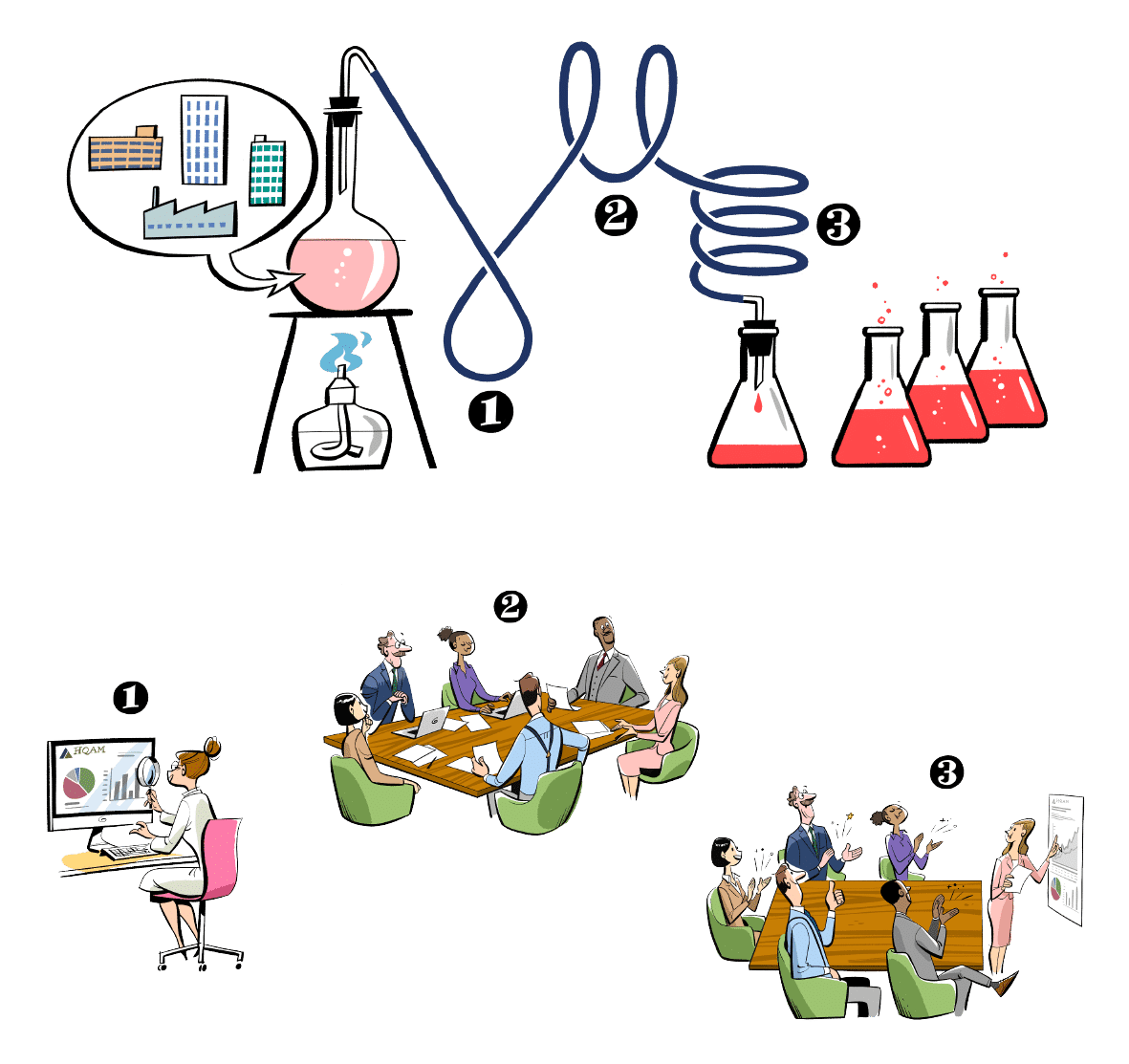

Quality at attractive valuation

Our investment style is traditional, timeless and has its own performance and risk character. We believe that clear, disciplined, and systematic analysis is the key to sustainable investment success.

With this philosophy, the focus is on the quality of a company. This means looking for companies that have solid fundamentals, such as a strong balance sheet, stable sales growth, sound business strategy, sustainable competitive position and a solid management team. In addition, the company must be attractively valued in both absolute and relative terms.

Our analyses for both bonds and equities are based exclusively on our own research and analytical tools developed in-house.

The selection criteria have a demonstrable influence on the business success of a company. We pursue a 100% bottom-up and index-independent “best-of-overall” approach. Not every industry is equally capable of generating quality companies, whether due to regulatory framework conditions or simply as a result of structural changes.

