Michael Griesdorf | the Market NZZ

Covid-19 has led to a flight to quality stocks. However, names such as Sika and Ems-Chemie have been beating the market for much longer. The Market shows what makes a good company and which Swiss quality stocks are still worth buying today.

Despite much progress in combating the pandemic, the outlook remains uncertain. Thus, it cannot be ruled out that there will be further restrictions on society and the economy in the future because of the covid mutations.

For companies and shareholders, this means that forecasts for the medium to longer term are subject to various uncertainties. Many companies are now announcing targets for two to three years from now, but often with the disclaimer that the forecasts only apply if the pandemic does not worsen again.

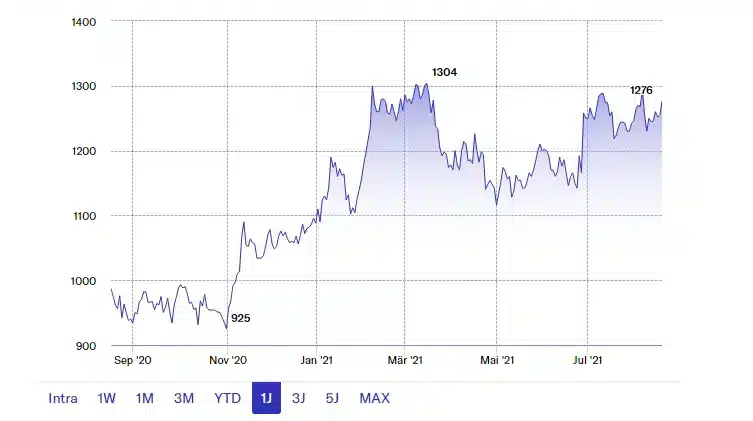

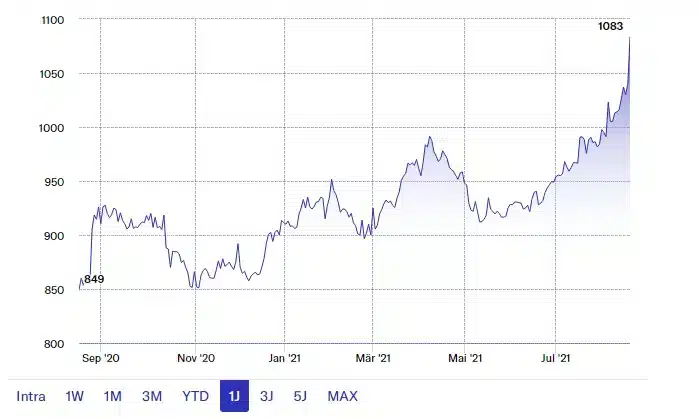

Ultimately, therefore, virtually everyone is still riding on sight. As a result, investors are looking for security and therefore prefer stocks of quality companies. Since the outbreak of the pandemic, names such as Sika, Ems-Chemie, Givaudan and Dätwyler have clearly outperformed the market as a whole:

However, the better performance of quality stocks is not a new phenomenon. The aforementioned stocks had already outperformed the market before the outbreak of the virus.

But what actually makes a good company, and what are the reasons why an investment is generally worthwhile in the long term? To answer these questions, The Market spoke with two experts and gives examples of where an investment is still worthwhile today despite high valuations.

Strong market position as a basic prerequisite for quality

For Moritz Baumann, Head of Research at Albin Kistler, an asset manager focused on quality companies, a lasting strong market positioning is the fundamental basis.

“For us, it is first important that a company has a unique market position that cannot be attacked,” says Baumann. A good market position can manifest itself in many ways. Examples, Baumann says, include a company’s size, its cost advantages, intangible assets or the provision of goods, technologies and services that are difficult to replace.

Diego Föllmi, managing partner of Hérens Quality Asset Management, also focuses on a company’s market positioning.

“The first question we always ask ourselves is what a company’s competitive advantage is. Among other things, we want to see that it has a high level of innovative strength and thus pricing power,” says Föllmi.

Another distinguishing feature put forward by Föllmi and von Baumann is the strength of the balance sheet and the ability to maintain it. The more solidly financed a company is, the more likely it is to seize market opportunities as they arise.

“For us, good companies are those with low debt and a high equity ratio,” both say in unison. Föllmi and Baumann also pay attention to a high and stable cash flow, which supports the balance sheet.

Only good management knows how to leverage strengths

Nevertheless, these prerequisites are only one side of the coin. Making the right use of them is the other, according to Baumann:

“For us, the performance of the management is very important. Only if they are experienced, act confidently in crises, tackle changes proactively and never rest on their laurels will the intrinsically high-quality substance of a company still be there in ten years’ time. This includes the management board handling capital efficiently and giving preference to organic over acquisitive growth. We don’t want sun kings,” he says.

