Tarrifs déjà-vu

Trump is not new to the role of President of the U.S., and this is also not the first time he has imposed tariffs on goods from U.S. trading partners as part of his MAGA efforts (link). We saw similar events unfold in 2018, though not to the same drastic extent. Eight years ago, only 4.1% of total imports to the U.S. were subject to tariffs, mainly affecting steel, aluminum, washing machines, and solar panels. Research shows that these actions effectively acted as hidden taxes, which negatively impacted economic growth1.

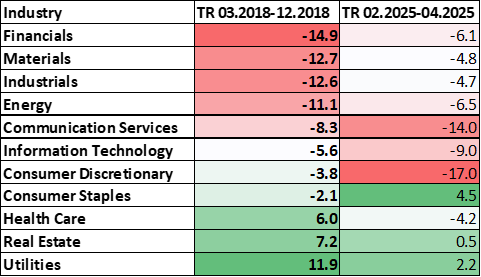

In essence, the results contradicted the intended goals: the tariffs failed to boost employment, manufacturing was hampered due to rising costs and foreign retaliation. Unsurprisingly, the stock market reacted negatively to this policy intervention. Financials, Materials, Industrials, and Energy were the weakest performing sectors in 2018 following the tariff announcements.

Figure 1. Total return (in %) by industries in 2018, 2025

Now, the situation is entirely different, as it affects the majority of U.S. imports. A 10% tariff is essentially applied across almost every import category, with some facing even steeper rates — 25% for steel and an astonishing 3000% for solar panels.

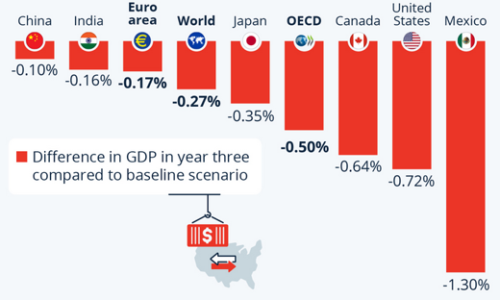

We already have some assessments on how this will impact economic growth and inflation. The OECD2 estimates that a 10% tariff on all non-commodity imports to and from the U.S. would have particularly negative effects on the GDP growth of Mexico, the U.S., and Canada. Additionally, artificially stimulated inflation could prevent the U.S. from lowering interest rates — or even force a reversal in policy if inflation spirals out of control.

Figure 2. Estimated impact of 10% tariff increase impact on all non-commodity import to and from the US in year 3

The April 2nd tariffs alone are projected to reduce U.S. real GDP growth by 0.5 percentage points in 2025 and 0.1 percentage points in 2026, according to Yale Lab3.

We see indications in companies’ earnings calls that they are raising prices and plan to pass on the tariff-related costs to customers. Given that U.S. multinationals are highly globalized and a rapid supply chain reshuffle is nearly impossible in the near term, the impact of these actions could be significant.

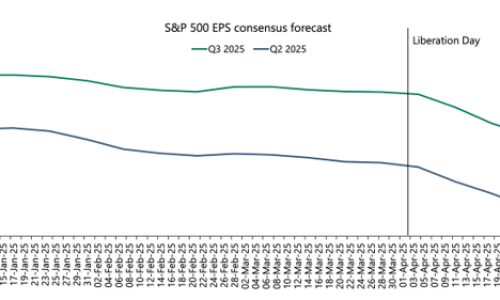

Figure 3. S&P 500 earnings downgrade after ‘Liberation Day’

Earnings forecasts for U.S. companies have been revised downward since Liberation Day, so the real impact on earnings power will be tangible. The companies are also postponing their capex investments given high degree of uncertainty. A tough question remains: has the market fully priced in the curb in earnings growth?

No one wins a trade war

Research on past experiences with trade wars and tariff implementations shows that such actions rarely create value for any party involved. A study covering 150 countries from 1963 to 2014 demonstrates that tariff increases have a significantly negative impact on output, investment, and productivity in the mid-term4. Another study suggests that tariff shocks tend to have a more substantial economic impact than trade policy uncertainty5.

Potential winners and losers

We’re already seeing some winners and losers emerging from the current wave of tariffs. Software companies offering ERP systems — essential for managing disrupted supply chains — are seeing rising demand. Any tech company offering operational efficiency solutions is also likely to benefit. Other potential winners include low-cost retailers such as Costco, Kroger, Dollar General, and Dollar Tree, which enjoy cost advantages and localized sourcing. These companies can also more quickly adapt their supply chains to further localize sourcing.

On the losing side, companies heavily exposed to manufacturing in China, such as Wal-Mart and Amazon, as well as fashion and sporting goods brands like Nike, Gap and Skechers, are likely to face negative impacts. The semiconductor sector seems to be hit the hardest, especially in the advanced chip segment, due to its strategic importance and exposure to restrictions, sanctions, and regulation.

The path forward for the industrial sector remains uncertain. Currently, it appears that many companies are passing rising costs on to end consumers. However, it’s unclear whether this can be done without sacrificing demand.

Market view of the tariff impact

Looking at the stock market’s performance in February and March, we observed a strong rotation toward more defensive sectors, while cyclical, growth-exposed companies were sold off. The biggest hits were taken by China-exposed goods-producing firms such as Nvidia, Apple, Nike. Time will tell if the market correctly priced in the economic slowdown and earnings damage from the tariffs. It’s likely that further declines are coming, especially in sectors where the market has not yet fully reflected the risks. Uncertainty is being added by the ability to administer tariff regulation and to control the value chains in multiple industries, including semiconductors.

References

- Amiti, M., Redding, S. J., & Weinstein, D. E. (2019). The impact of the 2018 tariffs on prices and welfare. Journal of Economic Perspectives, 33(4), 187-210.

- OECD Economic Outlook, Interim Report March 2025.

- The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April, Published by: Yale Budget Lab, 2025

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.