Valuation jungles

Valuation is far more than a bold P/E ratio or a neat DCF model—it tells the story of a company, a sector, or even an entire market. It is shaped by culture, history, investor psychology, and structural quirks. Why do Swiss consumer giants trade at double the earnings multiple of equally profitable Japanese industrials? Why does a U.S. software firm with no profits command a richer valuation than a cash-rich Korean conglomerate? And why are some of the world’s fastest-growing economies home to some of the cheapest stocks?

In this insight, we explore valuation paradoxes across global markets and, additionally, ask if quality companies always enjoyed premium valuations, or is this a more recent phenomenon?

Swiss premium valuation paradox

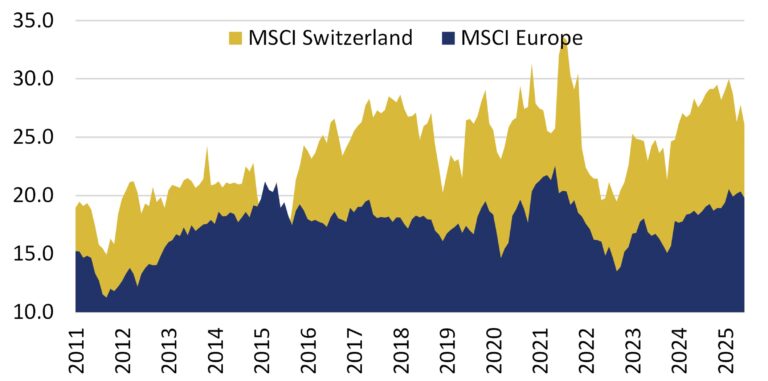

Switzerland boasts not only one of the priciest real estate markets in the world, but also one of the most expensive equity markets. The valuation gap versus European stocks has historically averaged around 50%. While a P/E of 25-28 is normal for Swiss firms, such levels would be considered lofty in Japan, Europe, or even the U.S.

Figure 1. Valuation levels (PE), MSCI Switzerland vs MSCI Europe

Swiss companies are perceived as high-quality, low-risk, and shareholder-friendly. The country produces a disproportionate number of “quality” stocks compared to its European peers – 11 firms out of 100 best companies, just a bit running behind the leader, UK, with 14 firms, according to our Excellence award ranking. Historically low interest rates, a strong home bias, and the principle of “invest in the currency you spend” have reinforced investors’ willingness to pay for safety and predictability.

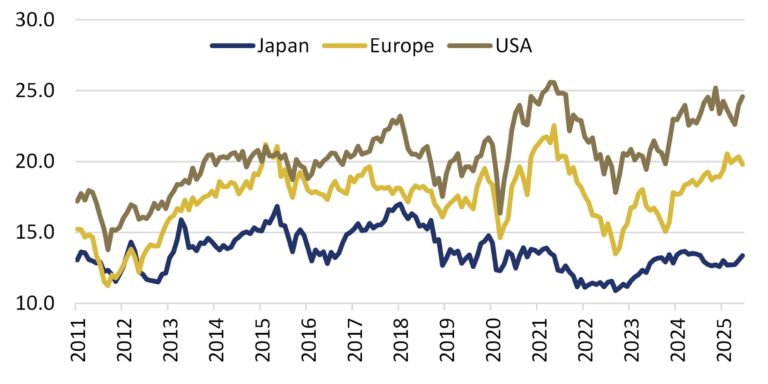

Japanese Discount Paradox

Japanese companies often match their developed-market peers in business quality and growth, yet their valuations remain markedly lower. While the U.S. premium can be explained by superior growth rates, Japan’s discount is rooted in perceptions: weaker corporate governance, a history of deflation, adverse demographics, and long-standing investor skepticism all weigh on multiples.

