A strategy is an investor’s best friend

Is it hard to be successful at investing? Well, that depends. Is it hard for a cooking newbie to succeed at French pastry with the first attempt? Even if there is a recipe, something most probably will go wrong if one has no idea how to determine if this amount of “layers” and “creaminess” is layered and creamy enough. However, every newly made batch adds to skills and experience. The same applies to investing and while there is a multitude of factors that can influence one’s success or failure, a strategy is an absolutely indispensable prerequisite for this process to be cognitive decision-making rather than a pure game of luck. And while over time the strategy most certainly can change to cater to a shift in goals, the framework it creates will keep you disciplined and accountable. The logical question then emerges: how can one determine what strategy suits him/her the best and where should one start? Ideally, everyone strives to acquire a top-quality asset at the best price possible, let it be a bottle of wine, a box of chocolate, or a share of a publicly listed company. With the former two, quality can be easily determined by the smell and taste, while with stocks this very often is reflected in growth story and fundamentals. Therefore, to find out what kind of inclinations you have as an investor, let us take a quick and easy blind test.

Put your senses to the test

Consider three companies – X, Y and Z. Company “X” is a Consumer Discretionary, company “Y” is a Technology stock under Software category and company “Z” is Healthcare, classified as Pharmaceuticals. The first impression is usually brought by “smell”, or in the case of a business, by its growth profile, both in terms of turnover and earnings.

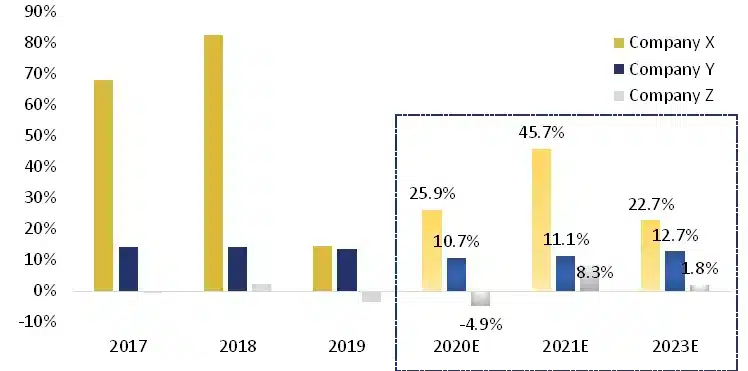

Fig 1: Revenue growth (YoY), actual and estimated

Source: Hérens Quality Asset Management, Thomson Reuters

It becomes quite apparent that Company X is way ahead of the other two when it comes to revenue growth, both historical and projected. Company Y in comparison looks rather bleak, despite double-digit growth numbers, while the profile of Company Z is a mixed bag. A similar picture can be observed in the development of earnings.

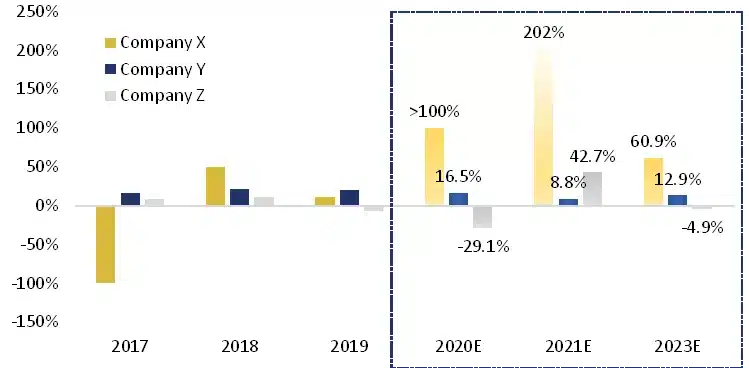

Fig 2: Net Income growth (YoY), actual and estimated

Source: Hérens Quality Asset Management, Thomson Reuters

While growth profile is important no doubt, so are fundamentals and valuation. Same as “taste” justify (or not) the price, they provide you with an understanding of how much value you are receiving with each of the stock under consideration.

