Marketing Material

VAT

Semiconductor industry is a tricky one, mainly because there is likely no other space that has been exhibiting such distinctive up and down-cycle pattern over the years. It is also a very tight community with a long tail, meaning there are hundreds of different companies that are a part of the value chain, but most of them, especially on the equipment side, have small customer pool that they depend upon. And eventually, it all comes down to foundry titans – TSMC and Samsung that cumulatively own around 72% of the market, and the way they manage their capacity will have immediate and profound domino effect on all other players.

To manage customer risk and downplay market cyclicality, a company with exposure to semiconductor market should make sure a) its products are of essential/critical nature, b) it has the best product on the market and, ideally, there is no real substitution, c) there are long lead times that extend beyond downcycles. And if latter characteristics is quite difficult to come by, first two are more frequent in the space. VAT, a Swiss sub-system provider, is exactly the kind of company that owns abovementioned quality traits.

VAT is a pure-play vacuum valve supplier for leading edge manufacturing, and it commands close to 60% market share across all industries, but even more so in the semiconductor space. Company’s products that are sold as either single valves or customer specific modules, are mission critical components in the advanced production processes that must meet a long list of rigid quality criteria. With 5% to 6% of annual revenues spent on R&D and over 400 active patents and applications, VAT succeeds where others fail, and thus is able not only to maintain but expand further its mostly monopolistic position in this niche market.

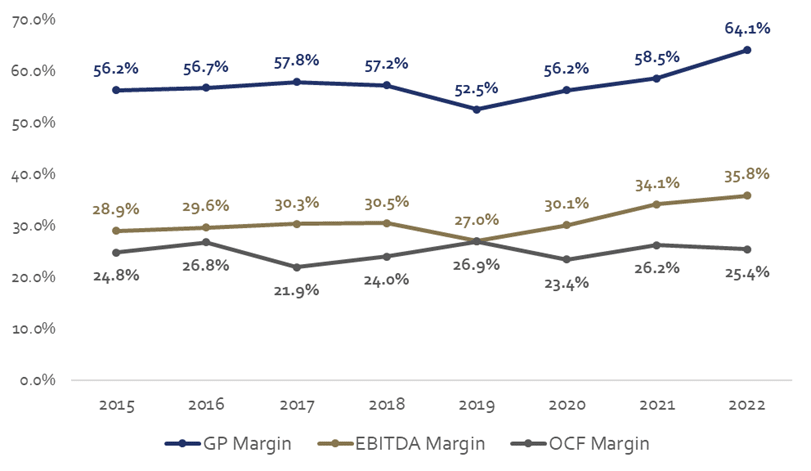

Moreover, about 20% of VAT’s revenue stems from service. With over 20-year lifetime of a valve, company’s service elements have the potential to generate long tail of revenues that can be five times bigger than that of the original product. And although lead times are not long (3-4 months) and VAT feels the impact of the cycle in its order books that later on bleeds into P&L, given the very nature of company’s products, time for them is a relative construct. Undisputed market leadership, superior product portfolio, highly flexible operating model and strong secular growth factors all give VAT the ability to deliver low double digit sales growth and 32-37% EBITDA margin over this cycle. It is a high-quality, profitable, cash generative business that we feel comfortable owning in our portfolios as of December 2023.

VAT has managed to maintain exceptionally strong margin profile through the cycles thanks to mission-critical nature of its products and unrivalled market leadership.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.