Markets’ efficiency

Compare market reaction to the earnings results of two companies. 1. A software company reported 11% sales growth (slightly below guidance) and 44% earnings growth (substantially above guidance). Despite maintaining revenue (+7–8%) and EPS (+10–11%) forecasts, these were not at the higher end of its previous guidance range. The share price plummeted by 20% during a trading session. 2. A food and car retail company reported a 2% decline in quarterly sales and a 23% drop in EPS. The company provided no guidance, citing the deteriorating macroeconomic environment and fiscal tightening, which continue to erode consumer purchasing power and threaten future earnings. Surprisingly, the share price dropped only 0.74% after the results were announced.

The software company is listed on Nasdaq and is Salesforce, while the retail company trades on Nasdaq Baltic and is Tallinna Kaubamaja. The stark difference in market reactions highlights disparities between these equity markets. The U.S. market, driven by algorithmic trading, forward-looking analysis by top-tier experts, and extreme scrutiny by participants, is highly sensitive. By contrast, the Baltic markets are comparatively underdeveloped, with minimal coverage and passive investor activity. Both markets, however, demonstrate irrational behavior, either overreacting or underreacting to fundamental factors. Over time, the share prices of both companies moved toward their fair values. The software company’s stock recovered its losses within six months and outperformed the market. The retail company’s share price continued a gradual decline, albeit at a modest pace. Leaving the Baltic market aside, we focus in this article on the U.S. market, which has undergone significant changes in recent years.

Market vs. Stock Volatility

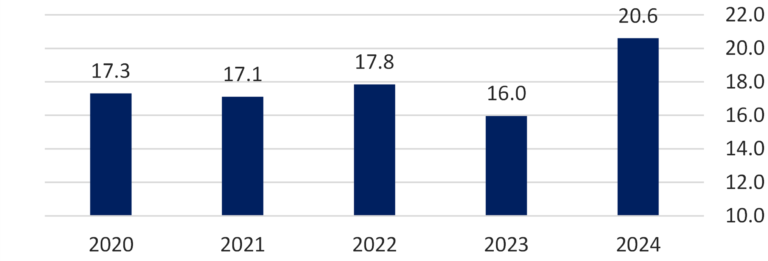

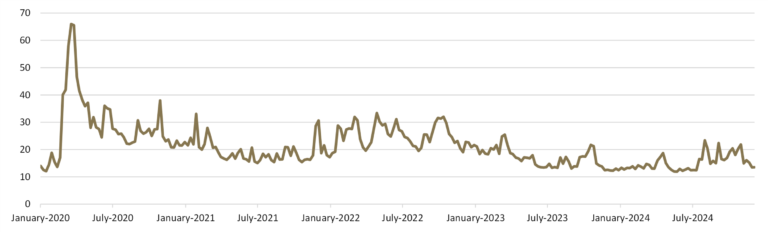

Individual stock volatility surged in 2024, specifically obvious increase was seen in the technological sectors and among the most tradable stock (see Fig. 1). Market-wide data confirm this trend, with volatility levels in 2024 surpassing those of 2023 and previous years, even during erratic periods, caused by global events. Interestingly, the overall market has not become volatile, except for a brief panic in August, after which the index swiftly recovered (see Fig. 2).

Figure 1: Stock volatility of S&P 500 components

Figure 2: S&P 500 index volatility

Earnings calls and macro stuff

This abnormal stock-level volatility is largely driven by advancements in trading and analytical tools, particularly those powered by algorithms and AI. Financial firms offering sell-side analysis have significantly increased their investment in market coverage and the development of sophisticated analytical tools. We’ve observed an expansion in the coverage universe to include European small-cap and Asian companies. Additionally, alternative sources like Tegus and Alpha Value now provide robust, fact-based expert opinions, further enhancing the quality of information available to market participants.

Forming a clear opinion—whether to Buy, Sell, or Hold—has become more challenging. It’s common to see conflicting recommendations from major brokerage firms on the same day, with one upgrading a stock while another downgrades it. This divergence fuels sharp price movements and amplifies market volatility.

Earnings announcements, in particular, act as flashpoints for these price swings. Market participants, armed with advanced analytical tools, scrutinize management commentary in great detail, leading to rapid shifts in perceptions of a company’s fair value.

Global uncertainty further exacerbates this volatility, manifesting across several dimensions. First, macroeconomic uncertainty has grown, with every U.S. economic dataset exerting a substantial influence on market movements. While the previous decade saw relative economic stability and clear global trends, recent years have been marked by an increase in “black swan” events, starting with the pandemic, which has eroded consumer and producer confidence.

Second, political dynamics now play a far greater role in business development. Industries like semiconductors, often considered strategically important at the national level, are increasingly impacted by sanctions and political interference, which influence business decisions and corporate earnings.

Finally, the interplay of macroeconomic and political factors can no longer be ignored. Even companies with stellar financials and top-tier management must now navigate these external pressures, which have become integral to their valuations.

Our response: analysis-based approach powered by AI

We recognize these market changes and are addressing them through our enhanced analytical Quality approach. With increased volatility, market valuations often deviating from fair value, and the growing availability of GenAI tools, new investment opportunities are emerging. Our focus remains on developing advanced analytical Quality tools that add value to the investment decision-making process. For some time now, we have been closely monitoring companies with B2C business models with the help of big data analysis.

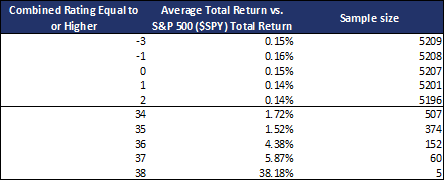

In line with our commitment to deepening our analytical capabilities, we have developed an earnings call monitoring tool. This tool helps to detect sentiment expressed by management, effectively screening the entire market. By contextualizing sentiment ratings with performance data, we discovered a strong correlation between sentiment and the relative performance of a company’s shares over the following three months. Companies with a combined sentiment rating of 36-38 have outperformed the market by 4.4% per quarter, or 19% annually, based on data from 2022-2024.

Figure 3: Highest and lowest Earnings calls combined ratings and relative performance

The data and our observations indicate that equity markets are evolving, with individual stock volatility likely to remain elevated. While market value will eventually align with fair value, this process may take time due to heightened sensitivity to earnings announcements and macroeconomic or geopolitical shifts. In the current environment, companies with weaker business models are facing heightened scrutiny, underscoring the importance of fundamental analysis. These changes present both, challenges, and opportunities. Adapting to this new landscape allows us to refine our Quality strategies and deliver consistent value in a more volatile market environment.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.