Föllmi also looks at the wealth of experience and performance of the management team when making a selection.

“In certain industries, such as IT, we want to see that the CEO has the necessary experience of the core processes and thus understands the subject matter,” says Föllmi, adding, “For us, it’s also the little things that count and that are ultimately decisive for the success of the company. For example, it is important to us how often the management meets, how it is composed, that it is independent and that there are not repeated changes in the management body within a short period of time. We also pay attention to how they communicate with us and other investors. If we don’t get satisfactory answers to our questions, we don’t invest.”

A unique market position, a clean balance sheet and good management: according to Baumann and Föllmi, companies with these characteristics usually also show an above-average return on invested capital as well as steady growth in sales, profit and cash flow.

However, Baumann warns against a casual approach to these key figures: “Anyone who only works with quantitative, mechanical quality filters and focuses on the snapshot runs the risk of parting with good companies simply because they have not been patient enough and have paid too much attention to certain negative points. Quality shows itself over longer periods, in which there may well be one or two bad years,” he says.

Quality pays off

However, according to Föllmi and Baumann, those who take the aforementioned aspects into account when selecting their companies have the best chance of beating the market in the longer term.

Föllmi justifies this with the fundamental laws of economics. “Only those who are competitive, i.e. who earn at least the cost of capital, will survive in the long run. That applies to all economic entities. That’s why we think it’s important not to cut any corners here and also to analyze all companies in the same way,” he says.

According to Föllmi, the strength of quality companies is particularly evident in difficult times. “They usually handle crises better than ordinary companies. Moreover, in such phases they often even benefit from the weakness of others.”

Baumann, on the other hand, says: “Globalization is creating ever larger, more open markets. Information is becoming more easily accessible, and ideas are spreading faster. These structural drivers allow good companies almost inexhaustible growth opportunities. As a result, their profits rise, and so does their share price.”

However, Baumann identifies another reason for the better performance of quality on the stock market:

“The long-term potential of good companies is always underestimated.” Many investors are often too optimistic about bad companies and too pessimistic about good ones, he said. “Good companies often grow much stronger and more sustainably than people think. As a result, earnings estimates are usually wrong, and that’s why they consistently surprise on the upside. The bulk of investors lag behind reality.”

For Baumann and Föllmi, it is still appropriate to invest in quality, especially in uncertain times like today. However, Föllmi warns, “Given the high valuations, discipline and selection are essential at the moment.”

Baumann also agrees with this. However, he points out that with good companies, the time of entry is less important than the fact that investors are invested at all.

“You can’t be naive and think you’re going to get quality at discount valuations at some point.” What is needed, he says, is a willingness to make a long-term commitment so that the potential of quality companies can also unfold. “There is virtually nothing more secure than a diversified portfolio of top companies,” Baumann says.

Cheap quality can still be found

Despite their popularity, Baumann still finds undervalued quality today – for example at SFS and Bystronic, among others.

“In addition to rock-solid financing, SFS, which specializes in the manufacture of precision molded parts and special screws, has a high-caliber management team with a long-term focus,” he says. SFS has succeeded in positioning itself in many small but highly attractive niches, where it usually occupies a leading market position. It is therefore not surprising that SFS is investing in further capacities and thus in the future of the company despite the pandemic.

SFS Na. in Fr.

Bystronic is a leader in sheet metal processing using lasers. “As a result of the recently completed focusing, the handsome financial strength can now be used in a targeted manner for the further expansion of this core competence. Growth and profitability are above average compared to the competition and compensate for the cyclical character. The transparent communication with measurable targets also speaks in favor of the management,” says Baumann, justifying Bystronic’s investment case.

Bystronic Na. in Fr.

Meanwhile, Föllmi is betting on Emmi and Galenica, among others:

“Emmi holds 50% of the Swiss domestic market. In addition, the milk processor is the world’s number one in the distribution of Swiss cheese and the European leader in the distribution of cold coffee drinks and Italian dessert specialties. Furthermore, Emmi is very well positioned to respond quickly to and benefit from new consumer trends. Even if the share is not a high-margin growth stock, it is a good example of Swiss excellence,” says Föllmi.

Emmi Na. in Fr.

Galenica is a fully integrated distributor of medicines that also develops its own over-the-counter medicines, he said. “Galenica has a dominant position in all its distribution channels. It also operates in a consolidated market with high barriers to entry, stable regulation and structural growth factors. Like Emmi, Galenica is a quality stock that compensates for rather modest growth with a steady focus on profit and margin expansion,” Föllmi adds.

Galenica Na. in Fr.

So despite demanding valuations for many quality stocks, there are still opportunities for investors looking for quality.

https://themarket.ch/analyse/warum-es-sich-lohnt-in-qualitaetsaktien-zu-investieren-ld.4809