Historical snapshot

Buy high, sell higher – this is the main mantra of momentum stocks, though it may not be obvious to investors who remember the decade following the dot-com bubble. At first glance, it seems counterintuitive to buy a stock which has already grown substantially? How sustainable is this momentum? On the other hand, is it truly more comfortable to try catching a falling knife by opening a position after a price decline? How confident can one be that such a drop is not the start of a downtrend, or that the long-term compounding trend of a multi-year winner has not been broken?

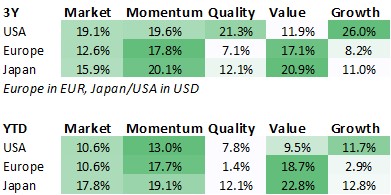

Historical performance across major investment styles—not only classical value and growth, but also momentum—shows strong evidence that momentum has consistently been one of the best-performing strategies over the course of decades.

Figure 1. Style performance by decades

In the 2020s, momentum has continued to rank among the best-performing investment styles across regional markets, along with growth in the U.S., value in Europe and Japan. This development aligns with our earlier view that global trends are becoming more important to investors than the traditional financial status quo (see Insight).

Figure 2. MSCI factor indices performance, local, net TR, as of 31.08.2025

A bunch of biases

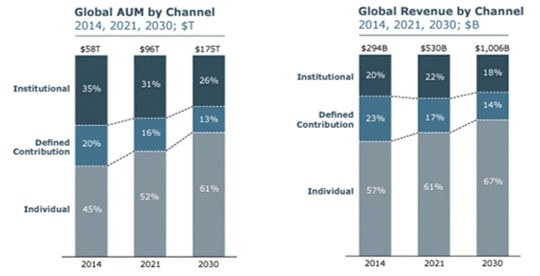

Several factors underpin momentum’s strong performance: investor herding behavior and other cognitive biases, the rise of passive investing, and the democratization of markets. Investing has become significantly more accessible, driven by lower trading fees, abundant information, and widespread availability of investing platforms. Combined with overall wealth growth, these trends have fueled substantial inflows from private investors. This dynamic is expected to persist, supporting long-term market growth (see Fig. 3).

Figure 3. Global AUM by Investor type

The consequences are clearly visible: meme stocks, heightened volatility, and the popularity of thematic investing (e.g., EVs, cannabis, nuclear energy). Naturally, these forces reinforce the outperformance of momentum-style strategies. Research further shows that private individuals often spend only a few minutes researching companies, with price charts serving as the primary basis for their investment decisions².

Private investors, even more than professional ones, are highly susceptible to behavioral biases. These include conservatism bias, representativeness bias, and emotional biases such as loss aversion, overconfidence, and self-attribution3. Emotional behavior—driven by FOMO, fear, greed, and herding tendencies—continues to exert a strong influence on financial markets.

Passives Investing

Passive investing, primarily through index trackers, has become a powerful market force. By design, these strategies are effectively momentum-driven: market-cap weighting channels additional inflows into companies that have already performed well, amplifying their growth and creating a self-reinforcing cycle. This dynamic particularly favors large-cap stocks.

However, such tendencies carry risks. When stock prices diverge too far from fair value, companies can end up with unjustifiably high valuations. An economic downturn could break this cycle, leading momentum strategies to underperform.

Quality+Momentum – best combo?

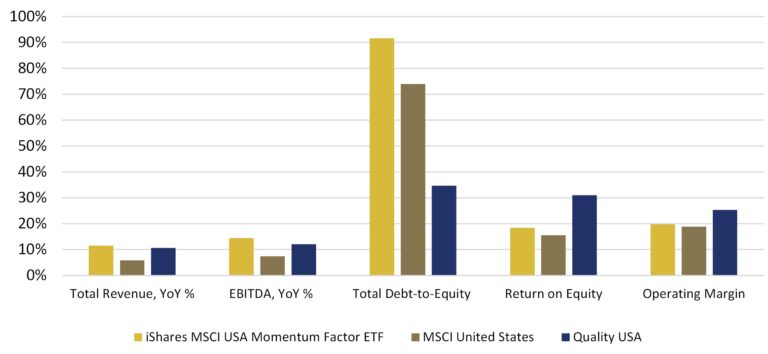

Momentum can reverse sharply, and this is where combining it with Quality may provide a cushion during substantial drawdowns. Historically, Quality companies have shown more resilience in downturns, supported by strong balance sheets, sound governance, and pricing power.

An analysis of momentum-style constituents reveals that their indebtedness is generally higher than the market average. While profitability and margins are broadly in line with the market, momentum companies lag Quality firms on nearly all financial metrics. That said, momentum firms do deliver growth rates comparable to Quality companies, and both styles outpace the broader market.

Figure 4. Fundamental characteristic of Momentum vs. Quality vs. Market

Recently, momentum exposure has been skewed toward defense and banking stocks—sectors with weaker balance sheets and, in the case of defense, relatively limited earnings power. This underscores the importance of quality factors, especially given the weaker fundamentals of many momentum stocks.

Strong financial characteristics are crucial in times of economic slowdown or reduced government support—both of which have been key tailwinds in recent periods for momentum stocks. Moreover, momentum investing inherently involves high turnover. Applying a Quality lens can help moderate this turnover, reducing trading costs that otherwise erode performance.

References

- https://www.robeco.com/en-int/insights/2021/09/momentum-is-a-self-fulfilling-prophecy-and-therein-lies-its-strength

- Huang, Jinsui & Zhang, Peiying & Zhang, Junbin. (2023). Understanding Momentum and Reversal Investing Strategies. Journal of Economics, Finance and Accounting Studies. 5. 106-112.

- Laarits, Toomas and Wurgler, Jeffrey A., The Research Behavior of Individual Investors (March 20, 2025).

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.