PARTNERSHIP

HQAM x OHOR Sustainable Quality Portfolio

2023 marked the beginning of an exciting partnership between Hérens Quality Asset Management AG and Oliver Heer Ocean Racing (www.oliverheer.ch). As part of this collaboration, we introduced a new structured product – the HQAM x OHOR Sustainable Quality Portfolio. This product with its thematic investment portfolio is designed to invest in Quality companies* that provide products or services that directly or indirectly contribute to addressing environmental challenges. To qualify for inclusion in the portfolio, a company must offer its customers products or services which promote environmental sustainability, such as recycling services and products, energy-efficient products, circular economy solutions, water-saving technologies and others.

*Quality companies are those companies that comply with Hérens Quality Asset Management quantitative financial criteria (e.g., conservative financing, high capital profitability, stable profits and other factors) and qualitative criteria (e.g., strong market position, proven business model, led by experienced management teams and other factors).

Race Tracker – Vendée Globe 2024

Experience the thrilling progress of the Vendée Globe 2024 up close! Track Oliver Heer’s position live and follow along as he takes on the challenges of the world’s oceans. As a proud partner, we support Oliver on his extraordinary journey and share his passion for the adventure and challenge of the Vendée Globe.

Oliver Heer Ocean Racing

Immerse yourself in the world of professional ocean sailing

HQAM x OHOR Partnership

HQAM x OHOR Interview Oliver Heer und Jelena Oleksejenko

HQAM x OHOR Interview Oliver Heer und Diego Föllmi

HQAM Marktgespräch Summer Special mit Oliver Heer

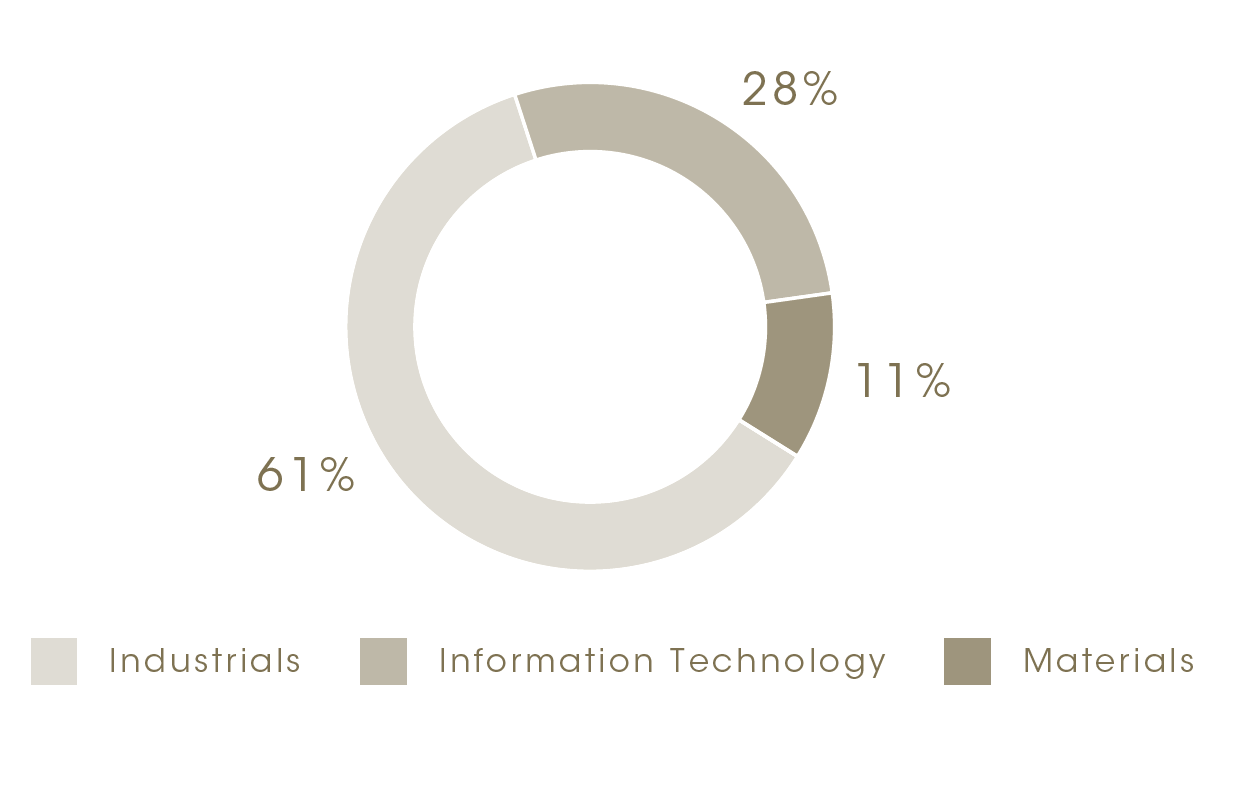

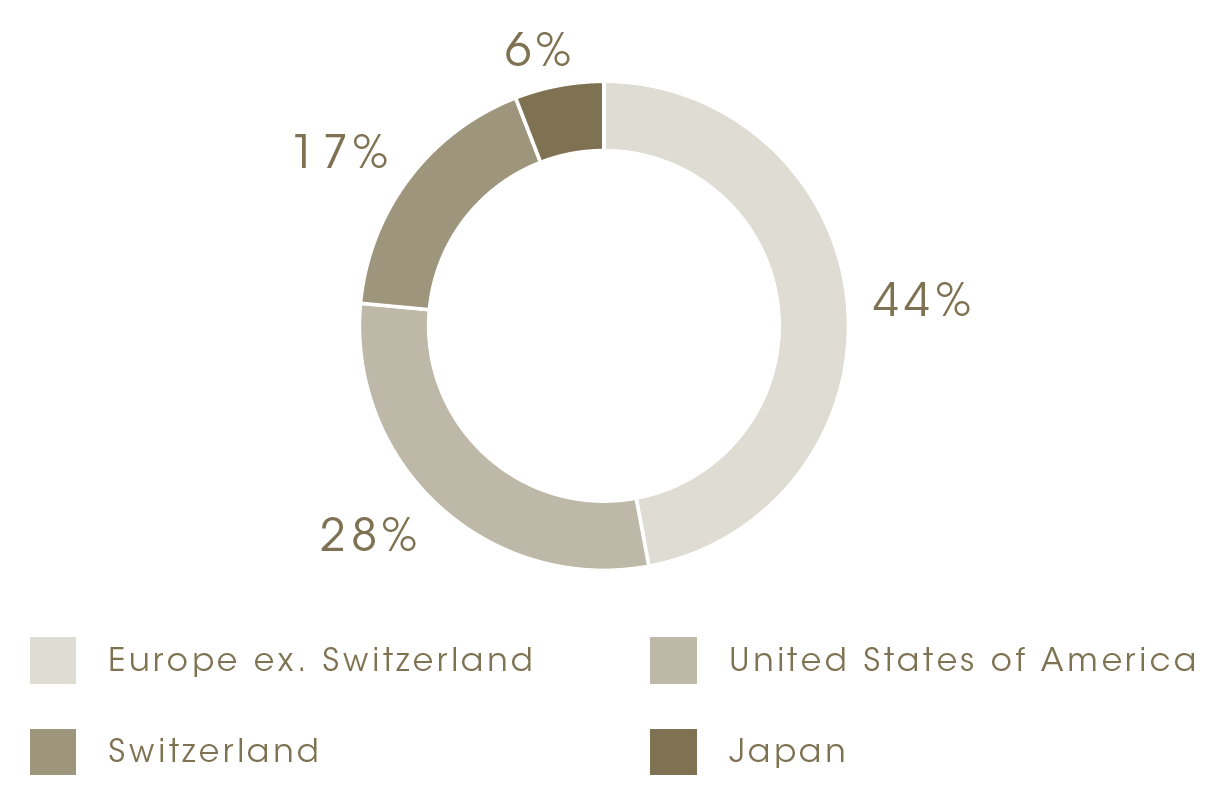

PORTFOLIO

A three-dimensional investment approach is applied to the portfolio

QUALITY AT ATTRACTIVE VALUATION

Companies that stand out for their financial quality are characterized by strong balance sheets, high returns on capital and consistent profitability. In addition, the quality of the business models is reflected in strong market positions, clear and sustainable competitive advantages, and outstanding management teams. Furthermore, valuation is carefully considered during the investment process.

ESG-INTEGRATION

HQAM x OHOR Sustainable Quality Portfolio adheres to an ESG Integration approach. At Hérens Quality Asset Management, we believe that a Quality company must have proper ESG practices, as mismanagement of ESG can have severe implications for the fundamental quality of a company and investment returns. Therefore, ESG criteria are fully integrated in our investment process. Before investing in a company, our analysts perform detailed ESG research, which includes quantitative analysis of ESG performance indicators and qualitative analysis of a company’s ESG policies, strategy and the associated sustainability risks.

