Marketing Material

Zoetis

Let us introduce you to an unusual, in a conventional sense, Healthcare company whose patients are not people, but…animals. US-listed Zoetis that through IPO was spined off from Pfizer back in 2012, discovers, develops, manufactures and sells critical medicines and vaccines both for livestock and companion animals. If you want your cat or dog to live long and be healthy, or the herd to generate value, Zoetis will be a reliable partner along your journey to achieve this goal. With almost equal split between domestic and international markets sales-wise, Zoetis is also well diversified across species, product categories and franchises.

Although it is not a hyper growth stock, Zoetis is a good representation of solid, high-quality business model that constantly feeds its relevance through innovation and remains resilient over the cycles. With roughly 7%-8% of annual revenues re-invested in R&D, Zoetis has spent more than $4 bn on new product development and lifecycle innovation over last ten years. This allowed company to enter new horizons to secure future growth, while also feeding core portfolio to extend its time on the market.

Pet care, which accounts for c65% and has been steadily increasing its share in the total portfolio over the years, serves an attractive, highly profitable market that grows at 6-8% per annum and is recession-proof, as demonstrated by results of 2009. Track-record of Livestock segment, on the other hand, is more volatile given constant, yet unpredictable nature, of disease outbreaks. Nevertheless, it still grows in low single digits and, importantly, acts as a cash cow for Zoetis to use for R&D purposes.

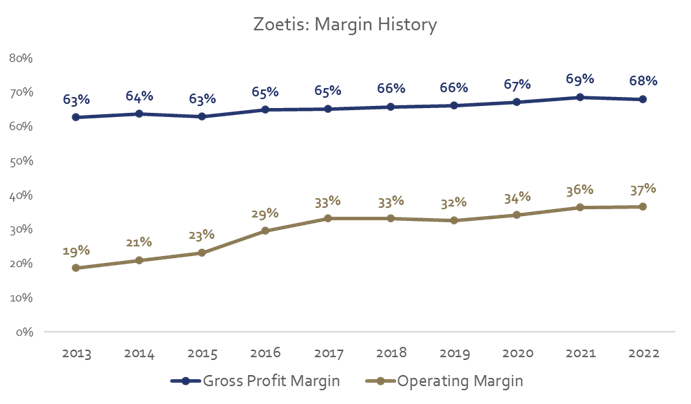

Leading market shares for majority of portfolio products, pricing power, impressive track record of margin expansion – these are just few qualities that make Zoetis a robust quality business and an attractive long-term investment as of December 2023.

Resilience and broad-based quality of Zoetis is well reflected in historical margin progression.

ADVERTISEMENT

This post has been prepared solely for information and advertising purposes and does not constitute a solicitation, offer or recommendation to buy or sell any investment instruments or to engage in any other transactions. The related prospectus and the key investor information (e.g. PRIIPS KIID / Key Information Document) can be obtained free of charge on our website Hérens QualityAsset Management – HQAM.