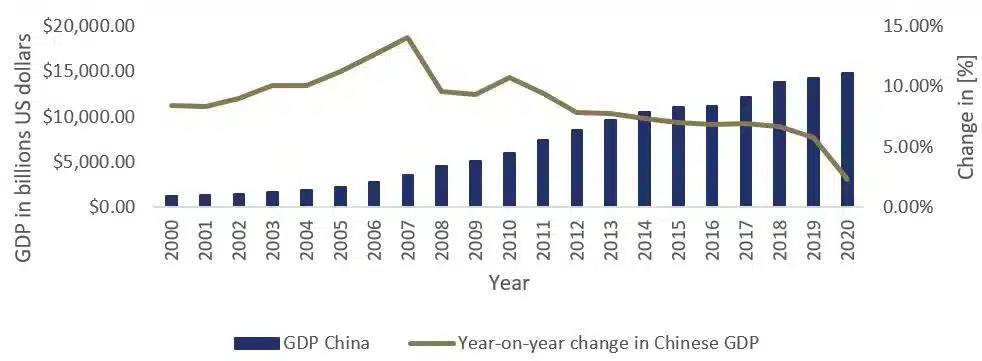

In the last two decades, China has been recognized as the country where the “American Dream” could be realized. Many companies from the IT & technology sector have been able to record incredible growth in recent years. However, it is not only the companies from the technology sector that are well-known in the Western world that have been able to record impressive development. Companies from other sectors, such as education, real estate or retail, have also been able to achieve high growth rates in the last two decades together with the general strong growth of the Chinese economy.

Fig.1: Chinese GDP in the period between 2000 and 2020.

Source: Hérens Quality AM, Statista

Fast growth is slowed down

The reform and opening-up policy in the 1970s and 1980s, as well as China’s accession to the WTO in 2001, also made the Chinese stock market attractive to foreign investors. In addition to rapid economic growth, strong productivity gains throughout the country attracted investors around the globe. But in recent months, the mood for the Chinese stock market has clouded over noticeably. In addition to the global Covid-19 pandemic, which had also hit China hard, there were other events that had startled some investors. On the one hand, there are the state interventions in entire industries, such as the recent strong intervention in the private education sector or the gaming sector, and on the other hand, China also faces structural risks. These include the high level of debt in the country, not only that of private individuals but also that of companies, as can be seen in the real estate sector (e.g. Evergrande or Kaisa Group).

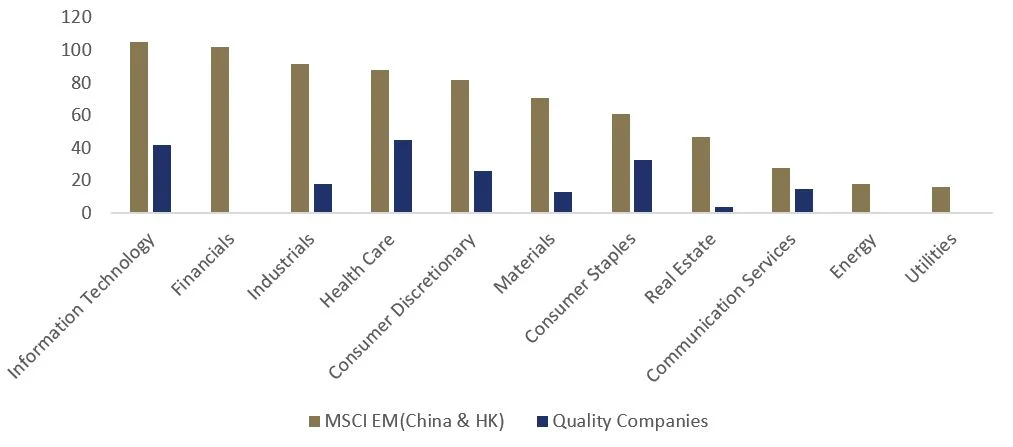

In which sectors are Quality companies overweight respectively underweight?