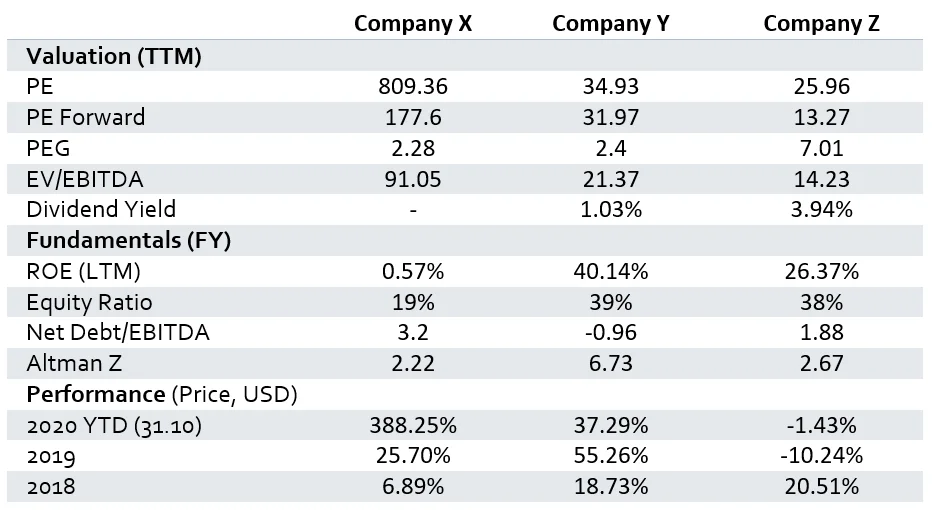

Fig.3: Selected Valuation and Fundamental metrics

Source: Hérens Quality Asset Management, Thomson Reuters

As it appears, for the mesmerizing growth of Company X one will be paying a fortune and, given “red-zoned” Altman Z and low Equity profile of the stock, this growth was primarily funded by debt that might have created some solvency issues. Company Z, on the other hand, looks the cheapest based on traditional valuation metrics, but if growth profile is included in the equation (PEG – Price to Earnings Growth), it turns to be the most expensive one, especially given a rather mediocre performance. It nevertheless has solid fundamentals and is a decent dividend payer. Stock Y offers you something in the middle – it is definitely not cheap, but its underlying financials are strong and it did provide sustainably decent returns in the past. Although one must not forget the general rule of thumb saying that past performance must not be used as collateral for the future one because tides might and do change.

Of course, there is a huge chunk of information missing to make a qualified decision – like how well is the company run, how severe is the competition, what are underlying market trends, etc., and the list can go on. But for the sake of a simple exercise, given that all three are big, global companies with a good market position– which one would your choice fall upon? If Company X is the most appealing, then you are likely to be the type of investor who is ready to chase growth no matter the cost. If you chose Company Z, your risk appetite is definitely much lower and despite poor historical performance, you still see the value in the bargain and scheduled “gifts” in the form of dividends will keep you “locked-in”. If company Y caught your eye, then you most likely have inclinations to what we call quality.

Time to open the cards

Now that the choice is made, it’s time for the moment of truth. Company “X” is Tesla, Company “Y” is Microsoft and Company “Z” is Pfizer. It should be hard to argue that Tesla is an utterly “hyped” company where plenty of faith and expectations are embedded and depend on the success of one single person. In contrast Microsoft is usually seen as an “old and boring” story, while a crucial fact – that it has sustainably delivered progressive top and bottom line growth keeping its balance sheet quality and profitability in check – is very often being overlooked. Pfizer, as any other pharma giant, is a classic example of a defensive stock with common patent expiration issues and cut-throat competition in never-ending R&D race. Perhaps, 90% success rate in COVID vaccine is exactly what it needs to create “buzz” so much loved by investors these days and break the losing streak.