1H 2025 Review

‘Shrug off everything and buy the dip’

Checking the Truth Social network and carefully reading through companies’ earnings calls – that was where the attention of market participants was focused starting in January 2025. Trump’s tariff maneuvering had a significant impact on market movements, stimulating a shift toward more defensive sectors and putting the Value style in the spotlight. Interestingly, the market soon entered “TACO” mode (Trump Always Chickens Out), quickly shrugging off negative news and resulting in a W-shaped rebound.

Military conflicts around the world became another major factor influencing the markets, driving up gold prices and boosting returns of defense stocks, which were further supported by large planned government investments in the industry. Fears of recession and stagflation occasionally surfaced but had no severe or lasting negative impact on returns, as markets remained near all-time highs. Macro data has not yet raised alarm among investors, while interest rates continue to decline in Europe and remain in a “wait-and-see” phase in the U.S.

Despite substantial volatility throughout the first half of the year, the U.S. stock market ended strongly, delivering a net total return of 6.1% (MSCI USA in USD). Initial concerns about tariffs were quickly proven to be overblown, giving way to renewed optimism surrounding AI and expectations of tax cuts. MSCI World (in EUR) ended half year period in red mainly because of USD/EUR unfavorable movement.

In both the U.S. and Europe, among the best-performing sector was Industrials (+13% in USD and +17% in EUR, respectively), driven by the standout performance of defense stocks. In Europe, the Financial sector, led by commercial banking giants, outperformed even Industrials with an impressive return of 23.2%. In the U.S., Communication Services (+11%) was the second-best performer, buoyed by heavyweights like Meta and Netflix, as well as strength among gaming companies.

Conversely, the Consumer Discretionary sector lagged in both regions, declining by -3% (in USD) in the U.S. and -7% (in EUR) in Europe, weighed down by tariff exposure and shifting consumer trends in apparel, footwear, and retail.

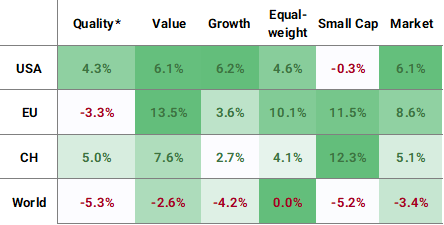

The Value investment style dominated primarily in Europe, outperforming other styles significantly as banks posted strong gains. Growth was the worst-performing style in Europe, hindered by recession concerns and trade war fears that pushed investors toward more defensive strategies.

Defensive investing styles, including minimum volatility and dividends, also topped the performance charts in the U.S.. The Quality style, due to its growth bias, exhibited performance trends similar to Growth.

Looking ahead, we expect the next major market movements to be driven by news from the Federal Reserve, shifts in macroeconomic data, and developments in the geopolitical landscape.

Figure Performance (TR) 30.06.2025 by regions based on MSCI regional indices (Currencies: USA

– in USD, EU – in EUR, CH – in CHF, World – in EUR); * – Hérens Quality Portfolios

You can access the entire half year review via the link below.

ADVERTISING

This article has been prepared solely for information and advertising purposes and constitutes neither a solicitation nor an offer or recommendation to buy or sell any investment instruments or to engage in any other transactions.