This time is different?

During two days (26th and 27th of January 2023) Buzzfeed, an online media company, the stock rose 200% on the news of ChatGPT integration and its efforts of automated content creation to replace its human workforce. Also C3.ai, an enterprise AI application provider, rose 30% in 3 days and 85% for the full first month of 2023 after announcing it will implement OpenAI technology and release a Generative AI software suite. These violent moves bring back those bitcoin/metaverse vibes from early 2021 as private investors are still searching for a “new new thing” that would make them rich in the next decade. How do we know this time is for real? And which companies would really profit?

What’s the story? Morning glory

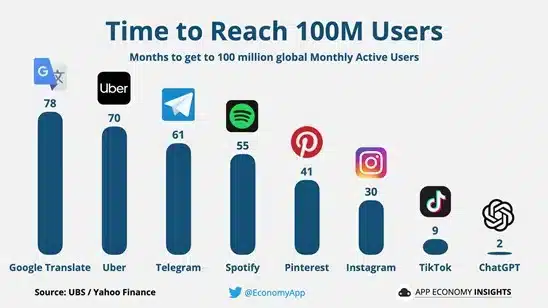

OpenAI (a company co-founded by Sam Altman, Reid Hoffman, Elon Musk, Peter Thiel and many others) released its ChatGPT (Generative Pre-trained Transformer) chatbot on 30th of November and more or less immediately went viral – it reached 1 million users in under a week and 100 million users in 2 months improving TikTok record by…like a lot.

Its popularity was amplified by increased social media penetration, but still this result looks stunning. Internet users googled “OpenAI” more times than Kim Kardashian and Elon Musk combined – impressive development for a productivity tool that still could be used for entertainment purposes. Following early success Microsoft invested $10 bn into the company (in addition to $1 bn in 2019) and announced ChatGPT integration into its Bing search engine and Teams paid subscription.

Rise of the Robots

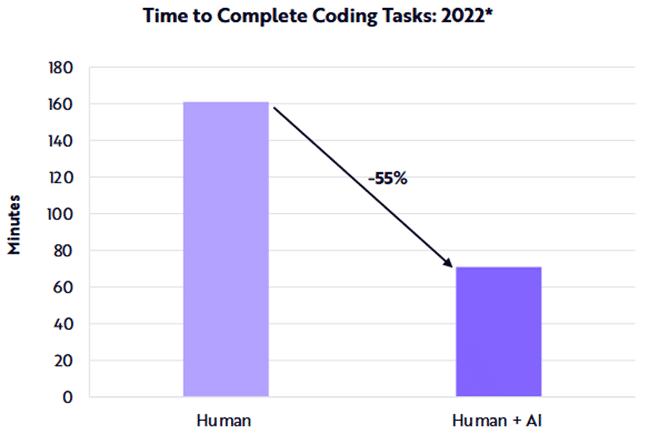

We see more and more discussions about how using ChatGPT will change our daily routine and we at HQAM think that the impact will be a tremendous productivity boost during the next decade. After 3 big stages of economic growth marked by personal computer, Internet and smartphone inventions we are entering the 4th – accelerated AI implementation into our daily lives. ChatGPT just showcased the world what an outdated model with uneven factual accuracy can do, but many others will follow, and it is difficult to underestimate the effect. Just look at this single chart: most of IT developers are using ChatGPT / GitHub Co-pilot or an alternative solution and according to ARK Invest (we know we know, but this number looks credible) time to complete coding task using one of these tools could be cut in half – quite an efficiency gain, especially for smaller motivated teams with no to little cash flows.

We are probably looking at the start of the new innovation cycle (last was driven by 0% rates) and the first results (just a wild guess) could appear by the end of 2023.

FED was fighting low workforce bargaining power with more and more easing until it did too much of it during pandemic resulting in tightest labor market in decades. There are 11 million open positions in the US now and unemployment of 3.4% so AI might be a good solution to solve this situation in addition to monetary tightening. A lot of routine manual tasks will be automated which is has a huge deflationary effect on labor participation rate. From the industries that will become more efficient one can mention traditional people intensive business models with low operating leverage work – the ultimate endgame will be many different specialized chatbots for legal, book-keeping, financial advice, or healthcare. And they will be no single winner in this.

Quality AI

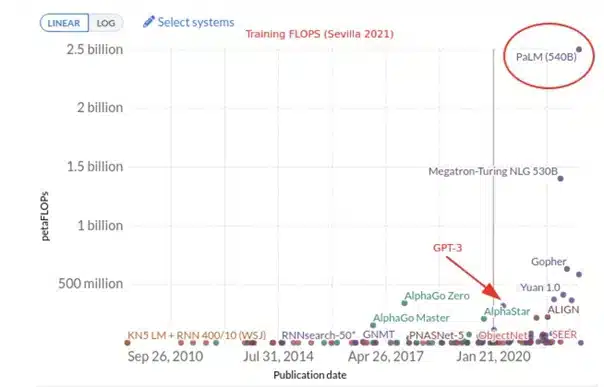

Many retail investors already called ChatGPT a killer of Google and its search business which is quite a misunderstanding. Firstly, the product will not be free, OpenAI already introduced a subscription for $20 per month which not many users will be ready to pay to replace free search. Secondly, Alphabet has its own much more advanced product PaLM which is expected to be rolled as a product called Bard later this year. And Alphabet is clearly a pioneer in the space and a potential winner.

Another one is Meta which had a rather rocky performance during the last 3 years – after performing well in 2020-21 on the back of e-commerce and digital ad growth, it lost a whopping 65% in 2022 on stalled revenue growth and increased investments in metaverse and infrastructure. The biggest part of these investments is going directly into servers and Nvidia GPUs that will power algorithms for better ad targeting and conversion. So Meta has all potential to capitalize on that and offer advertisers to find the right customers to see a product ad they will be willing to buy. And do not forget that Meta added a lot of manpower for content moderation in recent years and these tasks could be much better automated now.

If you don’t want to bet on who will create the best model – you can also choose a company that is providing the best hardware in the space – above mentioned Nvidia. Nvidia GPUs will account for the majority of capital expenditure to power artificial intelligence products. Citigroup estimated that ChatGPT opportunity alone is worth around 5 bn in the next 12 months for Nvidia or roughly 17% of revenue. And this is just one early-stage client that will be followed by many more. If you doubt that Nvidia can sustain its lead just add AMD, its closest competitor, to your portfolio.

Another duo of companies that will benefit, in our opinion, are Synopsys and Cadence – the leaders in semiconductor electronic design automation (EDA). Semiconductor industry is one of the fastest growing and should double by 2030, as artificial intelligence progresses there will be more and more chips needed to collect and process information from the outside world and both companies provide a relatively safe way to play this trend as industry is suffering from bottlenecks and supply chain disruptions. ChatGPT is one of the reasons projections for both companies will be revised upwards as higher AI product penetration forecasts will secure more investment in chip design.

All in all, it is just another sign of how technology is important for growth in productivity and future GDP growth. Companies that invest in R&D and have innovative products will outperform those that do not do this.