Too much of ESG?

Last month, former head of the board of governors at the Japanese Government Pension Fund, the largest retirement fund in the world, speculated that ESG investing may be showing signs of a bubble1. Indeed, opportunities in ESG space have been extensively favoured by investors: inflows into sustainable ETFs tripled in 2020 from a year earlier2. However, unlike many short-term fads, we believe that ESG is a trend, which is here to stay. With that in mind, investors may find themselves scrutinizing their portfolios, wondering, whether they should join the ESG party as well. In all the fairness, variety of ESG products and approaches can leave one baffled by which one to favour, while robust evidence for long-term outperformance of sustainable investing is yet to come. In case of the Japanese Pension Fund, for example, portfolio managers were left unimpressed with ESG returns, failing to beat the benchmark by investing in a basket of indices focused on women empowerment, carbon efficiency and other ESG-inspired themes3.

Quality investing favours strong ESG profile

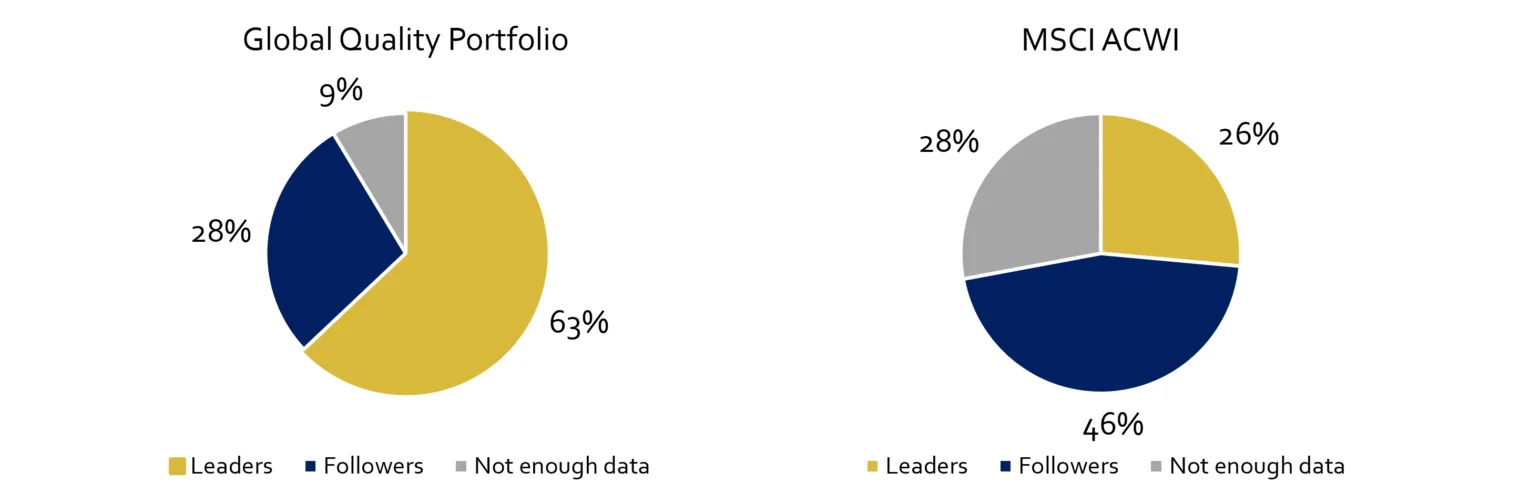

Unsurprisingly, achieving sustainable outperformance requires a little more work than simply tracking an ESG-focused index. While ESG is certainly a material factor in long-term shareholder value creation, other aspects of a company’s business must also be considered to solidify the investment case and, besides, these aspects can become precondition for good ESG behavior. Therefore, we have always adhered to an integrated approach, wherein ESG analysis is yet another essential attribute of quality investment style. Fortunately, one does not have to sacrifice financial strength for the strength of ESG or vice versa, as we often observe that quality companies put emphasis on sustainability as part of their business strategies and exhibit excellent ESG performance, enabling construction of a responsible portfolio. Our comprehensive ESG assessment also includes the analysis of corporate KPIs, such as GHG emissions, employee injury rate, board independence and many others, which are compared to the sector medians. As depicted in Figure 1, quality investment universe is better at disclosing ESG data and obviously has a higher tilt towards ESG leaders – companies with better ESG metrics in general, compared to their peers.