THEMATIC FIT

In addition, HQAM x OHOR Sustainable Quality Portfolio adheres to thematic investment approach. The HQAM x OHOR Sustainable Quality Portfolio invests in companies that offer products or services which promote environmental sustainability, such as recycling services and products, energy-efficient products, circular economy solutions, water-saving technologies and many others. A qualitative and quantitative analysis of the company’s product portfolio, target markets, customer base, strategy, and other factors is conducted to determine the role its products or services play in addressing environmental challenges.

INVESTMENT

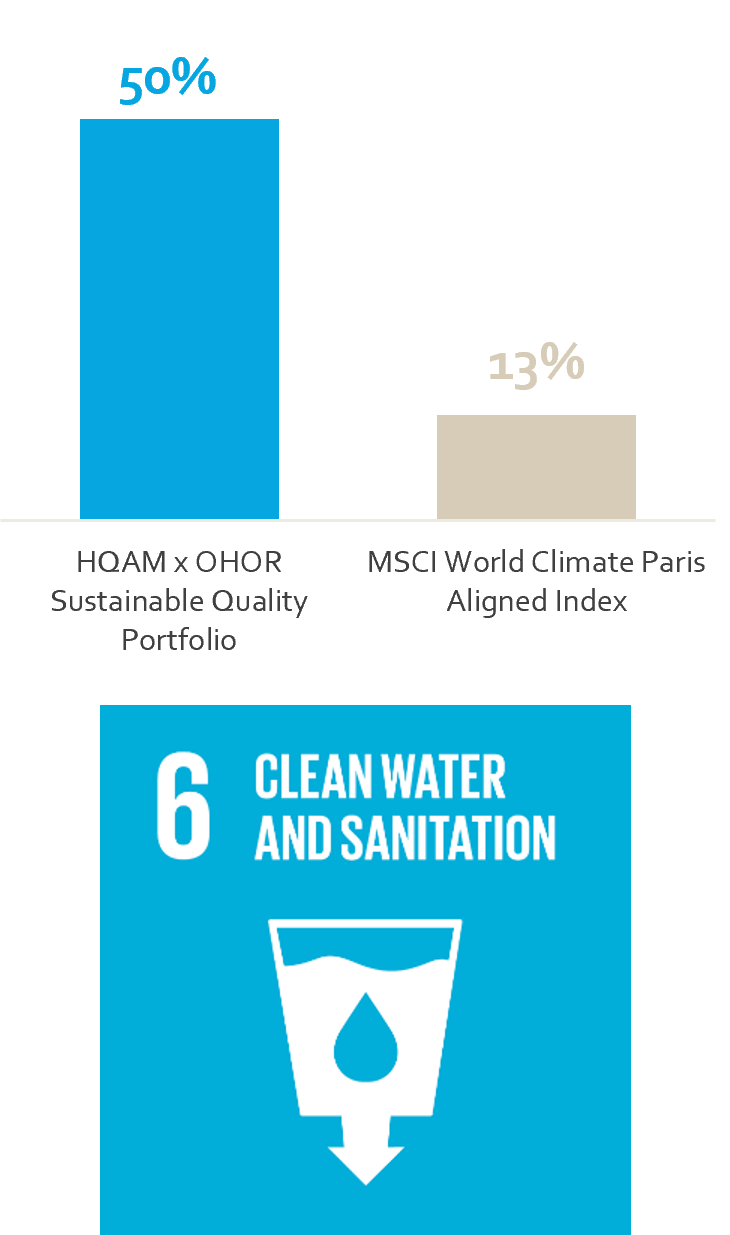

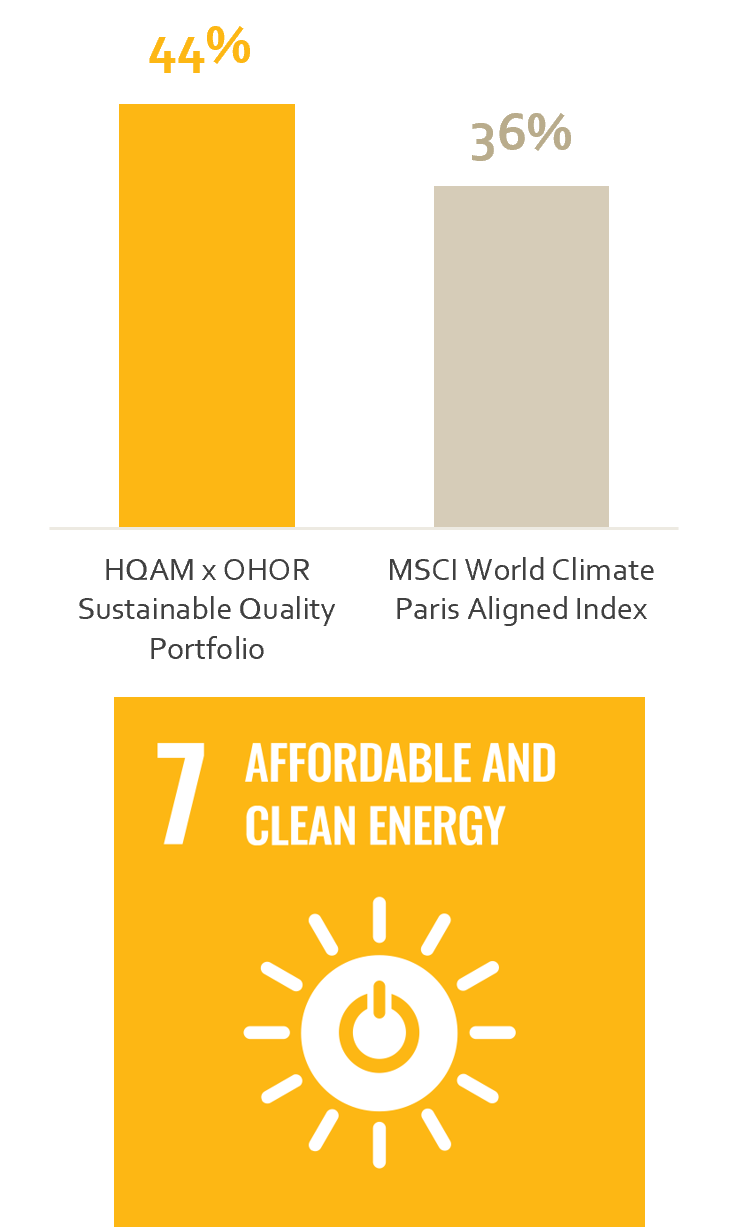

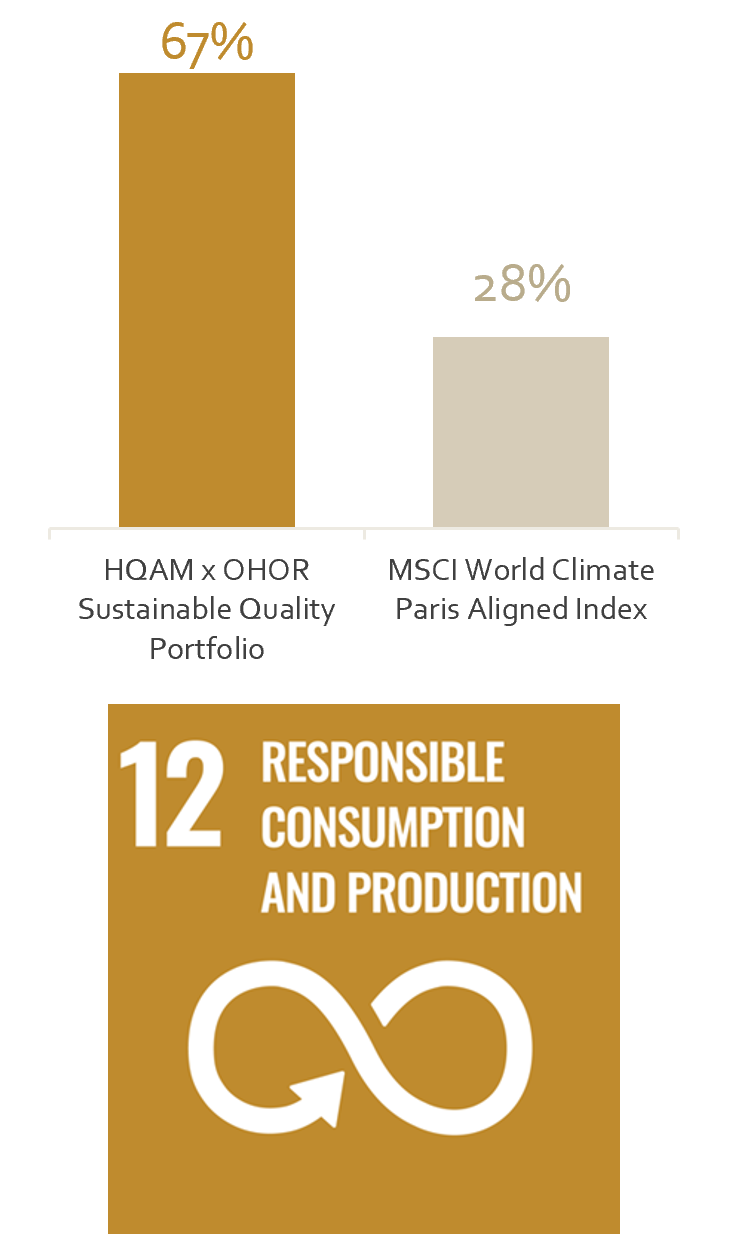

