2024 review

A year of AI stars

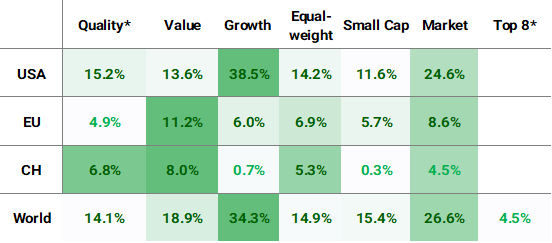

The past year saw remarkable performance, particularly driven by the US market and its growth segment, which delivered exceptional results. Other markets struggled to keep pace, especially Switzerland, where major players such as Nestlé and Novartis faced significant pressure. These heavyweight companies have had a global impact, with the US market benefiting significantly—Nvidia alone contributed over a fifth of the total market’s performance.

In both the US and Europe, equally-weighted benchmarks lagged behind overall market performance. In the US, the MSCI USA Equal Weight Index in USD rose by 16.8%, compared to a 28.5% increase for the MSCI USA in USD. Similarly, in Europe, the MSCI Europe Equal Weight Index in EUR grew by 5.9%, versus 7.7% for the MSCI Europe in EUR. Small-cap stocks notably underperformed, making it a triumphant year for large caps, which generated substantial returns. The driving force behind this performance was, unsurprisingly, advancements in artificial intelligence (AI).

Political factors also played a significant role in market dynamics. For instance, Donald Trump’s presidential election victory influenced certain sectors positively while pressuring others into underperformance. Additionally, a weaker macroeconomic backdrop in Europe hindered listed companies’ ability to deliver robust returns. As a result, we observed increased capital flows into US companies.

Investment style trends were mixed. In the US, growth-focused strategies dominated, delivering returns 2.5 times higher than those in Europe and Switzerland, where growth-style investments underperformed the broader market. Quality, as an investment style, also struggled, trailing behind momentum in the US and value in Europe.

On a sectoral level, Communications (+39%) and IT (+37%) were the standout performers in the US. In contrast, sectors like Health Care, Materials, and Energy lagged. Europe saw a similar pattern, with Communications (+16%) and Financials (+26%) leading, while Materials, Energy, and Consumer Staples faced challenges in achieving strong returns.

Looking ahead, we anticipate investor attention to shift towards other sectors and firms with more attractive valuations compared to the current market heavyweights.

Figure 1 Performance (TR) 2024 by regions based on MSCI regional indices (Currencies: USA – in USD, EU – in EUR, CH – in CHF, World – in EUR); * – Hérens Quality Portfolios

You can access the entire annual report via the link below.