When the ship’s captain is ousted

For a Board of Directors to make the tough decision to fire a CEO, there must be an exceptionally strong reason. Usually, this involves either a reputational scandal (and sometimes even that is not enough, as in the case of Elon Musk) or prolonged financial and/or operational underperformance. Corporate history offers a number of examples of CEOs removed due to weak performance: Carly Fiorina (HP), Olli-Pekka Kallasvuo (Nokia), John Flannery (GE). No company is immune to an underperforming CEO, so boards must be prepared to react swiftly. However, the risk of CEO underperformance can be reduced if s/he has relevant industry experience and an academic background aligned with the company’s core business as shown in our research.

Hard facts matter

A number of academic studies have examined what types of CEOs tend to deliver the strongest results. Founder-CEOs are consistently shown to be high performers1, as they are generally willing to take greater risks and invest more aggressively in innovation2. They also possess deep understanding of their product, technology, market niche, and customer preferences. In addition to this, the CEO must have the right skill set. Among the most important are enterprise market knowledge skills — the ability to focus on growth rather than mere maintenance3. Research shows that CEOs with strong industry-specific experience tend to deliver better short-term returns, while generalists often show an initial performance decline. However, this decline can be offset if the generalist CEO has a long tenure within the company4. Another study analyzed CEO performance during crises. During COVID-19, internally promoted CEOs generated higher cash returns than external hires. This occurred because insider CEOs had deeper knowledge of the company’s operations and people, allowing them to make faster, more accurate decisions under force-majeure conditions5.

A decade ago, we examined whether industry experience mattered in fashion retail, IT, and pharmaceuticals6. The findings showed that IT and fashion retail CEOs were predominantly founders, product-development leaders, or (in fashion) professional merchandisers. In pharmaceuticals, however, CEOs more often came from legal, financial, or general business backgrounds. When this data was compared with stock-market performance, we found that in fashion retail and IT, CEOs with relevant experience significantly outperformed those without it, while in pharmaceuticals the hypothesis did not hold.

Can CEO Innovator outperform?

In the current study, we expanded the industry coverage to sectors where high-quality companies are most represented: technology, healthcare equipment, pharmaceuticals, machinery, gaming, and entertainment. We also extended the analysis period — from 2004 through November 2025. CEOs lacking relevant experience have the lowest probability of outperforming their industry benchmark (Level III), compared with CEOs who have industry-specific and product-development experience (Level I) or those with general experience in a related business niche (Level II).

Figure 1. Share of CEO out/underperformers based on their background level

The highest share of outperforming CEOs with industry-relevant backgrounds is found in the fashion retail industry. Here, 75% of Level I CEOs and 78% of Level II CEOs outperform their industry benchmark. Luxury houses such as Hermès and LVMH — run by families with exceptionally deep industry expertise and strong intuition for markets and consumer trends — have both significantly outperformed their respective sectors. On the other side, there is Pharma, where the background of a CEO appears to be of a lesser relevance – the difference in share of outperforming and underperforming CEOs is basically non-existent. It is also notable that in all industies except Pharma Level I CEOs have significantly longer tenures.

The performance analysis of companies relative to their industry benchmarks shows that having a CEO with a relevant industry background — a Level I CEO — is generally the most beneficial for shareholders.

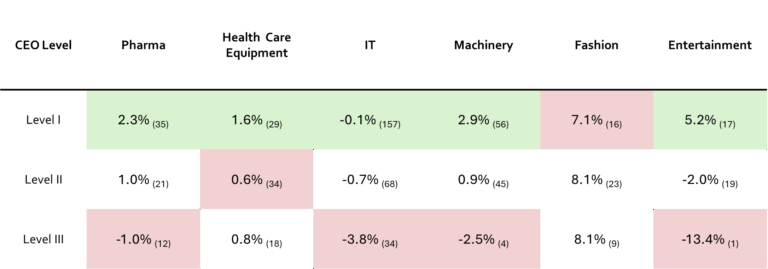

Figure 2. Relative (vs. industry index) performance of CEOs based on their background level

Across nearly all industries — with the exception of fashion retail — the most qualified CEOs (Level I) deliver superior performance relative to their peers. Meanwhile, Level III CEOs lag the benchmark in four out of six industries.

The most pronounced and statistically significant underperformance appears in the technology industry, indicating that CEO qualification in tech must be monitored particularly closely.

CEO level at Quality companies

We incorporate these findings into our investment process. While CEO qualification is not the primary determinant in our decision-making, it can meaningfully strengthen or weaken a buy thesis, especially when comparing companies within the same industry.

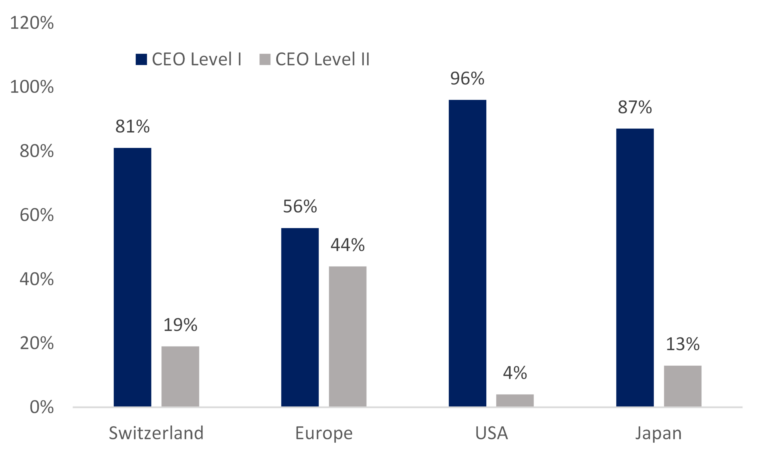

Across all regional portfolios, there is not a single company led by a Level III CEO. Instead, we maintain a bias toward companies with highly qualified leadership, with the strongest concentration in the United States.

Figure 3: S&P 500 5 largest stocks concentration

Given the value added by highly qualified CEOs in quality-focused portfolios, these companies are well positioned for long-term value creation. We also view very positively the companies led by founders or deep industry insiders, as they tend to combine strategic clarity with operational expertise and understanding of the consumer preferences.

Of course, CEO qualifications must be considered alongside other governance factors — such as the strength of the Board of Directors and overall decision-making culture — to ensure a comprehensive assessment of corporate quality. However, CEO is surely the key person, which is able to steer locomotive in the ‘right direction’.

References

1. Adams, R., Almeida, H., & Ferreira, D. (2009). Understanding the relationship between founder–CEOs and firm performance. Journal of Empirical Finance, 16(1), 136–150.

2. Li, M., & Patel, P. C. (2019). Jack of all, master of all? CEO generalist experience and firm performance. The Leadership Quarterly, 30(3), 320–334.

3. Kannan-Narasimhan, R. (Priya), Wang, R., & Zhu, P. (2023). Founder versus agent CEOs: Effects of founder status and power on firm innovation and cost of capital. Journal of Business Research, 167(114180).

4. Wang, X., Li, Y., Fu, C., & Yue, Z. (2025). Does CEO Competence Affect Enterprises’ Financial Performance? International Review of Economics & Finance, 99(104001).

5. Haque, M. R., Choi, B., Lee, D., & Wright, S. (2022). Insider vs. Outsider CEO and Firm Performance: Evidence from the Covid-19 Pandemic. Finance Research Letters, 47, Part A(102609).

6. Barber, F., & Bistrova, J. (2015). Many CEOs aren’t breakthrough innovators (and that’s OK). Harvard Business Review, 4.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.