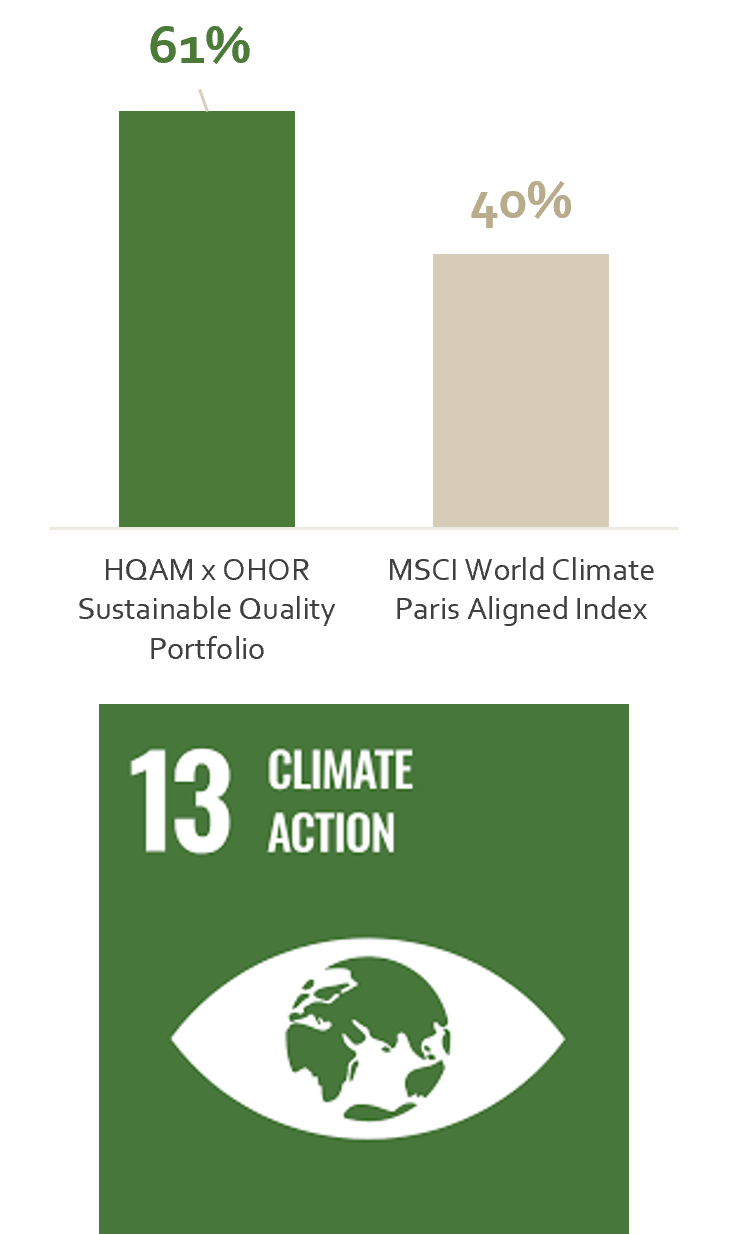

Investment in the HQAM x OHOR Sustainable Quality Portfolio supports companies driving following environmental goals:

Water savings

Tetra Tech’s water solutions help clients preserve essential resource of water: since 2021, the company has enabled 4.75 trillion gallons per year of treated, saved, or reused water

