A journey from USD 20bn to a total collapse

One-day drastic stock declines of Baidu (-14%), Viphop (-21%), ViacomCBS (-23%) held by a particular investment portfolio were not driven by the fundamental factors, but rather by the sudden and huge supply of these stocks that flushed to the market. That was the end of the story for the formerly successful trader.

Bill Hwang, the owner and the manager of Archegos Capital experienced the fastest wealth collapse after his very concentrated portfolio melted down, triggering immediate selling to cover losses caused by 5-times leveraging. So, the USD 20bn capital of Mr. Hwang, which has literally evaporated in a week’s time, fell a victim to the lack of proper risk management. Leveraged and concetrated portfolio consisting of companies of questionable quality, which had volatile price charts, paved the way to such a grand failure. How to avoid this kind of unpleasant experience and enjoy sustainable performance of the portfolio?

Concentration and Quality

We have been often arguing that it is absolutely fine to have a rather concentrated portfolio of 8-15 holdings. Limited number of companies allows to know those really well and, therefore, gives the ability to sell immediately after first clouds appear in the sky. The research proves that unsystematic risk is already minimized when the number of holdings reach 15 stocks and further diversification decreases the odds of beating the market1. When the portfolio is rather concentrated, one should be extremely confident about the quality of its holdings, which could be suitable for core portfolio. Brief quantitative screening of holdings from Archegos portfolio, which was minimally diversified as judged from the large positions being held in a particular stocks, shows that the quality of the selected companies was far from optimal.

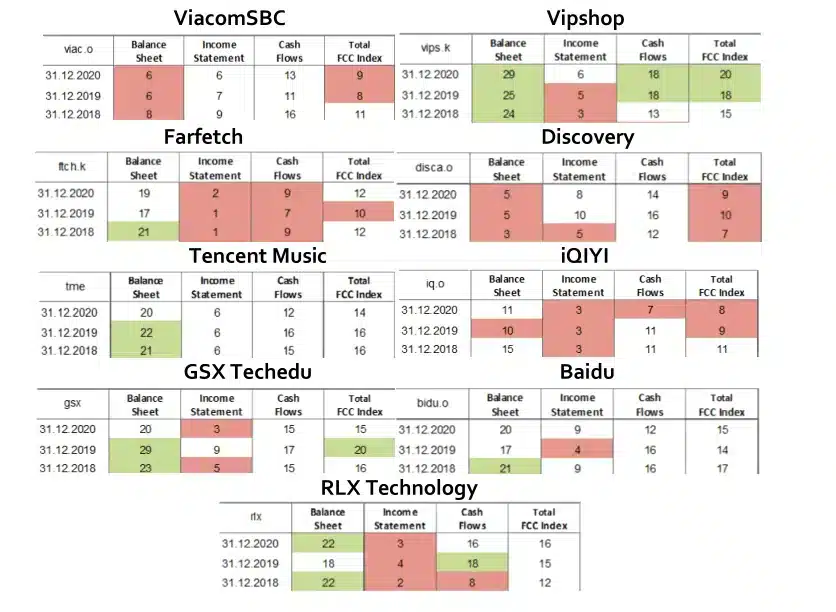

Our financial conditions check indicates that quality status might have been claimed only by one holding, Chinese online branded products retailer Vipshop. Mediocre quality is offered by Tencent Music, Baidu, RLX Technology and probably they do not deserve to be part of highly concentrated portfolio.

Fig.1: Financial conditions of companies held in Archegos Capital portfolio (green – high quality, red – poor quality (alert))

Source: Hérens Quality AM, Reuters

Financial conditions of other holdings scream of high risk via poorly financed balance sheet or difficulty in generating stable and positive cash flows. These types of holdings probably could become interesting bets in a satellite portfolio that is meant to have high risk/high return profile. However, such companies should not be on the radar when one considers selection of targets for a core portfolio. Furthermore, just last year iQiyi, Chinese Netflix equivalent, fell under fraud investigation by SEC.

Another holding that faces fraud accusations is Chinese online education company, GSX Techedu, which might become even bigger fraud case than the recent Luckin Coffee scandal. Such a surprising composition of Archegos’ portfolio raises additional concerns about stock selection and questions the sustainability of the returns.

Coming back again to the diversification, it is clear that the importance of having companies from different sectors and countries increases exponentially with reduction of number of titles in the portfolio. This was exactly the problem of Hwang’s portfolio that had significant bias towards Chinese companies (6 major holdings), which were obviously added to the portfolio in a pursuit of high and fast returns.

Leverage

Leverage does not influence your odds, but it accelerates the outcome, either positive or negative. In case of a negative outcome, it can be really painful and lead to the disastrous consequences – loss of wealth in the case of Bill Hwang or even loss of life in case of a Robinhood trader, who exposed himself to crazy level of risk by trading options and committed suicide as a way-out.

Perhaps, under certain conditions, use of a very limited leverage by a very experienced investor could play out well, but as a rule of a thumb it leads to the unnecessary risk-taking and paves the way to swift capital losses. In no way leverage should be applied to the volatile stocks. Even if the company itself is fundamentally strong but its stock price is volatile, temporary underappreciation of the market can lead to margin call and stop-loss positions, never allowing you to recover your losses. Huge volatility of the stock positions Archegos had in its portfolio was the second major problem.

Fig.2: Risk characteristics of stocks held in Archegos Capital portfolio

| 3Y Volatility | 3Y Beta | |

| ViacomSBC | 57.6% | 1.29 |

| Vipshop | 50.4% | 1.92 |

| Farfetch | 88.3% | 3.34 |

| Discovery | 48.8% | 1.52 |

| Tencent Music | 39.1% | 1.35 |

| iQIYI | 61.9% | 1.18 |

| GSX Techedu | 91.4% | 0.28 |

| Baidu | 46.4% | 1.66 |

| RLX Technology – IPO in January 2021 | ||

Source: Hérens Quality AM, Reuters

Bearing in mind that the broader market volatility is usually around 18-20%, it becomes clear that the volatility of Archegos’ portfolio, simple average of which was ca. 60%, was deadly and the known outcome was just a matter of time. Sensitivity to the market, as measured by beta, also points to the riskiness of the portfolio holdings – all of the companies have betas of substantially higher than one, with GSX as an exception, but which, in turn, anyway is a very risky stock, taking into account its abnormal volatility.

Patience and reasonable approach

Becoming rich overnight is not possible, unless you receive an inheritance. And risky bets implying concentrated and leveraged positions usually won’t help in building sustainable wealth, but could rather destroy it.

Our experience in managing high conviction concentrated quality portfolios proves that having market level volatility and beta below one even of the 8-stock portfolio is not a mission impossible, but rather common figures we see daily. Focus on high quality companies with competitive business model and strong management is the key in the race to achieve high long-term return at lowered stress level.

References:

- Kaufman, K. (2018). Here’s why Warren Buffett and other great Investors don’t diversify. Forbes, July 24, 2018