Never put all of your eggs in one basket…but how big should the basket be?

It will unlikely come as a surprise to many, but investing is not an exact science. Rather, it is a process of discovering things that work and sticking to them, or what is commonly known as having a workable strategy. Now, because it is not an exact science, some strategies might be perfectly suitable for one investor, but be totally inappropriate for another, simply because human factor acts as a key differentiator in the decision-making, eventually producing divergent results. It also means that if you put your mind to it, you can succeed where market failed and deliver the outcome commonly perceived as highly improbable. It will take hard work, dedication, and conviction to do so, but in the end, it will be worth the effort.

For instance, while it is a common knowledge that concentrated portfolios (8-10 stocks) are more risky by nature if compared to the ones labelled “diversified” (20+ stocks), it does not mean that a portfolio that defies such perception can’t be constructed. In fact, we know it can because we have one and it delivers outstanding results, not only risk-wise, but also return-wise. Although it might sound somewhat improbable, raw facts don’t lie and the facts are that our Global Quality Top 8 Strategy has consistently outperformed the market since inception, which was in a distant 2014, while maintaining beta below 1.

Fig.1: Historical performance for Global Quality Top 8 Portfolio, CHF, as of 31.08.2021

Source: Hérens Quality AM, Reuters

How do we do it and why it works

Our premise to the construction of such portfolio is rather simple and in its essence is an extension of the overall investment strategy that pursues quality stocks. On the top of our default selection criteria, which, among other things, requires robust financials, sustainable competitive edge, and strong managerial backbone, we add another layer that results into meticulous cherry-picking.

For any company to qualify for our Global Quality Top 8 Portfolio, it must check all the boxes of the selection framework that aggregates five dimensions. First is the scale of operations and the size of Total Addressable Market (TAM) – all the portfolio holdings are well-diversified global players with addressable market sizes no less than 500 mio. Secondly, all companies have meaningful market shares (#1 or #2) in their respectful areas of operations/business segments. Moreover, they possess multiple best-in-class characteristics, like margins, deployment of capital, productivity of innovation or product quality. Tangible pricing power is another common trait of our Conviction Ideas, as none of the holdings operate in price taking industries, but all of them have the ability to pass on their costs to consumers. The final crucial point is careful assessment of major industry risks, like the one retail was experiencing from online disruption, none of which the Conviction Ideas can have.

By sifting potential investment targets through abovementioned criteria, we eliminate risk on company level, or through quality, unlike “diversified portfolios” that attempt to do so through quantity by adding multitude of different stocks. Also, because all our Global Quality Top holdings have quality layer and are exposed to long-term, secular trends, they tend to produce very attractive multi-year returns.

Have you heard of Synopsys?

Some of our ideas are not apparent, lack media attention and it is highly likely many are hardly aware of their existence. Like American Electronic Design Automation (EDA) provider Synopsys, which rides multiple long-terms trends and supplies technologies to all leading semiconductors in the world.

EDA is the second largest expense in the semiconductor R&D after headcount and Synopsys knows how to hook the customers up and retain them –

as switching costs are high, relationships are “sticky”. With the largest business in the EDA industry and 2nd largest IP offering, Synopsys leads the race of the future, where Artificial intelligence, electrification & autonomy of autos, alongside with 5G and Internet of Things create unquenchable demand for advanced, domain-specific chips. Hence, the market that was worth $9.41 bn in 2020 is expected to deliver a compound annual growth rate (CAGR) of 9.3% from 2021 to 2028 (1).

Rising demand for computing power, growing layout and configuration complexity, as well as the need for better interconnection drive customers to Synopsys that can guide them in this essential process by putting all the pieces together and pushing the limits of the existing design tools. As a result, ability to intergrate multiple components in one product and unmatched breadth of its offering gives Synopsys strong negotiating power and drives customer accretion.

