Industry bias among the winners

Industries are never equal in terms of quality, which naturally leads to making industry-specific investments. Among industries, there are systematic value diluters and enhancers. This is what we have consistently observed based on factual evidence. Even with perfect management and excellent execution, headwinds faced by an industry cannot be fully mitigated. Therefore, we adhere to a bottom-up approach.

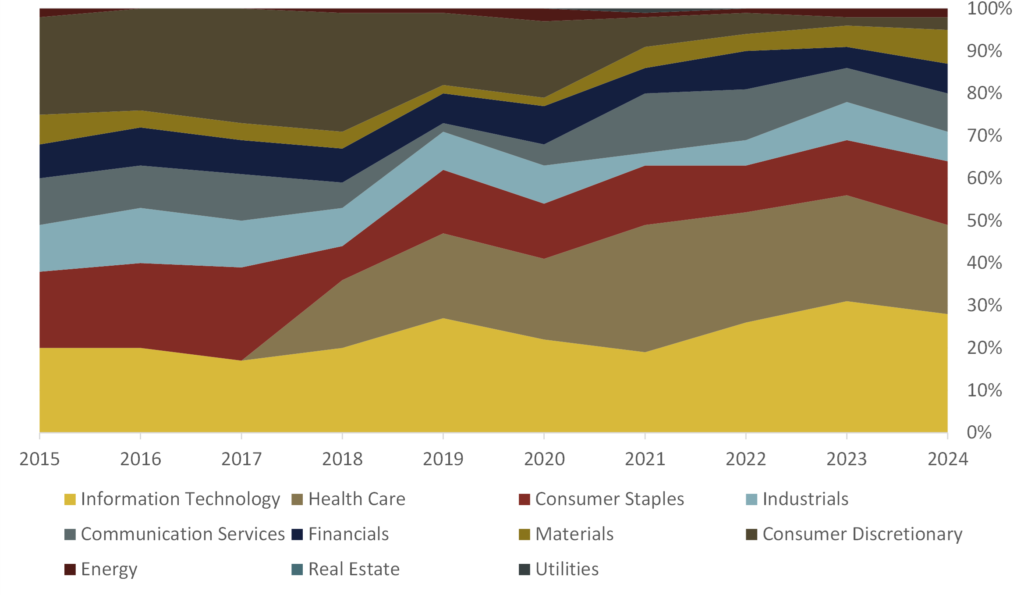

Let us examine the substantial differences in quality among various industries. We conduct a global corporate quality assessment as part of the Corporate Excellence Award, recognizing the best quality companies worldwide. Figure 1 shows the industry distribution of the top 100 companies, showcasing the highest financial quality. The Health Care and IT sectors have significantly increased their representation among the top companies. Recently, we have seen several winners coming from these industries: BioGaia (Sweden), Genmab (Sweden), and Vertex (USA) – health care companies that have demonstrated exceptional performance. Semiconductor companies (part of IT sector) also frequently qualify for the award.

Figure 1: Top 100 split by industries, universe: MSCI World AC

Consumer Discretionary and Industrials still make it to the top, but their representation is diminishing. Our award winners reflect this change as well; companies like H&M and Inditex, which were among the winners in 2015 and 2016, no longer appear at the top. Utilities and real estate sectors are struggling to be represented in the top selection—you won’t find any companies from these sectors there.

Quality and Non-Quality industries

Making industry bets is very widespread in investing, be it active or passive approach. Some gamble with oil prices, some make bets on banks and interest rates, others have global mega-trends at the core of their approach. The key question is whether the industries can be systematically classified as higher quality lower quality.

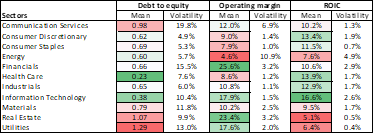

Figure 2: Key financial ratios by industries, universe: MSCI World AC

Looking at the average financial ratios over the last decade, one concludes that the best returns on capital are exhibited by companies in the IT industry. This industry is also notable for generating high margins and ensuring sustainability with robust balance sheets. This corresponds to the prevalence of the industry representatives in the Corporate Excellence Award (CEA) ranking. The health care industry, well-represented among the top 100 companies, overall boasts good financial stability but struggles with profitability.

Rather weak financial position is demonstrated by Consumer Discretionary sector, which aligns with the CEA assessment indicating that the quality of this sector has diminished substantially. Utilities and real estate sectors also fall into weaker categories based on fundamental qualities. The energy sector, characterized by strong balance sheets, suffers from low profitability and extremely high volatility compared to other industries, which significantly impacts the overall quality of the sector.

Systematic value-diluters and enhancers

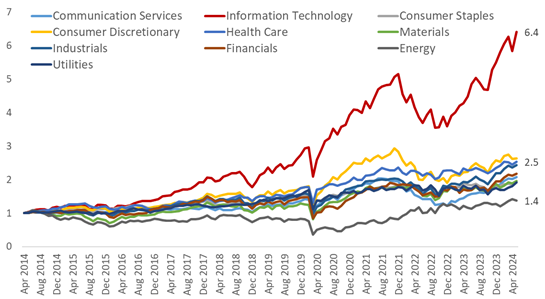

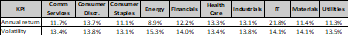

Long-term performance figures highlight the difference between financially stronger and weaker industries. The IT sector is clearly the leader, significantly outpacing other industries, primarily driven by the semiconductor group. In contrast, the energy industry is a value diluter, characterized by weak performance and substantial earnings volatility.

For instance, 1 USD invested 10 years ago in IT would translate into 6.4 USD, while only into 1.4 USD if invested in the energy sector. Although the energy sector might have delivered high returns at times, successful timing would have been required, which is extremely hard to achieve efficiently. This contrasts with betting on mega-trends such as digitization, productivity growth, and AI in the IT sector, which offer more predictable and sustained growth.

Figure 3: Performance and volatility by industry, universe: MSCI World AC

To sum up, industry bets are viable, and the quality varies among industries, which is also reflected in share price returns. According to McKinsey research, the determinants of an industry’s quality status include the degree of competitiveness and capital intensity1. Additionally, we would emphasize the degree of innovativeness and exposure to global market prices, which can limit the ability to influence input costs or output prices.

It’s important to remember that quality dispersion within a particular industry can be substantial, with clear winners and losers. This often results from differences in corporate governance, with stronger governance leading to better performance.

Limitation: Separate industry groups were not considered within this article. The quality of industry groups within one sector can be widely dispersed.

References

- Jiang, B., & Koller, T. (2006). Ein langfristiger Blick auf den ROIC. https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/a-long-term-look-at-roic#/

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.