Diversification = ‘free lunch’?

Thomas Cook collapsed this September, being responsible for huge losses incurred by small and large investors. How would one feel having this company in a poorly diversified portfolio? Of course, it was not the story of one day and the problems were mounting for a prolonged time, giving investors a chance to get rid of the holiday firm’s stock in time. However, there are cases, which are hard to envisage. Take Biogen, which lost 30%(!) on April’s day after the announcement that it ceases testing of a drug to treat Alzheimer disease. To lose 18 bn USD of value in one day is painful, but one has to acknowledge this kind of risk is common of the biotech industry.

Sure enough on a micro-level ‘black swans’ happen much more often as compared to the global ‘black swans’ and the portfolio diversification perfectly helps in this case. But there is a dilemma of how far one should go with the portfolio diversification as, naturally, it comes with additional costs such as larger analytical resources, lower marginal return of each added company, etc.

The theory states that having more than 15 companies in the portfolio will not help in reducing company-specific risk. In practice, well-known investors also do not appreciate extensive diversification, arguing that with many stocks in the portfolio one becomes too slow to react to change and, additionally, make one’s life more difficult in an effort to beat the benchmark 1.

Risk-adjusted returns of concentrated vs. diversified portfolios

A considerable number of studies was conducted to find out whether concentrated portfolios beat diversified ones, but the results are not unanimous and to a great extent depend on the methodology and sample. Fidelity2 and Vanguard3 concluded that portfolio concentration does not add any value, and on risk adjusted basis concentrated portfolios returns are weaker as compared to the returns of the diversified ones.

Other researchers analyzing U.S. equity funds have found that concentrated portfolios generate higher returns, even when adjusted for risk.4,5,6 Fulkerson et al.5 conclude that it is a positive sign when a manager increases portfolio concentration. This could be an indication that managers have information of sufficient value to compensate for the higher risk from portfolio concentration. Cohen et al.6 believe that portfolio managers tend to overdiversify their portfolios. This is not caused by a lack of ability to find the right stocks, but by institutional factors, such as regulations, which favor portfolio diversification.

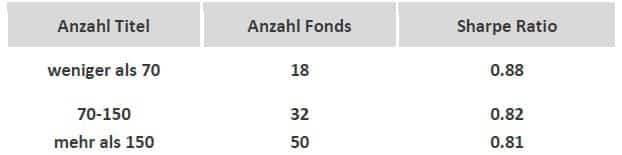

Fig. 1: Sharpe ratio of 100 largest USA strategy equity funds depending on the number of holdings, 5Y return

Source: Hérens Quality Asset Management, Reuters

In 2016 we have looked into the concentration issue ourselves by making analysis on the largest US equity funds. Fig. 1 shows that the Sharpe ratio, which adjusts the portfolio performance for risk, is the highest for the funds with the smallest number of holdings. Obviously concentration provides a certain tailwind for more portfolios with less titles as compared to their peer group.

Winners become harder to find

It seems that a new trend has come to the markets: investors are keen on investing in the companies, which are on hype disregarding their valuation. These companies often provide a significant contribution to the benchmark’s performance: e.g. in 2015 Amazon alone contributed 0.75% to MSCI US return, which was 1.4% that year.

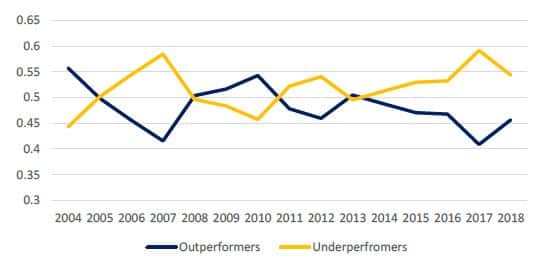

As a result, the number of winners on the market shrinks, and if one doesn’t have such a star in the portfolio, it becomes quite hard for him to beat the index. The chart below (Fig.2) shows that the number of outperforming companies during the last five years surrendered to the number of under-performers.

Fig. 2: Share of out- and underperformance in MSCI United States

Source: Hérens Quality Asset Management, Reuters

It creates the situation, when having diversified portfolio might not be helpful in beating the index as the probability of owning proportionally greater number of under-performing companies in the portfolio increases.

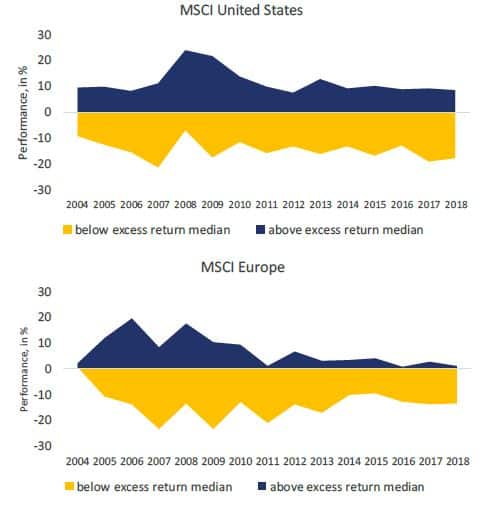

Additionally, we have divided the benchmark companies into groups, based on whether their excess return is below or above the median and then compared their average performance. The obtained results are quite interesting: under-performance outweighs, and particularly it becomes evident during the last decade (Fig. 3). Most probably, the general trend will continue advocating rather concentrated portfolios consisting of companies selected on the basis of the thorough research.

Fig. 3: Above vs. below median of excess returns, MSCI United States, MSCI Europe

Source: Hérens Quality Asset Management, Reuters

When making a decision about the degree of portfolio diversification, a portfolio manager has to take into account all relevant arguments such as market situation, theoretical and empirical research, limited intellectual capacity. And it seems that all of them encourage to have rather concentrated portfolio, where the chance to outperform the benchmark is objectively higher. Naturally, increased degree of portfolio concentration assumes also high quality of research, which has the capacity to identify winning companies that have minimal exposure to ‘black swan’ probability.

References

- Kaufman, K. (2018). Here’s why Warren Buffett and other great Investors don’t diversify. Forbes, July 24, 2018.

- Vanguard (2019). How to increase the odds of owning the few stocks that drive returns.

- Fidelity (2015). Does the Number of Stocks in a Portfolio Influence Performance?

- Yeung, D., Pellizzari, P., Bird, R., & Abidin, S. (2012). Diversification versus Concentration… and the Winner is? (No. 18).

- Fulkerson, J. A., & Riley, T. B. (2019). Portfolio concentration and mutual fund performance. Journal of Empirical Finance, 51, 1-16.

- Cohen, R. B., Polk, C., & Silli, B. (2010). Best ideas. Available at SSRN 1364827.