Time to panic?

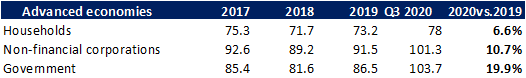

The risks associated with the sovereign indebtedness have tremendously increased during the pandemics as governments strived to support most affected businesses. The companies borrowed to ensure enough liquidity is available to survive and households have increased their debt exposure as a result of the economic downturn. Year of 2020 could be considered historical not only because of the unprecedented lockdowns, but also because of the unprecedented amount of borrowing. The degree of indebtedness increased within all economic subject groups. The most timid increase was among the households, while the most aggressive dynamics expectedly was observed on the national governments’ level (Fig.1).

Fig.1: Debt to GDP (in %) during 2017-2020 and its change during the pandemic year

Source: Hérens Quality AM, Bank für Internationalen Zahlungsausgleich

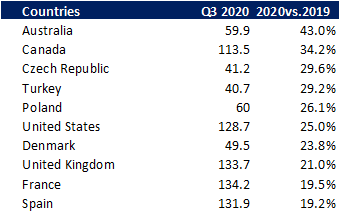

While the aggregate national debt to GDP ratio for the advanced economies rose by 20%, in certain countries the increase was substantially above this threshold (fig. 2). It looks particularly critical for the countries where the debt ratio already sits on a high level, such as Canada, the United States, the United Kingdom.

Fig.2: National debt expansion champions 2020, National debt to GDP (in %) and its change

Source: Source: Hérens Quality AM, Bank of International Settlements

Let us discuss whether the situation around huge debt piles is getting, in fact, dramatic and what does this substantial on-boarding of debt mean for the investors.

Consider other part of the balance sheet

While conducting standard financial analysis of the company, it is common for investors to judge about company’s financial stability on the basis of leverage ratios as well as relative net worth with relation to the amount of total assets. Attempt to tie up debt levels to generated revenues would look rather strange within the classical analytical framework. However, this is exactly what is actually being done when it comes to evaluation of sovereign risk, where debt is compared to country’s gross value added or GDP. Putting country’s debt amount in the context of what the country owns can completely alter the paradigm of stereotypic opinion about country’s long-term riskiness profile. The country might have significant debt to GDP ratio, while value of the assets at its disposal might easily cover the liabilities leading to the positive end balance (fig.3). For instance, consider net worth perspective applied to Japan, which is well-known for its debt champion position (debt to GDP ratio exceeds 230%). In net worth context, however, Japan does not look as risky as UK, while the latter has twice as less debt to GDP as Japan.

And you would be surprised to see G7 countries among the riskiest on the net worth scale, while smaller and developing counties such as Kazakhstan, Korea, Czech Republic look much more solid than it is commonly considered thanks to the relatively large asset base they have1.

Fig.3: Country net worth as % of GDP

Source: IWF, Swiss Re Institute

Knowledge about national net worth, which takes into account not only the borrowed funds but also the owned assets such as natural resources, financial and non-financial assets, would provide investors with better transparency of country’s true fiscal capacity and resilience2.

Others factors to consider

It is rather narrow-minded approach to focus just on the bold debt figure without acknowledging other factors that might totally change the perception of real situation with regard to the sovereign riskiness. Apart from the net worth, which is truly important aspect to acknowledge, one could consider per capital levels: for instance, debt per capita, or even better net debt per capita, which might show an opposite trend to the growing debt to GDP ratio. Knowing that increase in the population and, therefore in labour force, is the major GDP growth driver, this factor will provide an upside during evaluation of country’s financial resilience

Additionally, we cannot skip inflation factor, which tends to benefit the borrowers. Though inflation is on a very low level currently, financial markets are still very nervously watching its possible uptrend. Thus, huge debt in the inflationary environment would not look as scary, especially if the debt is mainly domestic.

Taking into account these nuances surrounding debt matters is important for figuring out how dramatic the reality is. However, the major obstacle in application of these ratios is that they do not appear to be low-hanging fruits as they are not readily available in the statistical databases, therefore one has to put extra-effort to calculate and integrate them into the risk evaluation model.

Macro risk implications for investors

Yes, global leveraging has substantially increased during the pandemics and it might negatively affect sovereign ratings, but we believe that for many countries it is not as bad as it may seem when you dive deeper into the nuances of the state indebtedness.

Sovereign stability of the country exerts substantial impact on country’s attractiveness and is closely watched by the capital markets, therefore, influencing the ease of capital access. While it is common to assess sovereign risk based on debt to GDP level, you get a substantially more objective picture when you judge it from the net worth perspective and don’t forget to account for other important aspects. Debt level is important, but even more important ratio to consider is real GDP growth, as a proof country’s global competitiveness and its ability to develop and expand the economy.

References:

- Yousefi, S.R. (2019). Public Sector Balance Sheet Strength and the Macro Economy

- P., Weckherlin, Ph.(2020). Wealth of nations: why it matters for policy makers and investors