Since the Corona sell-off in March 2020, share prices worldwide have risen much faster than corporate profits. This is putting particular pressure on the stock exchanges of the emerging markets, Japan and Europe to justify themselves.

The stock markets know no stopping. Since the Corona sell-off in March 2020, the global stock market has gained almost 90%. Indices such as the S&P 500, the Dax or the SMI are rushing from one high to the next.

If we look at the latest corporate results, optimism seems entirely justified. Companies around the world are raising their forecasts. In Switzerland alone, this happens almost daily. The latest examples are Belimo, Bossard, SFS, Sulzer, Leonteq, Cicor, Swissquote or most recently Bobst.

However, good results are also urgently needed, as an analysis by Swiss asset manager Hérens Quality Asset Management (HQAM) shows, which breaks down the total return of various international equity markets into their subcomponents.

As a result, share prices around the world have soared more sharply than earnings. As a result, valuations and thus expectations have risen, i.e. an expectation premium has built up, as the charts below show. In the emerging markets, Japan and Europe, share prices are particularly far ahead of earnings.

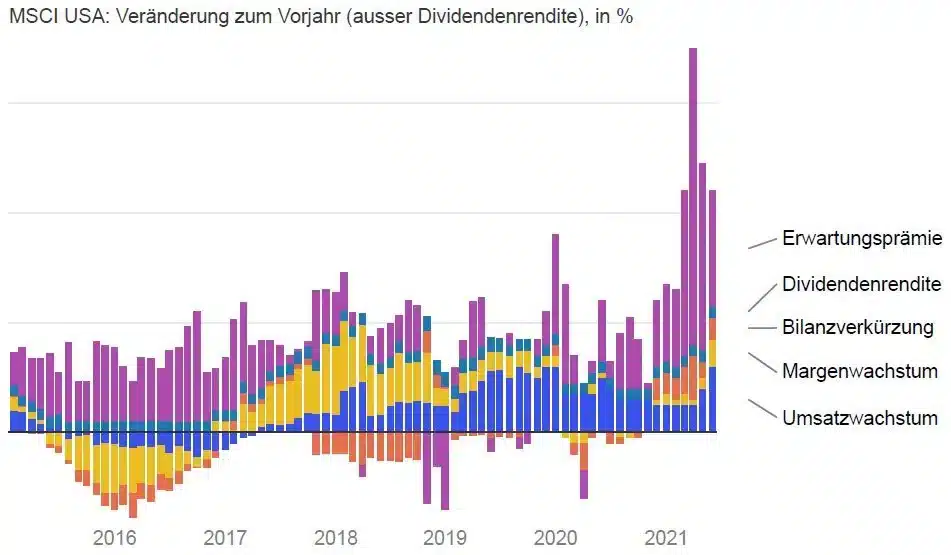

The USA shows the highest profit growth

However, the regions also differ in terms of profit growth. For example, the USA is the only market where sales never shrank, even during the pandemic (sales are highlighted in blue in the graph), and recently the strong recovery of the US economy has been reflected in an increase in growth.

Sales at the end of May, for example, were up almost 12% on the previous year. Added to this is the expansion of the margin by 5% (yellow). Less significant is the profit compression via the balance sheet contraction, which contributed not quite 4% to profit growth (red):

Profits rise significantly in the USA

Graphic: themarket.ch | Source: HQAM | Created with Datawrapper

“The U.S. stock market is home to many quality companies that can not only maintain sales and margins in difficult times, but even increase them,” says Diego Föllmi of HQAM. Foremost among these are the tech titans. “For us, the good performance shows the structural superiority of the U.S.” The expectations premium is up 21%. That’s low compared to the other markets analyzed.

