Quality in the current market

Inflation and higher interest rates are currently the focus of investors and have led to a shift towards value. Quality could not keep up in this environment. Regardless of the macroeconomic conditions, we believe that it is possible to identify companies that, due to their quality characteristics and the resulting flexibility, are able to respond appropriately to these challenges and generate sustainable added value. Our arguments: Despite the good economic situation, we continue to find ourselves in a low-growth environment with likely higher inflation and political uncertainty – an environment that continues to speak in favour of quality companies. They have pricing power that comes from their strong competitive position, greater profitability even as costs rise, and low leverage that protects them from higher capital costs. While it is sometimes difficult to ignore short-term market volatility, we remain focused on executing our investment philosophy and processes to deliver superior long-term performance.

The current article is part of a series of articles on the concentrated HQAM Quality Top Strategies, which aims to sharpen the understanding of quality and to differentiate the HQAM quality approach from non-quality and other quality approaches.

HQAM Quality in contrast to other providers

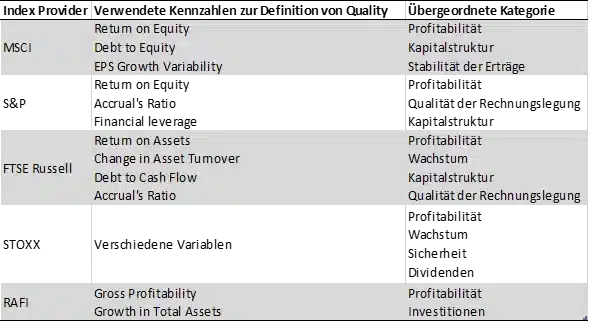

In contrast to factors such as value, size or beta, which are usually clearly defined, “quality” is not clearly defined – quality is understood differently by different providers. This can already be seen in a comparison of quality indices from various providers such as MSCI, FTSE Russell, S&P and STOXX (see Table 1). In this context, RAFI should also be mentioned, another provider of quality indices, which uses the two new factors of the 5-factor model from Fama-French – the profitability and investment factor – when constructing its index, and calls them quality factors. 1

IIn this issue, we supplement the Fama-French analysis of the Global Quality Top Strategy (CEI 12/2021) with a factor-based risk attribution, which provides additional information about the properties of concentrated Hérens Quality portfolios. Newer systems offer the possibility to differentiate between style factors (value, size, momentum, volatility, etc.). It is important to consider the characteristics in the overall context: The profile shows what Quality Investing stands for at Hérens Quality AM. At the same time, it serves as a distinction from non-quality and other quality approaches that are offered on the market.

Table.1: Quality criteria of popular index providers

Source: NZZ, Hérens Quality AM

Consistent Profile

The following results for the Global Quality Top 8 strategy can be transferred to the Top 15 and Top 25 strategies. In Fig 1, the consistency of the characteristics of the global top 8 strategy catches the eye.

Fig.1: Factor-Based Risk Attribution: Global Quality Top 8 – Consistent Characteristics

Or shown differently:

| Long | Short | Neutral |

| Earnings Consistency | Dividends | Volatility |

| Growth | Leverage | Momentum |

| Profitablity | Size | Turnover |

| Value |

Source: Hérens Quality AM, Bloomberg

As can be seen in Fig. 1, the Global Quality Top 8 strategy consistently invests in stocks of companies that are above average in terms of profitability and less indebted than the average benchmark company, that are growing faster and show stable earnings development, and that are slightly larger and more expensive and pay less dividends.

Some characteristics such as growth, profitability, stable profits, and low debt may come as no surprise with a quality portfolio. On the other hand, others are less intuitive and require explanation. What do features like short dividends and short size have to do with quality? What role do they play in the quality approach of Hérens Quality AM? We will deal with these and other aspects in another post.

___________________________

1 We cannot agree with this understanding of quality. In a previous post (CEI 12/2021) we showed that the investment factor for HQAM Quality, in contrast to the profitability factor, is not significant.