The “Election Effect”

Global equity markets hate uncertainty – they thrive on predictability, and when that predictability is compromised they tend to react negatively primarily because it increases risk for investors. Political or regulatory uncertainty (e.g., elections, trade policies, central bank decisions) can significantly influence markets in the short-term resulting in the tangible spike of volatility. When it comes down to elections, successfully predicting the outcomes is difficult and financial markets reflect this challenge. Over the past decade, pollsters, political analysts, and reporters have made several significant forecasting errors. A prominent example is the 2016 U.S. presidential election, where estimates placed Hillary Clinton’s chances of winning between 71% and 99%, but we all know who eventually took the Oval Office.

Back in September, Bloomberg published an interesting article summarizing results of the survey of Bloomberg Terminal subscribers1. As such, Kamala Harris victory in November’s US presidential election was considered as better for Treasuries and worse for stocks than a win for Donald Trump. Half of 340 survey participants, among which there were portfolio managers, traders and economists, planned on increasing exposure to equities if Trump wins, whereas just 28% said they would do so if Harris becomes president. At the same time, more than a third acknowledged they would reduce their stock exposure should Harris prevail. In contrast, nearly half of respondents indicated they would reduce bond exposure in the event of a Trump victory.

In the long-run, economic cycles matter more than political ones

Political decisions often focus on short-term agendas or election cycles, which typically last 4 to 6 years. Economic cycles, however, span for decades and reflect deeper, long-term trends like technological advancements, population growth, and globalization. These trends create lasting changes that outweigh temporary political shifts. Take current election cycle in U.S., for example. Regardless of which side wins, what seems clear is that neither candidate is expected to make fiscal discipline a central focus of their platform. Republicans favor tax cuts, while Democrats are likely to support spending on social and climate change initiatives. For financial markets, this means that we are unlikely to go back to the era of ultra-low interest rates, while inflation might remain slightly higher than it was over the last decade before the pandemic.

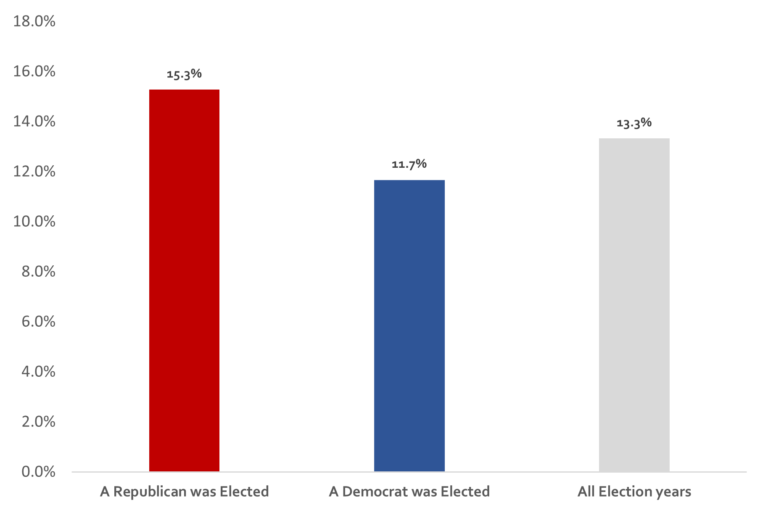

There have been 24 elections since S&P index began, 11 of which were won by a Republican nominee and 13 by a Democratic one and 20 out of these 24 terms (83%) provided positive performance. Therefore, over long-term, if we take US market as an example, the parity in power seems to make limited difference on the performance of the equity markets.

Figure 1: U.S. Presidential Elections Results (Average Total Return of S&P 500)

One can argue that in the U.S. that is a developed nation with stable political system, strong institutions, and checks and balances, election results are less likely to lead to sudden or drastic changes in policy. Investors have more confidence that democratic processes and the rule of law will prevail, regardless of who wins the election. In contrast, in developing or politically unstable nations, elections can lead to more pronounced changes in governance and economic policy. This unpredictability raises risks for investors, as shifts in power can result in significant policy changes, including nationalization, capital controls, or changes to tax and trade policies.

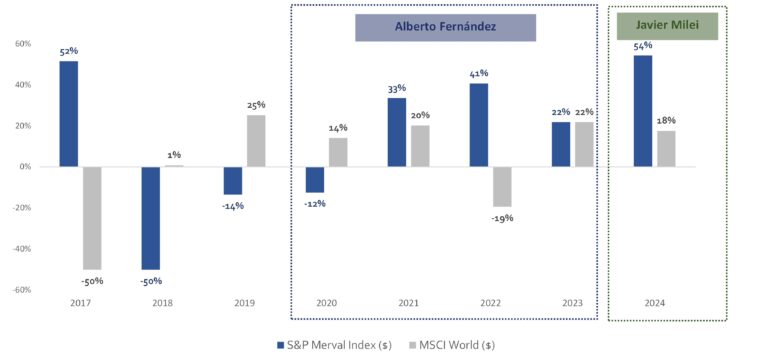

Argentina is an interesting example, with a complex socioeconomic situation and political instability, yet the stock market has shown growth both during Fernandez’s term and since Milei took office. It’s important to note that the increase in company valuations in recent years was driven not by economic development, but primarily by inflation, the peso’s devaluation, and the dollar-linked revenues of major listed companies. This year, growth has been further stimulated by the liberal reforms initiated by Milei.

The prolonged effect of Fernández’s policies has been continued instability in Argentina’s financial markets, with persistent concerns over inflation, currency depreciation, and external debt obligations. Following his election win, Argentina’s stock market (S&P Merval Index) has plunged 50% in a day.

Current president, Javier Milei, took office in December 2023, marking a significant shift in Argentina’s political landscape with his libertarian and anti-establishment positions. His presidency contrasts strongly with Alberto Fernández’s, as Milei advocates for drastic economic reforms, including cutting government spending, dollarizing the economy, and reducing the role of the state in economic matters. So far this year S&P Merval Index shot up 54%.

Figure 2: Annual Total Return Performance of S&P Merval Index and MSCI World, USD

How to navigate short-term election-induced volatility

By focusing on fundamental analysis and employing sound investment strategies, investors can navigate periods of pre-election uncertainty with greater confidence. Fundamental analysis emphasizes the intrinsic value of companies and provides a comprehensive view of their long-term potential, enabling investors to make more informed decisions at any given point of time. By examining key metrics such as price-to-earnings (P/E) ratio, debt levels, and cash flow, investors can identify companies with strong financial foundations that are more likely to weather political and economic shifts.

Furthermore, assessing factors like industry position, management effectiveness, and market trends helps investors distinguish companies that possess a competitive edge, giving them an added layer of security in uncertain times. This approach reduces emotional decision-making, fostering a more disciplined investment strategy focused on long-term growth rather than short-term market reactions.

Sound strategies, such as quality investing, promote a disciplined approach to investment. Quality strategy helps investors avoid the pitfalls of market speculation by prioritizing high-quality businesses with strong fundamentals. Quality investing also encourages patience, as it involves selecting companies that are leaders in their industries, often with durable competitive advantages, such as strong brand recognition or innovative products.

By concentrating on these resilient businesses, investors can weather market downturns more effectively and potentially achieve better risk-adjusted returns. Additionally, quality investing reduces the need for frequent trading, thus lowering transaction costs and minimizing the impact of short-term market volatility, fostering a more systematic and reliable investment process.

Sources:

1. https://www.bloomberg.com/news/articles/2024-09-16/survey-harris-win-better-for-bonds-worse-for-stocks-than-trump-victory?srnd=phx-markets

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.