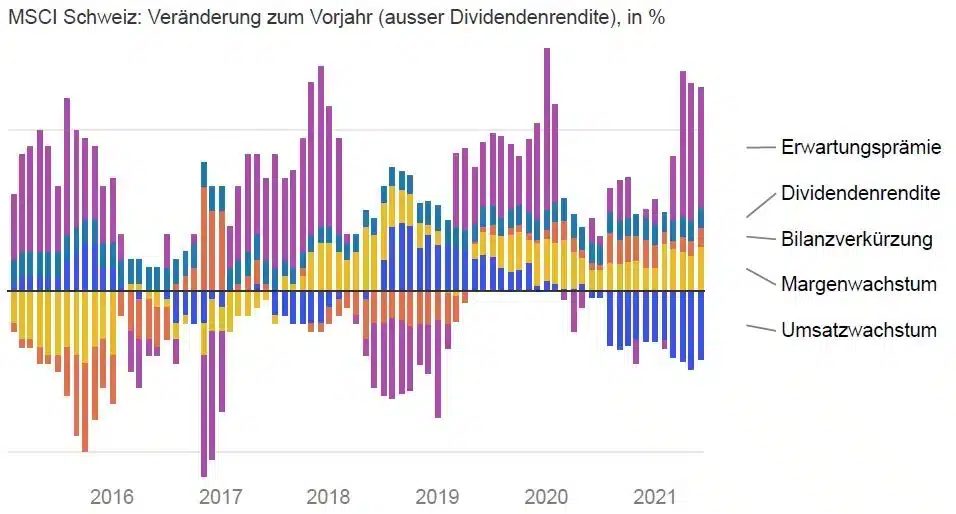

Swiss stock market with lowest expectation premium

Swiss companies performed even better than their US counterparts in terms of margin and expected premium. Despite a significant decline in sales, they have managed to widen their margins by 6%, which speaks for a high degree of flexibility and rigorous cost control. And now they should benefit from the normalization of growth, which will ensure a marked recovery in profits.

Swiss companies can expand margin despite decline in sales

Graphic: themarket.ch | Source: HQAM | Created with Datawrapper

In addition, the expectation premium has “only” increased by 15% (purple). This is the smallest increase of all regions considered. It is therefore likely that the recent breakout of the SMI is sustainable.

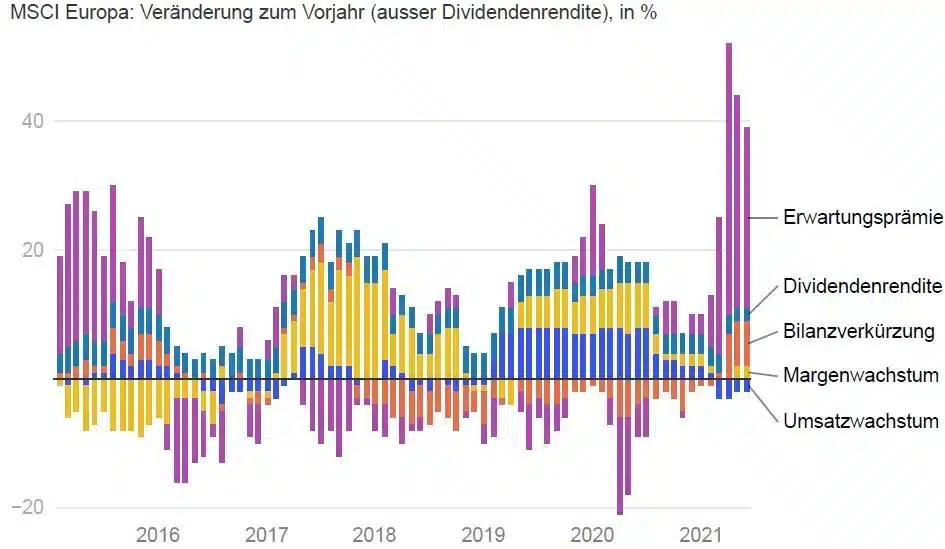

In Europe, the reopening is gradually being felt

Companies from Europe and the emerging markets also expanded their margins. This is likely due to the high share of commodity and energy stocks, which benefited from the strong rise in commodity prices. And now, a recovery in sales growth is emerging for the broad European market, as suggested by the performance of recent months. “The reopening of the economy is also making itself felt in Europe,” says Föllmi.