With the help of our Quality Investment approach, some of these risks, which focus on corporate quality assessment, can be prevented, although general political risks, in particular, cannot be avoided. As in all Quality Portfolios, companies from highly regulated or capital-intensive sectors are heavily underweighted in the Chinese market. This is also reflected in the fact that the real estate sector in China, which has come under strong pressure in recent weeks, is significantly less represented in our Quality approach than in the index, as can be seen in Figure 2. The increasingly regulated financial sector is also typically not a gathering place for Quality companies. But as mentioned above, Quality portfolios are also not immune to general political risks (e.g. the de facto dismantling of the private education industry overnight).

Fig.2: Weighting Quality vs. MSCI EM (China & HK) by sector

Source: Hérens Quality AM, Reuters

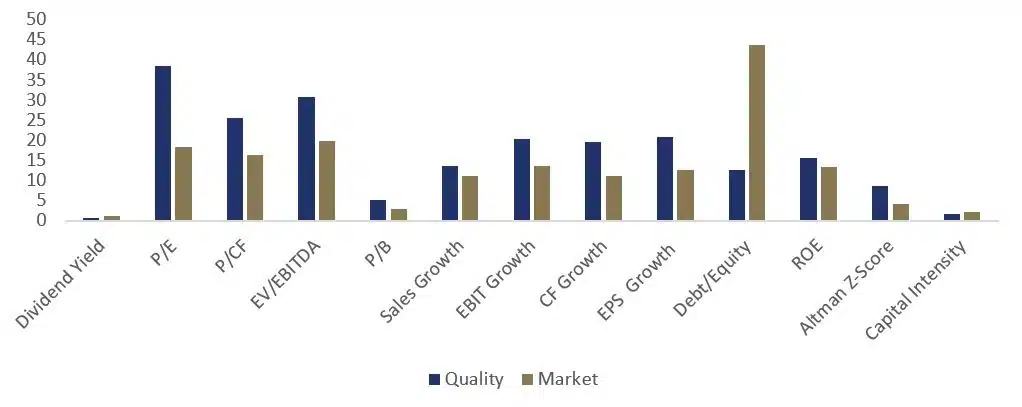

Fundamental differences between Quality companies and the Chinese market

If we focus on the fundamental figures of Chinese companies, we can clearly see the difference between Quality companies and the Chinese market. On the earnings level, the sales growth is striking, which is significantly higher for Quality companies compared to the market. On the other hand, this can also be seen in the EBIT growth, which is also significantly higher for Quality companies than for the market.

Fig.3: Fundamental figures of Chinese companies divided into Quality and market.

Source: Hérens Quality AM, Reuters

However, it is not only on the earnings level that Chinese Quality companies clearly stand out from the market, as the much lower debt/equity ratio impressively shows. The low debt/equity of Quality companies is a crucial factor for us to keep the risk as low as possible in the Chinese equity market. Another factor not to be ignored is the much better Altman Z-Score, which is a measure of the probability of a company’s insolvency, which is significantly higher for Quality companies than for the Chinese market.

The fundamental strength of quality companies is also in line with their risk ratios

The following charts shows two risk ratios and the total return to further support the statement that with Quality companies, some of the biggest risks in the Chinese stock market can be well controlled. The annual volatility differs only slightly from each other, but there are still differences between Quality (18.28%) and the market (18.88%). If the Operating Margins volatility is considered, it can be seen that Quality companies also have a lower volatility on the return side than the market. In addition to the two risk figures, the total return is also looked at. Here, too, Quality companies stand out massively from the market, as shown in figure 4.

Fig.4: Risk indicators and total return of Chinese companies divided into Quality and market.

Source: Hérens Quality AM, Reuters,

Successfully navigate through the Chinese stock market

In summary, it can be said that the Chinese stock market presents some challenges, especially of a political nature. Nevertheless, if the risk is taken, a consistent fundamental analysis aimed at identifying only the best Quality companies in the market can create a solid basis, at least in this respect, to continue to benefit from the above-average growth prospects of this market in the future. On the one hand, attention should be paid to the industry in which the company operates. On the other hand, the company’s earnings and debt should be analyzed in detail. Only through a strict application of these basic business principles can a certain degree of security be generated, even though another government intervention can hit a Quality company at any time. However, with solid financing, diversified sources of income and steady growth, the company is better prepared to withstand such an intervention and possibly even to generate a competitive advantage over its competitors.