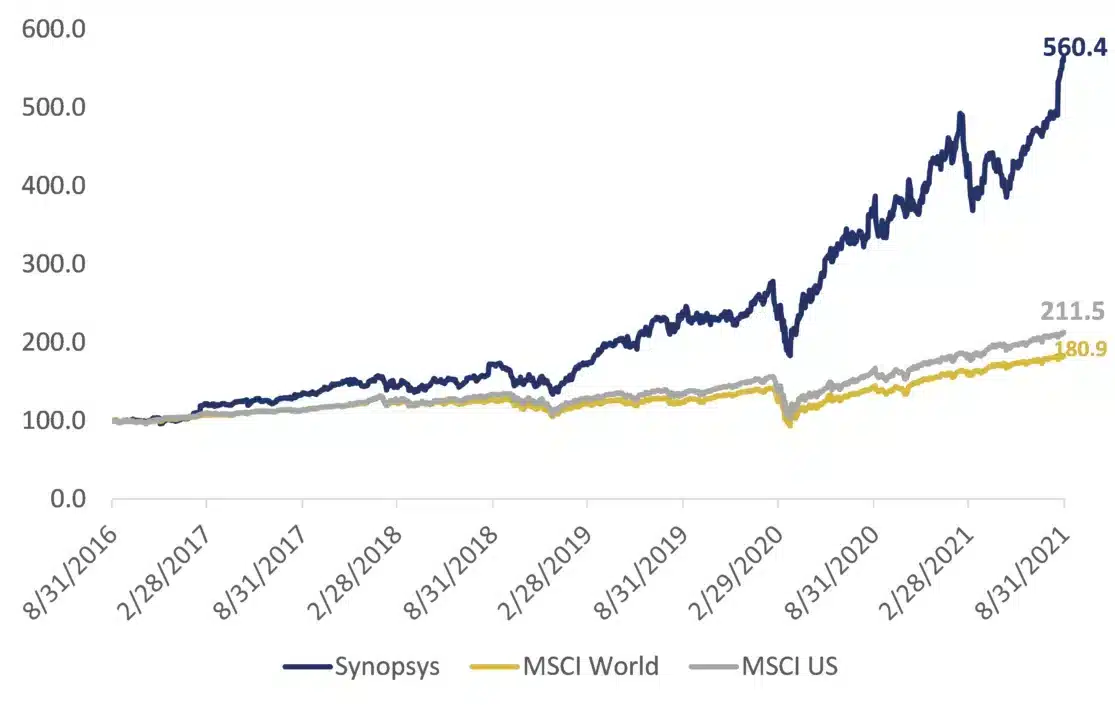

Market used to play cautious around Synopsys as their margins trailed that of the next biggest player and competitor – Cadence Design Systems. What market failed to fully appreciate back in the days was that company has been riding an extensive 5-year long investment cycle that resulted in a game-changing products Fusion Complier and Software Integrity – ones that have unlocked new customers (like ecosystem stocks) and brought growth prospects of the entire company to the whole new level. Once the understanding has reached the massess, the stock became unstoppable.

Fig.2: Indexed price performance of Synopsys, MSCI World and MSCI USA, 31.08.2016-31.08.2021, in USD

Source: Hérens Quality AM, Reuters

Compounding your wealth

Performance-wise, there are both good and bad days on the market, and no portfolio can deliver linear gains indefinitely. Similarly, some years will generate stronger returns than the others, depending of how wide is the available window of opportunity. Therefore, ability of our Global Quality Top 8 portfolio to consistently generate strong positive returns in different time-frames is precious, and frankly speaking rather unique characteristic. Remarkably, those returns are not that far behind ones delivered by Top performing equity funds of 2020, but with a much friendlier risk profile.

Fig.3: Historical performance of selected Top performing equity funds of 2020, as of 31.08.2021

Source: Hérens Quality AM, Bloomberg, Morningstar

It takes strong conviction in each of the portfolio holding to construct a successful concentrated product – and we stand by every company that we own.

References

- Electronic Design Automation Software Market Size, Share & Trends (May, 2021) Analysis Report by Grand View Research