The power of dividends

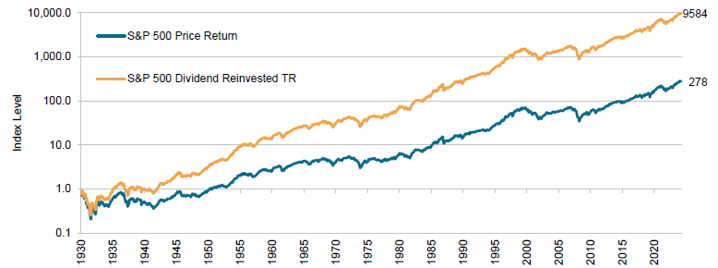

Dividends have long been a core driver of wealth creation. Since 1926, they have contributed about 31% of the S&P 500’s total return on a monthly basis1. Interestingly, in the last two decades, the contribution has been roughly half as much, highlighting the increasingly growth-oriented nature of the U.S. market and a shift toward buybacks in capital allocation. Still, over the long term, reinvested dividends account for the lion’s share of total returns through the power of compounding. Since 1930, a dollar invested in the S&P 500 would have grown to $9,584 if all dividends had been reinvested, compared with just $278 in price terms alone (Fig. 1)1.

Figure 1. S&P 500 Cumulative Growth

A lagging factor with a lasting appeal

That said, across equity styles, the dividend yield factor has been a laggard. Over the last 10 years, the MSCI World High Dividend Yield index delivered 9% (in USD) annualized return, compared to 12% (in USD) for the MSCI World Index. The dividend factor has also continued to lag over the last 3 years as market attention has centered on high-flying AI winners, and as the high-interest-rate environment has reduced the relative appeal of dividend-paying stocks compared to bonds. In recent history, the dividend factor outperformed only in 2022, 2018, and 2016, as it tends to perform best in risk-off environments and during rotations from growth to value.

Despite their lackluster performance, dividend-paying companies continue to hold strong appeal for many investors, regardless of the market cycle. Dividend stocks provide a regular income stream, supporting smoother compounding for investors who value a slow but steady ride. For investors approaching or already in retirement, dividend investing also aligns well with capital preservation goals, as the focus shifts from growth to income stability.

Quality overlap with Dividends

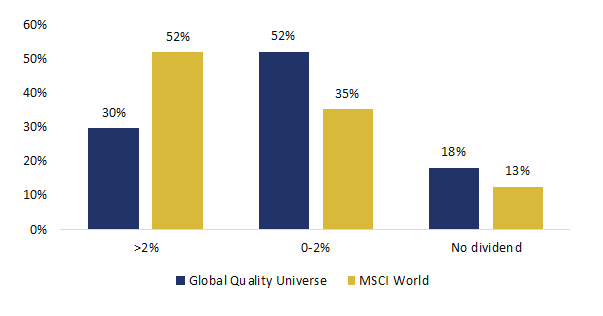

High-dividend-yield stocks are relatively uncommon within the Quality universe. As shown in Fig. 2, only about one-third of global Quality companies have a dividend yield above 2%, compared with more than half of the companies in the MSCI World Index. There are several reasons for this. First, Quality portfolios are typically composed of high-ROE businesses with attractive growth opportunities. These companies often prefer to retain profits to fund growth, rather than distribute them as dividends, as they can reinvest at superior rates. Second, dividend-focused strategies tend to underweight the Technology sector, which is well represented in the Quality universe. In contrast, high-yield sectors such as Energy, Utilities, and Real Estate contain relatively few firms that meet Quality inclusion criteria. Finally, because investors value the stability and profitability of Quality companies, their shares tend to trade at premium valuations. This higher price base mechanically lowers their dividend yield, even when payout ratios remain reasonable.

Figure 2. Distribution of Quality companies and the MSCI World Index according to dividend yield (as of 20/10/2025)

The pitfalls of dividend investing

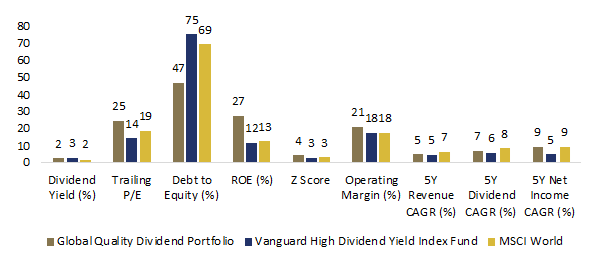

Even though the Quality universe is not particularly rich in dividend-paying stocks, attractive yields can still be found. Combining a dividend-focused approach with a Quality filter may therefore represent a compelling strategy. As illustrated in Fig. 3, portfolios concentrated purely on high-dividend companies tend to be skewed toward firms with heavier debt loads, lower returns on capital, slower growth, and a higher risk of bankruptcy, all of which can weigh on long-term performance.

Figure 3. Fundamental characteristics of HQAM Quality Dividend Portfolio, Vanguard High Dividend Yield Index Fund and MSCI World Index (as of 20/10/2025)

The biggest risk in dividend investing is the yield trap, when an apparently attractive yield actually reflects deteriorating fundamentals and an elevated risk of a dividend cut. After all, a stock’s yield rises when its price falls, and prices often decline for good reasons: shrinking margins, weakening demand, excessive leverage, or a fading competitive advantage. Chasing the highest yields can inadvertently concentrate a portfolio in companies already under financial stress. Such firms sometimes maintain payouts longer than they should, further worsening their underlying financials. In the end, shareholders suffer twice: first through capital losses, and later through a dividend reduction.

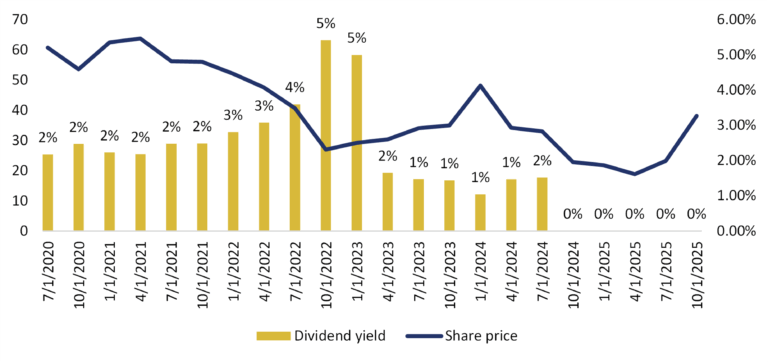

There are plenty of such examples in the history books. A prominent one is Intel, which cut its dividend by 66% in early 2023, which was anticipated by the market, as evidenced by its unusually high 4–5% yield preceding the announcement (Fig. 4). Later, in 2024, the company suspended its dividend altogether due to mounting financial strain.

Figure 4. Dividend yield and share price developments of Intel

In contrast, dividends of Quality companies are supported by strong balance sheets and consistent cash flows, making them far more sustainable. Moreover, given the favorable growth prospects of Quality firms, these companies are also well positioned to increase their dividends over time.

Combining Quality and Dividends

Dividend investing appeals to many. Who doesn’t like cash arriving in one’s account regularly? However, dividends alone do not guarantee wealth creation. Without a solid underlying business, a dividend can be cut, suspended, eroded by inflation, or financed with growing debt. This is why pairing dividend investing with Quality investing, putting an emphasis on durable economics, resilient cash flows, and sound balance sheets, is so important. Dividends distribute value, but Quality creates and protects it.

References

1. https://www.spglobal.com/spdji/en/research/article/a-fundamental-look-at-sp-500-dividend-aristocrats/

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.