Fig.1: Corporate ESG standing in Developed Markets, Quality vs. MSCI World (July, 2021)

Source: Hérens Quality AM, Reuters

Focus on ESG as a route to improved financial performance

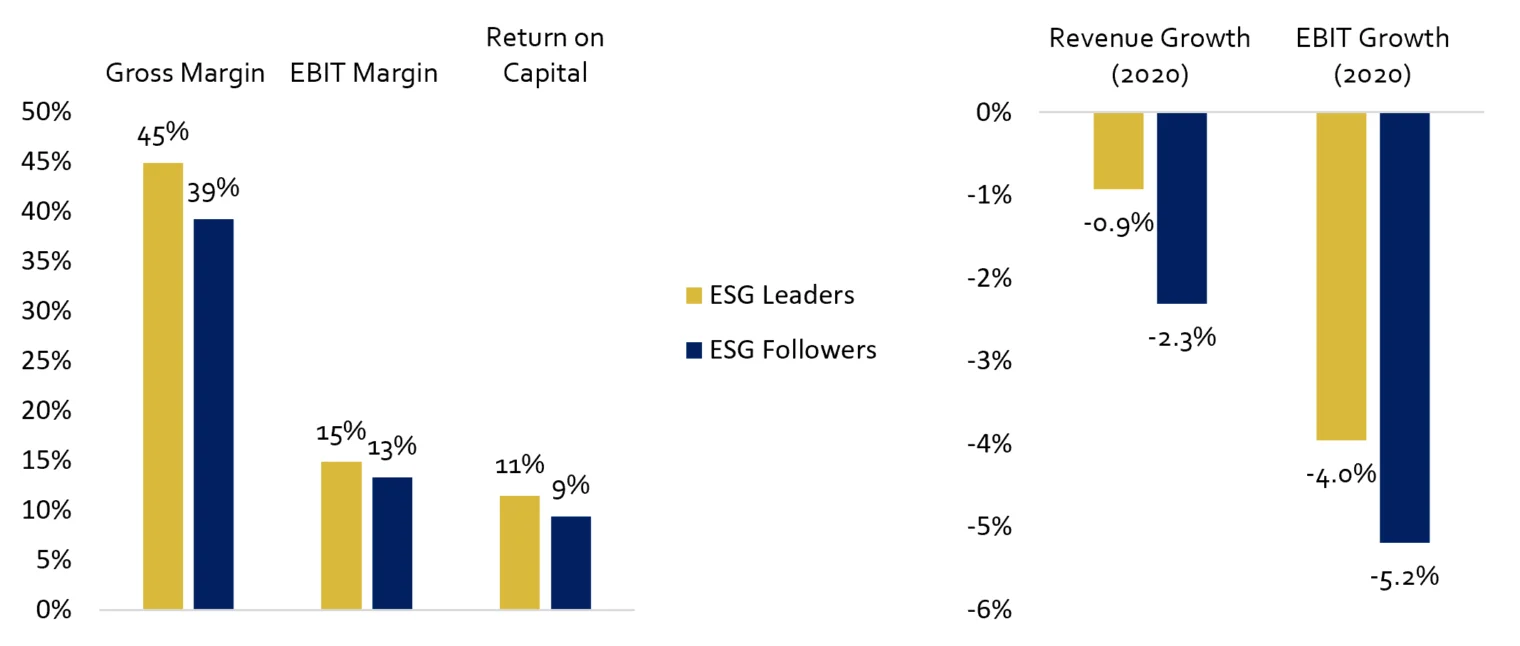

Quality’s tilt towards ESG leaders comes in handy not only because it is well-suited for sustainability-minded investors, but also because strength of ESG is arguably a factor contributing to excellent financial performance of quality companies. As depicted in Figure 2, companies outperforming their peers on quantitative ESG assessment deliver higher margins and better returns on capital, while their top and bottom lines stayed more resilient during 2020, when the crisis was rampant. Obviously, competent management of ESG-related issues can benefit not only the society, but the company itself through multiple efficiencies, such as an increased employee productivity, cost savings, better decision-making and risk management, enabled by the best corporate governance standards. For instance, TJX Companies, a leading US discounter, has managed to reduce carbon footprint across its stores in Canada by 6% by investing in energy-efficient technology, at the same time saving $1.6 million in annual energy costs. Furthermore, many companies are seizing new growth opportunities by introducing sustainability-driven products, which often command a pricing premium. For example, Orkla, a Norwegian food conglomerate, focuses on plant-based food lines, which have lower GHG footprint.

In 2020, Company saw sales across sustainable brands increase by 21% y/y, while the entire Foods segment only grew 3.7%. Such initiatives, undertaken by quality companies, help them maintain their competitive edge and improve business performance.