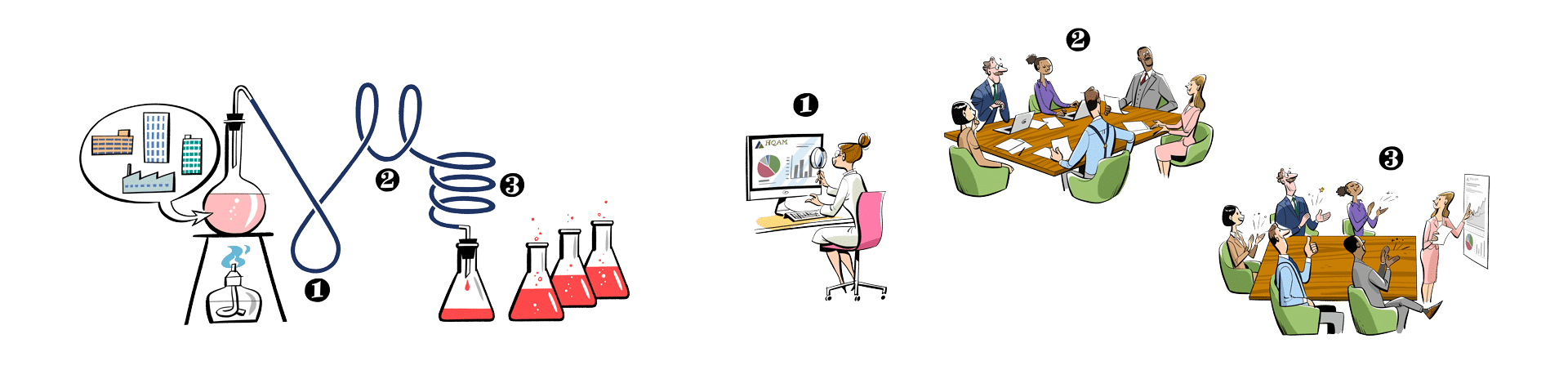

INVESTMENT PROCESS

Regional portfolios

Quantitative analysis

Financial strength

Our Quality companies must have a solid financial foundation, sound balance sheet and conservative financing. This means they are hardly dependent on debt capital and have a real opportunity for growth, both organically and through acquisitions.

Long-term growth

Our Quality companies must be able to use capital profitably and effectively, as well as benefit from competitive advantages at the same time. Therefore, they generate attractive, recurring profits from their core business.

Qualitative analysis

Management

Our Quality companies are led by competent and consistent management teams. Therefore, they are better positioned to overcome challenges and manage the industrial life cycle.

Valuation

Our Quality companies must have an attractive valuation, both in absolute and relative terms.

Market leader

Our Quality companies serve attractive markets with proven business models. Therefore, they benefit from a strong market positioning and above-average profitability.

Sustainability

Our Quality companies pay attention to social and ecological aspects. Therefore, they create long-term value for all shareholders and thus ensure their own survival.

