ESG Adoption and Corporate Quality

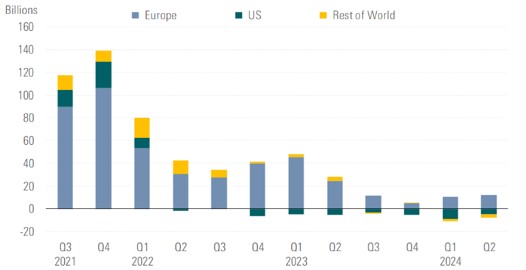

It may seem that ESG investing is losing momentum. The trend has slowed, as

evidenced by the inflows into ESG funds (Fig. 1). Several factors may explain this

cooling off: the valuations of companies with high ESG ratings are often high, the

impact of ESG investing is not immediately seen, ESG data are not 100% reliable.

Figure 1: Sustainable fund flows

In our view, this recent shift is not necessarily negative but rather a natural and

beneficial maturation of the ESG market. As the initial excitement wanes, investors

and stakeholders are now focusing more on the substance behind ESG claims,

demanding greater transparency and accountability. A tightening regulatory

environment should further support and promote the transformation of companies to

improve their ESG performance. The adoption of ESG principles to become a better corporate citizen requires top management to recognize the importance of these issues; otherwise, ESG compliance

risks becoming merely a financial burden of reporting metrics mandated by law.

Implementing ESG not solely for reporting purposes, but to improve processes, and

increase efficiency could serve as a litmus test for corporate quality.

ESG adoption offers valuable insights into the quality of governance. Moreover, it

provides benefits such as improved risk management, potential cost savings, and an

enhanced corporate image — all of which can contribute to sustainably higher

profitability. In this article, we examine how quickly companies are improving their ESG

performance by analyzing the dynamics of key performance indicators (KPIs) that

reflect changes in environmental, social, and governance criteria over the past three

years.

Environmental layer

The environmental pillar is a key focus for governing bodies, as climate change has

become critical. We examined how efficiently companies are reducing their

environmental footprint, using less energy, and generating less waste. The good news

is that all selected environmental KPIs showed improvement, with significant gains in

CO2 emissions reduction (-20%) and energy use decrease (-18%).

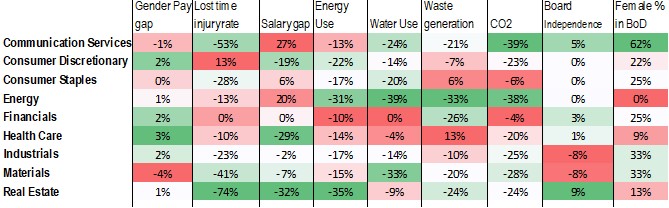

Figure 2: Environmental ratios dynamics during 2020-2023, MSCI World AC

The most substantial improvements were seen in traditionally high-polluting

industries, such as energy, materials, and real estate. The slowest progress was

observed in the financial and healthcare sectors, which typically have limited

opportunities to make significant improvements in the environmental dimension.

Figure 3: ESG ratios dynamics during 2020-2023 by industries, MSCI World AC

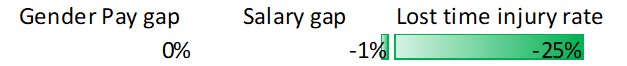

Social layer

When examining indicators related to the social dimension, often considered the

most sensitive of the three ESG pillars, there has been a clear improvement in

employee safety, as evidenced by a substantial decline in the lost time injury rate

(LTIR). However, the statistics on salary gaps, both in terms of gender disparity

and CEO pay ratio, have shown little to no progress over the past three years.

Figure 4: Social ratios dynamics during 2020-2023, MSCI World AC

LTIR was, as expected, considerably lower in the Real Estate and Materials

sectors (Fig.3). A decline in the Energy sector was both anticipated and

welcomed, and while it did occur, it lagged behind the majority of other sectors.

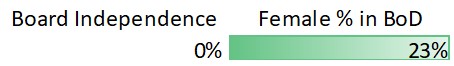

Governance layer

We analyzed two key ratios that reflect the situation on company Boards of

directors: the independence ratio of board members and the gender ratio. The

global median independence ratio stands at 53% and has remained largely

unchanged over the past three years. The gender ratio, however, shows a

different trend, improving year-over-year, either due to regulatory pressures or

a growing recognition of its value.

Figure 5: Governance ratios dynamics during 2020-2023, MSCI World AC

By industry, the most notable improvements in both ratios were observed in

Communication Services (Fig.3). Financials also performed well on average.

While the Materials and Industrials sectors made progress in gender balance,

they saw a decline in board independence.

Compliance with stakeholder expectations or real improvements?

The ESG reporting burden imposed by regulators and financiers on companies

may be too heavy in terms of organizational changes and the cost of compliance.

An IBM study highlighted the risk that the cost of reporting could outpace

investments in meaningful action to improve corporate citizenship1.

However, fears that companies are merely complying on paper without making

real progress in ESG are not supported by the data. There is clear evidence of

incremental improvements across the globe, particularly in environmental

initiatives and key social and governance areas such as employee safety and

better gender balance on boards. That said, progress in areas like fair

remuneration processes and increasing board independence has stalled, as these

seem not to be top priorities for many companies. While there is still room for

improvement across all ESG dimensions, the corporate world is undeniably

moving in the right direction.

References

IBM study, https://newsroom.ibm.com/2024-02-28-IBM-Study-Sustainability-Remains-a-Business-Imperative,-But-Current-Approaches-are-Falling-Short

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.