Clean mobility

Analog Devices is a key player in the electric vehicle (EV) industry, with >10M EVs using ADI battery management system

Green electricity

By expanding energy access in underserved areas and providing products for energy supply, Schneider Electric has helped 46.5M people gain access to green electricity since 2019

Based on portfolio composition as of 30.09.2024

Sources: Tetra Tech Sustainability Report 2024, Analog Devices Investor Day Presentation 2022, Schneider Electric Sustainability Report 2023

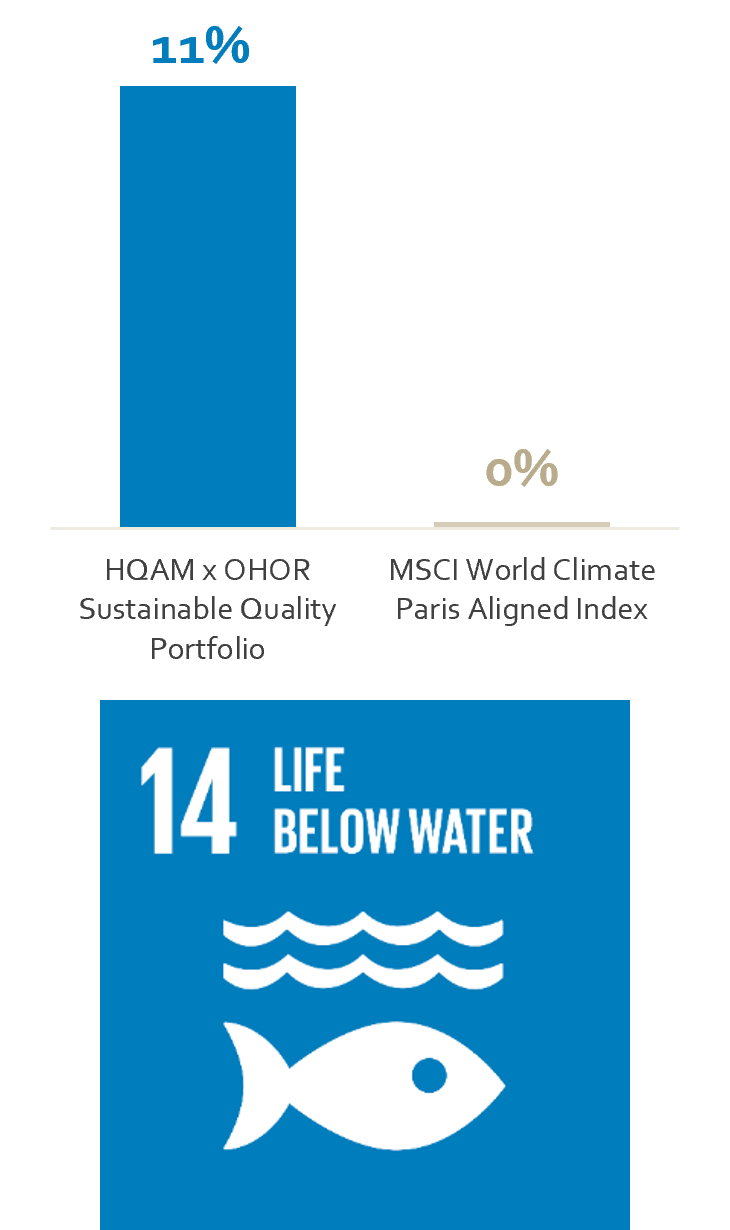

Products and Services

Through provision of sustainable products and solutions, as well as by managing their business activities in a responsible way, portfolio companies help to:

Source: Hérens Quality Asset Management AG, MSCI

Based on portfolio composition as of 30.09.2024

Based on portfolio composition as of 30/09/2024

Sources: Refinitiv

We deliver complete transparency

Our ESG integration process is fully transparent, and, upon request, we provide the necessary information to understand the sustainability profile of our Quality portfolios.

A detailed overview of individual

portfolio ESG profiles and their performance is also readily available to clients upon request. This includes a variety of environmental, social, and governance indicators, in addition to overall ESG ratings.

Below, three company examples from the HQAM x OHOR Sustainable Quality Portfolio are introduced.

CONTACT US

Further information

The HQAM x OHOR Sustainable Quality Portfolio is now available.

If you would like more detailed information, please contact us or enter your e-mail address and contact details in the form below.