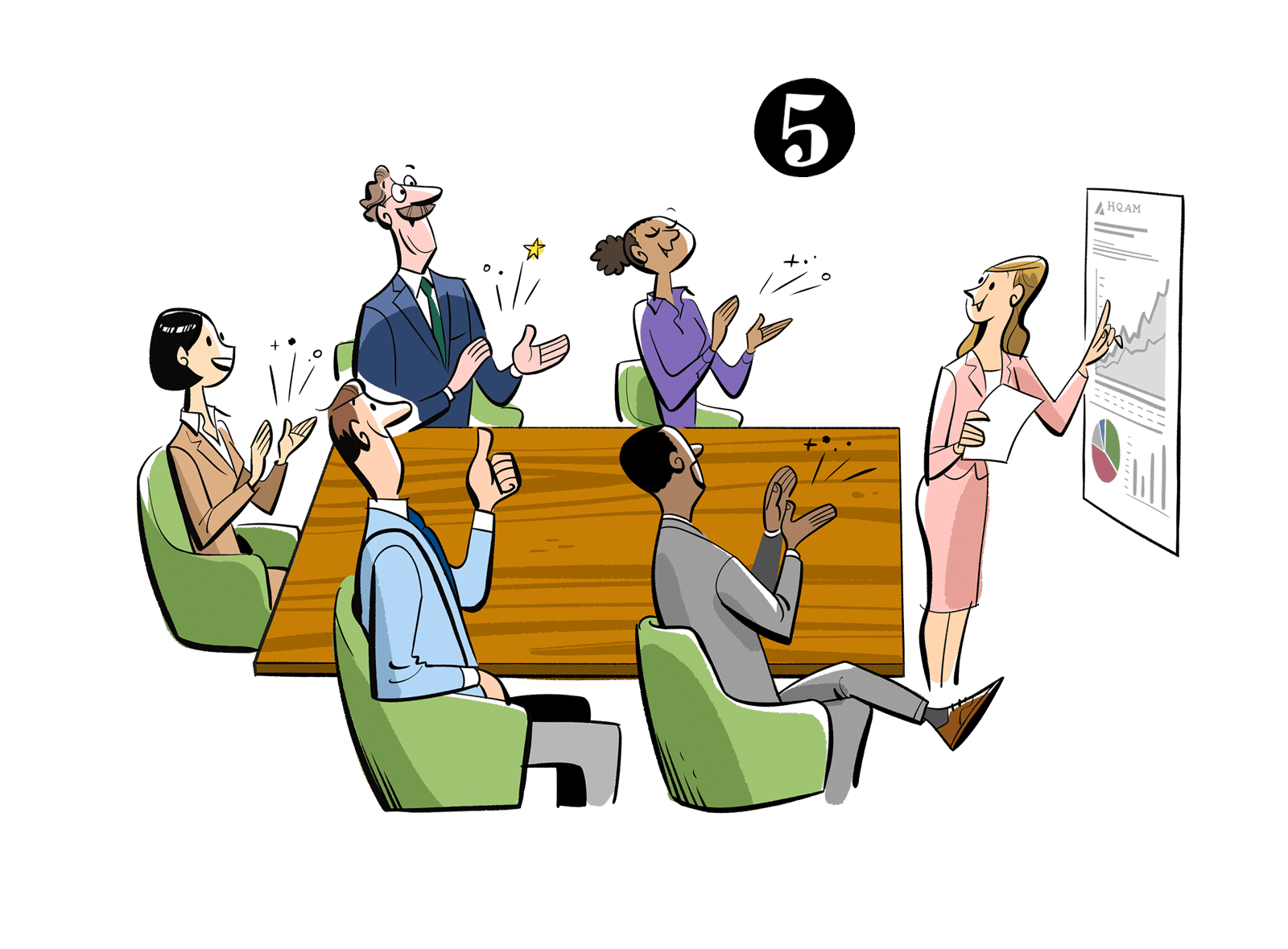

Investment Committee

The companies that have successfully passed both steps of our investment process are discussed in the meetings of the investment committee (6 members).

However, a company is only included in the portfolio if all quality and valuation criteria are met and all members of the investment committee unanimously make the Buy decision. This approach ensures that all parties involved are fully convinced and that there are no ambiguities or concerns.

Our investment philosophy is based on a careful and comprehensive analysis process, which ensures that only the best companies are included in the Quality portfolios. Intensive discussion within the Investment Committee and the requirement for a unanimous decision ensure a high level of quality control. The deep understanding of each company enables individual adjustments to be made and a flexible strategy to be implemented to promote the long-term success of the investments.

INVESTMENT PROCESS

Focused portfolios

For our focused Quality Top products, the investment criteria are expanded once again. An additional set of criteria is applied to each company, serving as a supplement to the standard quality analysis.

Our focused Quality Top Portfolios consist of what we consider to be the best companies from the respective investment universe. These typically have a strong global presence, show above-average growth potential and are technology and innovation leaders in their field.

Top Portfolios additional criteria

Our regional Quality portfolios serve as a starting point for the composition of our focused Top Portfolios. Only companies that are already included in our regional portfolios and meet our strict quality and valuation criteria are considered for our focused top portfolios. We specifically look for companies that are not only financially strong, but also have above-average growth potential and demonstrate technology and innovation leadership in their industries. In addition, the companies in our focused top portfolios are characterized by their global presence. Through this selective choice, we aim to provide our clients with long-term growth and attractive returns in a concentrated and quality-driven portfolio.

Investment Committee

Those companies that have successfully passed both steps of our investment process are discussed in the meetings of the Investment committee. These are companies that meet certain criteria and are considered potential opportunities for investment.

However, a company is only included in the portfolio if all quality and valuation criteria are met and all members of the investment committee unanimously make the Buy decision. This approach ensures that all parties involved are fully convinced and that there are no ambiguities or concerns.

Our investment philosophy is based on a careful and comprehensive analysis process, which ensures that only the best companies are included in the Quality portfolios. Intensive discussion within the Investment Committee and the requirement for a unanimous decision ensure a high level of quality control. The deep understanding of each company enables individual adjustments to be made and a flexible strategy to be implemented to promote the long-term success of the investments.