Figure 2. Valuation levels (PE), Topix vs MSCI Europe vs MSCI USA

The Growth vs. Value Mispricing Paradox

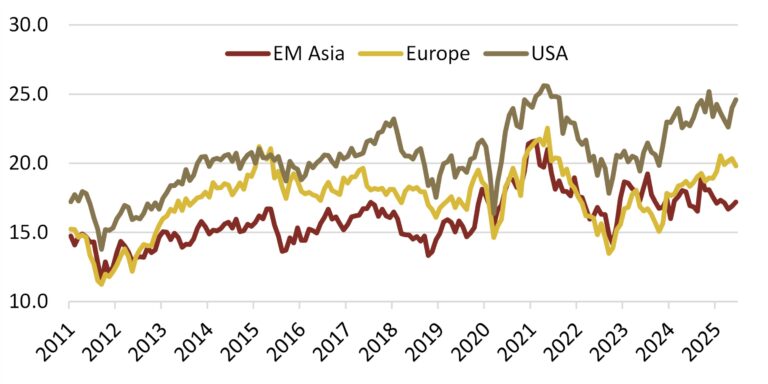

For over a decade, U.S. tech stocks have commanded high multiples, pulling up the valuation of the entire U.S. market. Mega-cap names have grown their share of the S&P 500 dramatically now taking about a third of total index weight.

In contrast, European market valuation has been always lagging behind the one of US market explained by the large share of value companies, coming from financial and energy sector, which were pushing down average valuation levels.

Figure 3. Vauation levels (PE), MSCI Emerging Asia vs MSCI Europe vs MSCI USA

US companies are also expensive as compared to their peers in fast-growing setting such as emerging Asia or Latin America. Despite delivering high growth and very high portion of companies with excellent financials, emerging markets conduct low valuation. This reflects differences in investor trust, government interference, corporate governance. Few years ago investing in Chinese stocks looked like playing a Minesweeper – one really had to dig into the trustworthiness of financials, while Muddy Waters and other short-sellers have been flourishing after revealing ‘creative accounting’ practices on a near-weekly basis. Additionally, you never know what happens tomorrow and how strict the government decides to regulate, as it happened to Alibaba and Tencent.

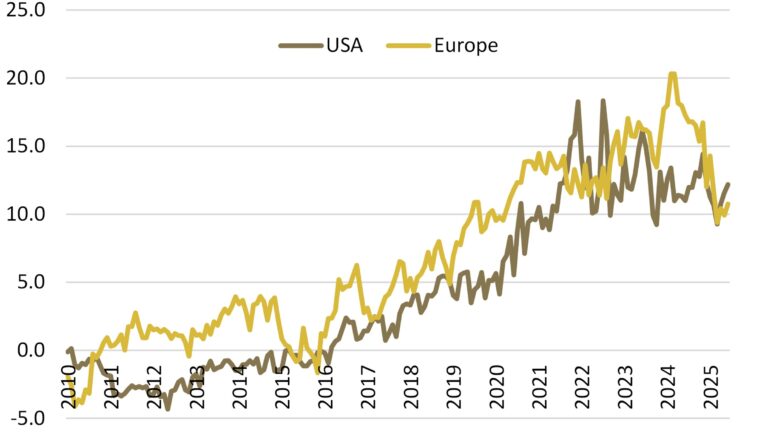

How expensive are Quality companies?

No question, quality requires premium for resilience, for better pricing power, for sustainable growth. But where is the limit?

Figure 4. Vauation (PE) gap between Quality and broad market , USA, Europe

Over the past decade, the valuation gap between quality companies and the broader market has widened sharply in both the U.S. and Europe. Ten years ago, the difference was negligible; now quality firms trade at roughly one-third higher multiples. The driver? Higher growth potential, increasingly tied to the tech sector, has elevated quality’s relative appeal.

Paradox of Valuation in AI context

When producing August Insight, we have witnessed the launch of ChatGPT 5.0 , which together with a flood of other AI models had made AI exposure—positive or negative—a central driver of valuations. There are multiple high quality firms on the market with extremely low valuation seemingly not justifiying their growth rates. However, when the business itself is under risk, the valuation of 19 for Accenture, 14 for Cognizant and for Gartner makes sense.

Valuation is a jungle — vines of data, thickets of sentiment, and sudden quicksand traps. Some trails lead to clearings of opportunity, others to dead ends. So, the clear roadmap is required to avoid valuation traps, while taking an oportunity path by critically analyzing the future development of business model.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.