Reopening makes itself felt in Europe

Graphic: themarket.ch | Source: HQAM | Created with Datawrapper

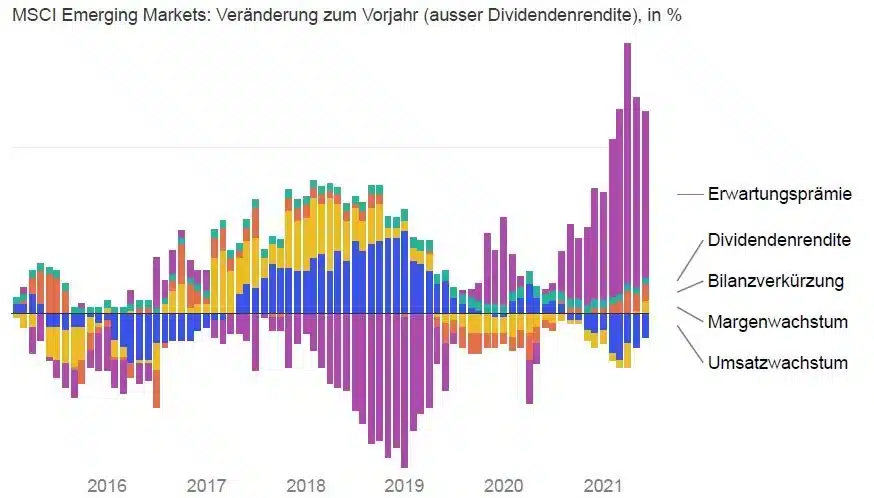

In both regions, balance sheet contraction is a major contributor to earnings growth. And in both, the expectations premium has risen significantly – by 50% in the emerging markets and by 28% in Europe. The pressure on companies to exceed expectations is therefore particularly great here.

Emerging markets with highest expectation premium

Graphic: themarket.ch | Source: HQAM | Created with Datawrapper

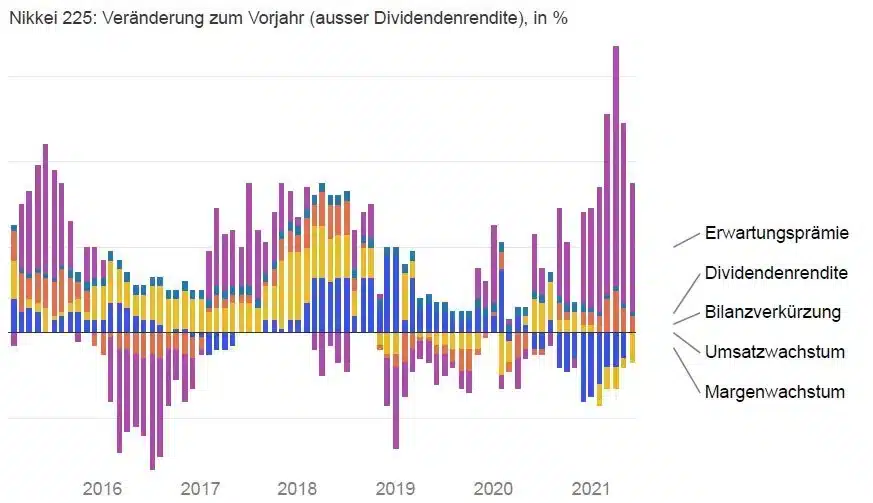

Japanese companies cannot maintain margins

The same applies to Japan, where the expectation premium shot up 30%. Not helping were margins, which were the only region to decline in Japan. This is surprising in that Japan’s companies have done a lot in recent years to become more profitable, more profitable and less cyclical.

In Japan, the margin is shrinking

Graphic: themarket.ch | Source: HQAM | Created with Datawrapper

“The special construction of the Nikkei 225 is also responsible for this,” explains Föllmi. Like the Dow Jones Industrial, Japan’s leading barometer is a price-weighted index in which stocks with a high price are given a higher weighting. For example, clothing retailer Fast Retailing, which owns Uniqlo, dominates with a share of about 10%. It was hit hard by the global lockdowns and suffered a significant drop in sales and profits.

Quality pays off, especially in difficult times

For Föllmi, two conclusions can be drawn from the analysis. “Once again, the focus on quality companies pays off especially in difficult times, as can be seen from the good track record of U.S. companies.” He is skeptical of cyclicals that have done very well. “In many, share prices are rushing ahead of fundamentals.” Here, the pressure of expectations and thus the potential for disappointment is particularly high. Companies will therefore have to raise their forecasts further in order to maintain price buoyancy. If they fail to do so, investor focus is likely to shift from cyclical names to defensive growth stocks such as Nestlé and Roche or the US tech giants. This is supported not least by signs that global growth may have peaked.

Gregor Mast

The Market | 22.06.2021.

https://themarket.ch/analyse/unternehmen-muessen-liefern-ld.4526