Through hardships to the stars

Wouldn’t it be amazing if all the life choices we made yielded a perfect score? If we applied for and got a perfect job, married a perfect person for life, bought a perfect house…if anything we decided on resulted in the best possible outcome? It would have been a wonderful world, except for it actually wouldn’t. In the absence of a challenge, many would be simply bored out of their minds. (Un)Fortunately, this is not the case and our journey, from the very end to the very beginning, is a constant process of learning and doing our best in order to progress. Making mistakes along the way is natural, but understanding what went wrong in order to avoid similar developments in the future is a vital component of the learning curve. And this could not be more true than in a reference to the investment decisions. Any investor’s foot slips now and then and all of us have made choices or calls that were far away from optimal. This is why we made it a habit to once in a while go through unfortunate past decisions in order to see if anything can be learnt from past mistakes that could help our future performance.

Government involvement as a weak spot

There are industries where external environment is such that regardless of how much quality a company bears by itself, there are just too many unknowns to properly assess the risk. A vivid example of those would be companies that – fully or partially in their operations – are dependent on government regulations. Those can change any time and have long-lasting negative effects on related companies, such as suddenly increased costs of operations or even loss of competitiveness.

Most vivid example here would be Swiss airport operator Flughafen Zurich that derived half of its revenues from State regulated airport operations. It has to be pointed out that we normally do avoid such cases, but because Flughafen had a very clear strategy to diversify away from regulated activities and delivered well on promises – by building a massive conventional centre named Circle that became fully operational in 2021 – our conviction in the investment case was strong. We held it for several years and the performance was very good. But on November 2018, Federal Office of Civil Aviation under pressure from EU airlines claimed that airport earns more than it is allowed to and therefore should share more profits with confederation through increased ordinance charges. In a week’s time stock lost 18% of its capitalization despite the fact that much of those claims had no merit and it was almost certain that the decision-making body in the face of a Federal Council would likely back the airport. We did sell it however in order not to take any chances (and with a profit), which turned out to be a solid decision given that the stock has never truly recovered from the November’s drop as pandemics had other plans for it.

The change is not always good

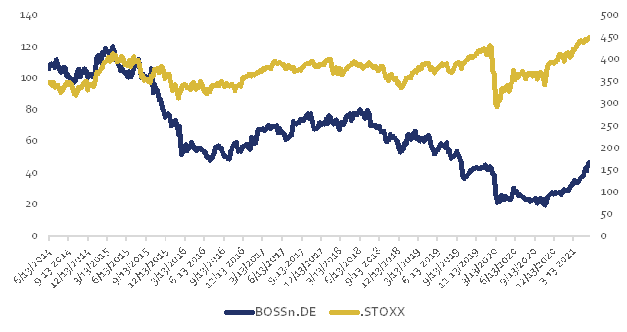

Another tough spot are companies that undergo transformation or restructuring process, especially if it runs deep to the very core – like it did at Hugo Boss. In the years following global financial crisis, German fashion group, well known worldwide for its men’s suits, have followed other industry players in their expansion attempts as end-market demand rapidly picked up. It has also ambitiously decided to challenge higher-end luxury brands and spend a lot of resources to develop lagging womenswear business. The diversion from the core brand, which happened way too fast, and its subsequent segregation into different categories have damaged its identity and made consumers confused.

It left company vulnerable and exposed when high-end fashion markets pressed hard on growth breaks, with 2015 and 2016 being one of the toughest in its history. – stained by profit warnings, stepping down of a CEO and sharp sell-off in shares. Although under new management Hugo Boss did fact-checked its ambitions and focused back on the core, its share price now is just a fraction of what it used to be in the early 2015 (EUR 110 per share versus just EUR 44 in the end of May 2021).

Should we have realized at time that company has bitten off more than it can chew, we could have sold it earlier and with a profit. Another thing that should have been realized is that any major transformation leads to a new business model that is yet to prove itself (or not) and makes all the past track record, which one relied upon in the investment decision, somewhat obsolete.

ig.1: Share price of Hugo Boss and Stoxx 600 Price from June 2014 until May 2021, EUR

Source: Hérens Quality AM, Reuters

It will get worse before it gets better

It is often considered that “sitting and waiting for a rebound” after a sell-off is a classical rookie mistake, but truth is that even an experienced investor can get trapped in this mentality – in our case even more, if the fundamentals of the company still look solid. But it is a rare exception rather than the rule and one has to take first signs of trouble seriously, because they might be just the very tip of the iceberg.

This was exactly the case with European discount airline Ryanair when in September 2017 it faced a rather humiliating problem of resource mismanagement that resulted into pilot rostering error and cancellations of over 50 flights per day over the time span of six weeks. Among other airlines Ryanair always stood proud over its cheap and reliable service and a remarkable ability to turn any kind of publicity in its favour, be it good or bad. But not this time. Every aspect of the situation was managed poorly – from failing to notify passengers in time about their flight cancellation to direct confrontation with pilots that had a time off work as CEO O’Leary tried to force them to defer leave.

While management explained the cancellations as a one-off screw-up, the pilots believed there was a deeper problem of the overall dissatisfaction with company’s remuneration system. Although company’s share price did rebound from September’s drop, internal tensions within Ryanair were bugging us greatly as this is never a good sign and a quality company must be strong in its core, which is personnel. Rising fuel costs and resulting higher air fares, although with a time lag, was another area of concern. Therefore we sold it in June 2018 to fix the gain and were right to do so as just two months after Ryanair pilots went on strike, sending shares into a free fall.

Revise. Reflect. Learn

It is never easy to admit that the course of action you have undertaken or the judgement you have bestowed was a fully or partially a faulty one. But if you won’t see it, admit it and conclude something useful from it, the vicious circle might go just on. A systematic revision of the mistakes is a crucial part of the investment process. It makes you see things differently, enhances your critical thinking, improves your model/system and sharpens your analytical skills. It makes you a better investor – for you and your clients.