Powering the economy and your portfolio

Can you guess which industry delivered the highest return over the last decade? Interestingly, it was not the high-flying Software. The gold mine was the Semiconductors Industry: makers of tiny pieces of silicone, that give life to everything that runs on electricity, as well as chip materials and manufacturing equipment suppliers. The fact is not surprising, when supported by couple of data points: since 2012, the Semiconductors Market has almost doubled to $590bn1, and it is expected to reach 1 trillion by 20301. As the world is undergoing digital transformation, technologies that will define the decades ahead, such as AI, autonomous driving and IoT, are all underpinned by the Semiconductors Industry, which enables crucial innovation by supplying more powerful, more advanced chips. However, with dismal performance in 2022 (-33%) and countless media articles about big and scary inventory adjustments happening in the market, one can almost think the industry is doomed. Admittedly, a few years ago, we, too, would be quite apprehensive of this notoriously cyclical space, but we have been observing favorable trends, which speak of increased resilience of the industry and make it an attractive opportunity for quality investors. This is also supported by the fact that, since 2013, share of semi stocks in our US Quality cluster rose to 9% from 4%, so let’s look at what drove the shift.

Sometimes, it really is different

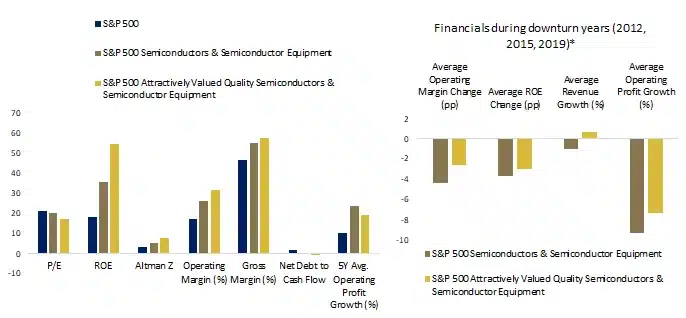

The Semiconductor Industry typically develops in a zigzag manner: during good times, chips are in tight supply, prices rise, and revenue grows exponentially, accompanied by overordering. However, as end market demand falters, inventory starts to pile up, and growth swings into negative territory. COVID-19-driven cycle is no different, and we are now seeing adjustment stage unfolding. There is, however, a catch. Recently, industry economics and its players’ fundamentals have changed. Over the last 15 years, the market has faced four downturns, however, compared to earlier times, recent adjustments have been quite benign. In 2009 and 2012, US largest semi players saw operating profit plunging over 20% (Fig. 1), with margins contracting massively. In contrast, in 2015, majority of industry participants managed to grow, despite market contraction, while in 2019 not only was the top line decline contained to mid-single-digits, but also operating margins, now well over 25%, remained more resilient.

Figure 1: Financials of S&P 500 Semiconductors & Semi Equipment Industry (2008-2021)

Source: Hérens Quality AM, Reuters

Evolving industry landscape

We see one key reason minimizing the pain of peak-to-trough cycles: breadth of the demand. Since 2009, share of chips sold for consumer applications has declined to 8% from 18%, and the largest future growth drivers are expected to be Automotive and Industrial segments1,2. Data Processing remains a large chunk (38%), but this segment is now wider than just PCs: with data generation having increased >150 times over the last 6 years3, demand is driven by data centers and AI. Chips are also becoming more sophisticated: since 2015, chip content has increased by 40-70% in different applications3. In addition, industry consolidation helps to stabilize margins through concentration of market shares, development of specialized know-how, economies of scale and pricing power. For example, top 5 chip companies today contribute 42% of market revenue, up from 34% in 20104. Some players have even built monopolies, such as ASML, the only manufacturer of EUV lithography equipment.

Harder, Better, Faster, Stronger

With incredible improvement in fundamentals, some highest-quality titles can now be found in the semiconductor space. As shown in Fig. 2, quality of the industry is above the market, proven by high returns on capital, low indebtedness, financial stability and strong margins, in addition to attractive valuation and growth rates. With industry that still remains quite volatile, it is especially important to pay attention to robustness of fundamentals and invest only in those titles that are able to navigate the downcycles without impairment of the financial health. Therefore, metrics of chip companies in our quality cluster are one more step ahead, and these companies have also historically shown more resilience in difficult times. However, all industry players are not created equal. For example, outsourced assembly and test companies (OSATs) and foundries (outsourced chip manufacturers) are typically capital-intensive and possess lower margins, although there are exceptions, such as TSMC, which controls half of the market and leads in advanced technology. The market of chip-making equipment has historically been even more cyclical than the chips industry itself; on the other hand, electronic design automation (EDA) software providers, such as Synopsys and Cadence, have resilient, recurring-revenue business models shielding them from industry ups and downs. Understanding such differences through in-depth research is crucial to identify top-quality companies.

Figure 2: Financial Characteristics of Semiconductors & Semi Equipment Industry

Source: Hérens Quality AM, Reuters; *there were no chip titles among quality in 2009

This too shall pass

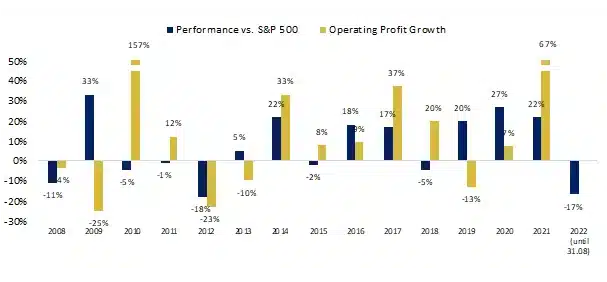

ISo is now a good time to invest in chips? Near-term, one better brace for more volatility, as the market gauges the depth of the downturn and draws timelines for the recovery, which, by many industry players, is expected around H2 2023. However, as shown in Fig. 3, semis tend to underperform not when times are tough, but when conditions are peaking, so waiting for the clouds to clear may not necessarily be the right strategy, and we view the double-digit pullback in stock prices as an attractive entry point for the long-term. For example, we have been holding Texas Instruments, analog chip leader, in our US Portfolio since 2010, and it has delivered >750% return. The way we see it, as long as quality remains intact, short-term pullbacks, inherent to the industry, are not to be feared, but rather used opportunistically. In our view, the greatest risk surrounding semis is geopolitics; however, as long as your portfolio remains diversified, we see the risk as worth considering, given attractive industry dynamics.

Figure 3: Total Return of Semiconductors & Semi Equipment Industry vs. S&P 500

Source: Hérens Quality AM, Reuters

1. The semiconductor decade: A trillion-dollar industry (April 2022), McKinsey

2. Faster, greener, smarter – reaching beyond the horizon in the world of semiconductors (2011), PwC

3. Applied Materials 2021 Investor Meeting Materials

4. Top 10 companies hold 57 of global semiconductor market, EE Times Asia (April 2022)