Fig.2: Median Gross Margin, EBIT Margin, Return on Capital (July 20201), Revenue and EBIT Growth in 2020 vs. 2019 of ESG Leaders vs. ESG Followers, MSCI World Index

Source: Hérens Quality AM, Reuters

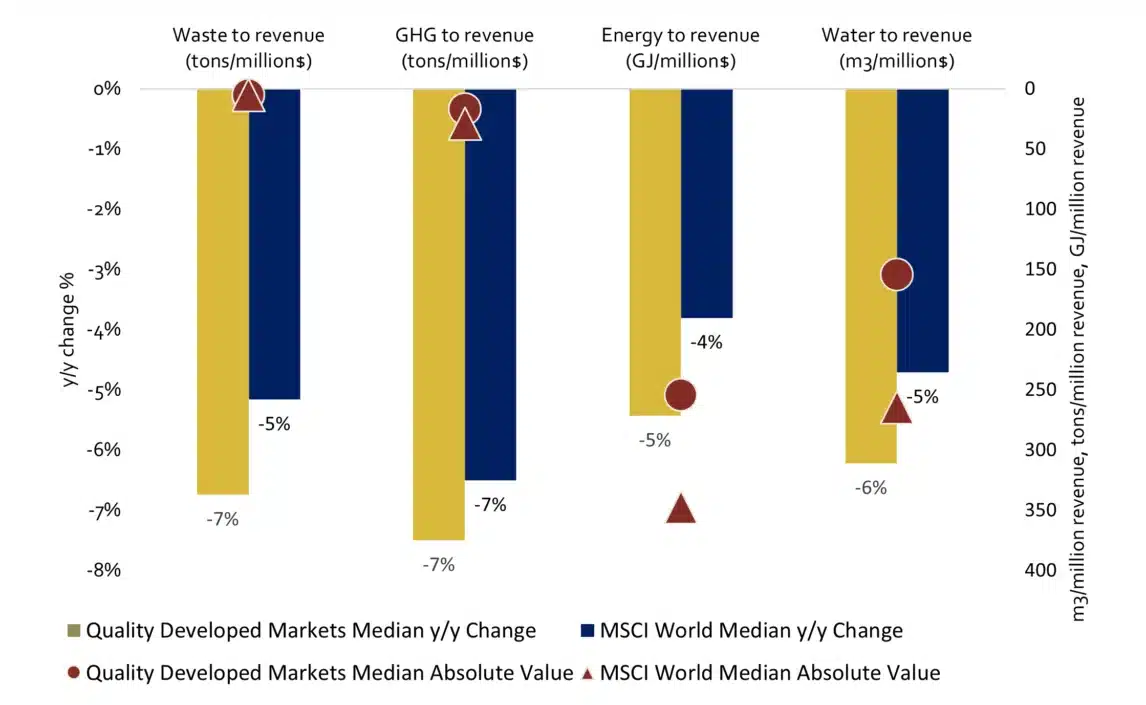

ESG is just as much about the journey as it is about the destination

When analysing ESG aspect of a company, another, not less important element we focus on, is dynamics of ESG KPIs, and here, again, quality companies shine. As Figure 3 illustrates, quality companies are making more tangible progress towards driving positive change regarding the impact on their stakeholders. For example, median water use to revenue within quality universe was already ~42% below the benchmark’s universe, but median y/y decrease in emissions among these companies was still 1.5 pct points higher than reductions among corporates in the broader market.

Fig.3: Median Values and Median y/y Change of Environmental KPIs in Developed Markets, Quality Universe vs. MSCI World (July 2021)

Source: Hérens Quality AM, Reuters

ESG analysis is a meaningful supplement to quality investing

While market participants pile up money into “green” funds, we have always argued that sustainable investing is an integral part of quality approach and embraced ESG analysis as part of our stock-picking since as early as 2010. Based on the facts above, it is evident that quality goes hand in hand with sustainability, and integration of ESG analysis into quality investing makes it a perfect fit for investors who seek not only well-managed companies with robust financials, but also ones that care about the society and the environment, making real impact. Some notable examples include Adobe, which has invested $186.7 million in community support over the last 3 years, Mowi, a leading seafood company, whose green financing projects enabled it to save 121 million m3 of water per year, or Accenture, whose energy management services helped clients avoid more than 800 thousand tons of CO2 in 2020.

References

- Bloomberg (2021), “Beware of ‘ESG Bubble,’ Says Ex-Chair of World’s Biggest Pension”

- ESG Investing (2021), “ESG ETF inflows reach $89bn in 2020”

- Bloomberg (2021), “The World’s Largest Pension Fund Has Cooled on ESG. Should You?”