1H 2024 Review – AI-exposed stocks rule the market

Since the beginning of the year, the market has been quite nervous with ups and downs whenever US statistical data was published, whether it was inflation, consumer confidence, or economic growth. All eyes were on central banks deciding whether to decrease the interest rates. Large swings, whether positive or negative, have also been seen during the reporting period. Often it is not about the results delivered below or above expectations. Now the forecasts for the next quarters and the year are scrutinized and affect share prices to a great extent.

The index performances were driven upwards by the leaders to a great extent, be it the US, Japan, or Europe. These leaders, as a rule, are heavily exposed to the AI craze, which has spilled over not only to IT but also to the Communications and Utilities sectors. In the US, IT (+27%) and Communications (+26%) stocks, especially the heavyweights, have contributed the majority of the year-to-date returns. Utilities (+11%) enjoyed AI euphoria too, as investors contemplated the implications of the rapidly expanding data center infrastructure on electricity demand growth. In Europe, the best performer was IT, followed by Health Care and Financials. Conversely, the Real Estate sector in all considered markets was at the bottom of the performance leaderboard, as rate cuts were repeatedly deferred and have yet to materialize.

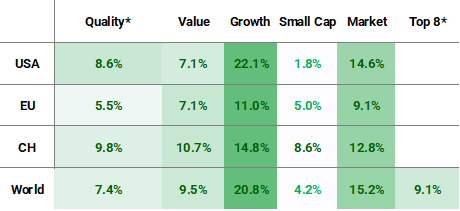

The investment style landscape does not look unexpected: Growth continues to massively outperform Value stocks, with a particularly large gap in the US, where the “Magnificent 7” continue to drive indices further. Momentum was the leader among investing styles with 29% growth. This phenomenon might be explained by the huge market power of passive investment vehicles, which to a great extent stimulate momentum growth. Quality style this time was lagging behind major indices because of its equal-weight approach and due to Quality’s skew towards software businesses, while technology hardware led the performance in the first half. In Europe, the lack of exposure to financials also weighed on quality style performance. The first half of the year was obviously driven by large-cap markets, primarily in the US. In Europe, the situation was more moderate; although small caps lagged behind the general market, the gap was not that dramatic.

Further market movements will be influenced by the macrodata, given their role in rate changes, as well as whether companies will be able to fulfill market expectations regarding AI development.

Figure 1 Fig.1 Performance (TR) 30.06.2024 by regions based on MSCI regional indices (Currencies: USA – in USD, EU – in EUR, CH – in CHF, World – in EUR); * – Hérens Quality Portfolios

You can access the entire half year review via the link below.