Rollercoaster year for Quality in Switzerland

Back in 2022, when all the hell broke loose in the equity markets, Quality in Switzerland, same as in other regions across the globe, has suffered substantial set-back performance wise. While country itself got somewhat sheltered from massive spike in inflation and interest rate hikes – although both items have experienced upward movement – Swiss companies, being global players, had to face consequences of a slowdown in economic growth and weak consumer sentiment. We have always argued that given the very nature of Quality companies, they would be sailing strong even if operational momentum goes through temporary phase of weakness. But as investors attempted to protect their worth by either fleeing into cash or Commodities that soared as a result of the war in Ukraine, sentiment was clearly set to overlook long-term picture in the face of immediate, short-term fears. Fundamental quality and durable business models – something that is well known to generate solid long-term shareholder returns – were largely ignored and therefore did not provide shelter to the investors during those turbulent times.

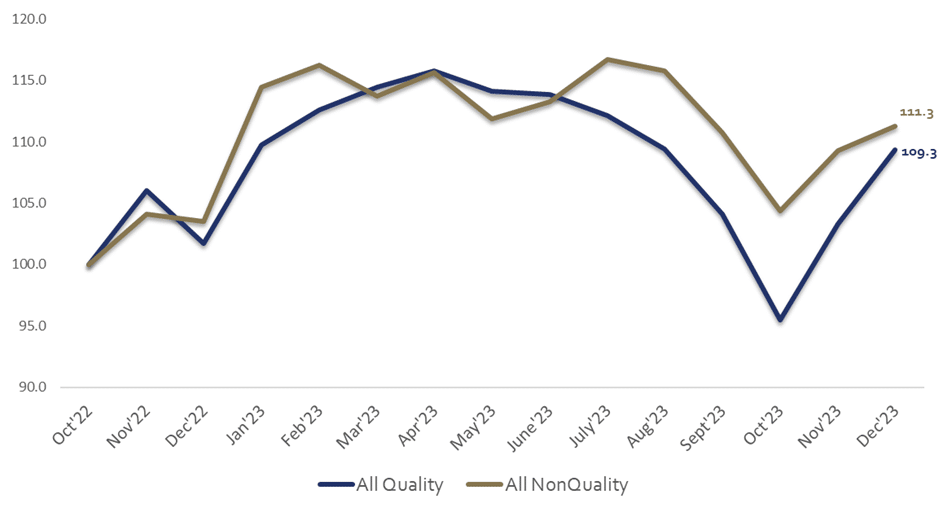

Figure 1: Indexed Total Return Performance (October 2022=100) of Quality and Non-Quality clusters, regardless of Valuation (Gross, in CHF) 30.10-2022-31.12.2023

As fears subsided and dust settled, market was able to think rationally yet again. And, as one would expect, investors began picking up competitive and financially sound companies as 2023 entered the stage. All the points we have been relentlessly making back in 2022 – that Quality stocks are more than equipped to deal with exogenous shocks and input costs inflation because of the strong pricing power and well managed cost base – have finally come to be appreciated.

As a result, Quality in Switzerland came back strong in the beginning of 2023 and held up well right until the end of May, when tables turned and Non-Quality began taking up the pace, predominantly driven by com-panies from the Financial sector (Figure 1). While Swiss Quality has very limited exposure to this sector (4.5% weight), Financials have rather substantial weight in the broader benchmark (16% in MSCI Switzer-land). Also, as reporting season unfolded during summer, selective Quality stocks fell out of favour as gen-eral sentiment over relevant industry turned sour or lack of guidance upgrade was perceived as a sign of weakness, despite operational performance remaining very solid.

As we were closing in on 2023, markets flipped once again, and rally of Quality was so strong in November that in just one month Switzerland Quality Fund managed to close the underperformance gap that it had accumulated throughout the year and even generate outperformance during December to finish 2023 on the positive relative note.

You can access the full Annual Review 2023 for the Switzerland Quality Fund via the link below.