What’s up on the stock market?

The markets have erased all the gains they made on the optimism following Trump’s election and basically are now in the freefall after Trump has launched a global trade war. Tariffs and significant uncertainty regarding the governmental setup have greatly impacted the markets. Growth stocks, particularly in the technology sector, have been hit the hardest. Further uncertainty as retaliation comes in and negotiation process as well as recession becoming a probable realistic scenario, rule on the financial markets, quickly shifting investor mood to the ‘extreme fear’.

What is the deal?

So, what problems is Trump trying to solve? Issues in the U.S. have been building for years, but they were not really radically approached to be solved by previous US government. Concerns such as a massive budget deficit, a growing current account deficit, and the declining contribution of the manufacturing industry to added value are on the table for the Trump administration.

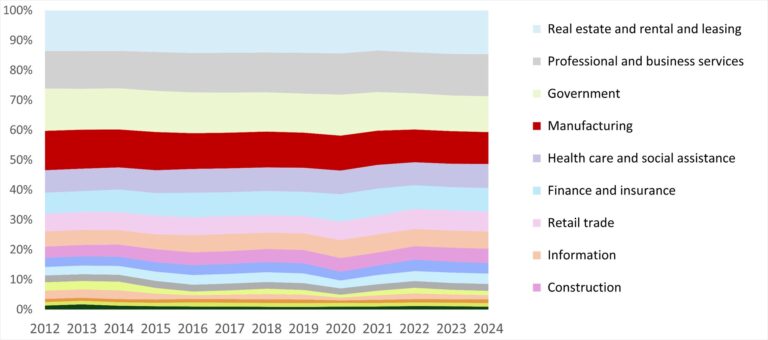

The manufacturing sector’s share of total U.S. GDP has declined by 20% over the past decade, making it the most visibly affected among the country’s largest economic contributors.

Figure 1: Industry contribution to GDP in US

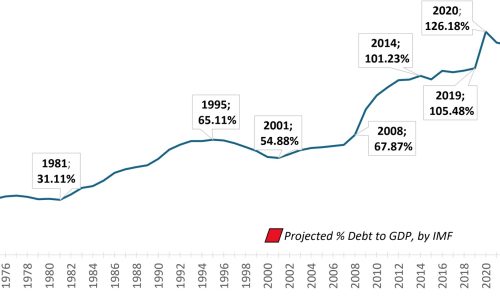

Meanwhile, U.S. federal debt continues to grow. As highlighted by Federal Reserve Chair Jerome Powell, its current trajectory is unsustainable. In 2024, the debt level surpassed 120% of GDP. While this is still below the levels seen in Japan, it is clear that action is needed to address the issue and reduce the refinancing burden, especially with relatively high interest rates.

Figure 2: Federal debt in % of GDP

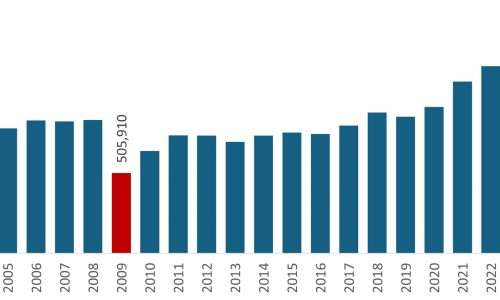

The trade deficit is also on a concerning path, showing consistent growth—further exacerbated in 2024 by the anticipated introduction of tariffs. The largest trade imbalances exist with China, the EU, Switzerland, and Mexico.

Figure 3: US Trade deficit, mUSD

The plan to address these issues includes higher tariffs, a weaker dollar, foreign governments holding U.S. Treasuries converting them into 100-year bonds, and lowering borrowing costs for U.S. industries. Security may now serve as a bargaining tool, with reduced U.S. payments to NATO leading to increased defense spending by other countries. This strategy could be referred to as the Mar-a-Lago Accord (MALA)—a play on historical economic agreements such as Bretton Woods and the Plaza Accord, both of which had a significant impact on the global financial system.

Are we heading towards economic crisis?

Although the primary goal of the Trump administration is to Make America Great Again, markets worry about a potential recession now not only in the US but also globally, which has become quite probable given tariff impact on the US economy and on global trade.

At present, the hard data the Fed focuses on remains robust: inflation has been tamed, and the labor market is still resilient. However, warning signs are emerging in leading indicators. Consumer sentiment has slumped, as households grow increasingly concerned about the inflationary impact of Trump’s tariffs. While manufacturers experienced a surge in orders earlier this year—driven by customers stockpiling ahead of a potential trade war—ongoing trade uncertainty is now causing delays in investment. At the same time, businesses are already reporting rising costs and are preparing to raise their own prices once again.

What does it all mean for stock portfolios?

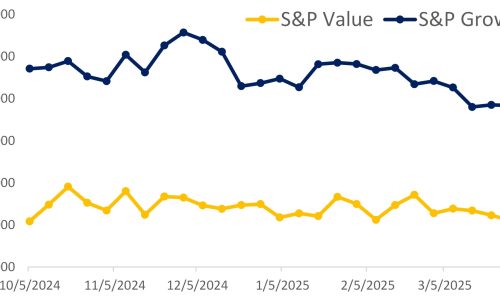

We expect downside pressure on the market and increased volatility to persist as uncertainty remains high, tariff impact is being assessed and tariff retaliation is coming into play. However, valuations have come down, with particularly sharp declines in growth companies, as well as cyclical ones and the ones being exposed to import/export operations.

Figure 4: Valuation levels (PE) of S&P Value and Growth indices

Historically, the quality investing tends to provide some protection in times of increased volatility. As shown in the chart, quality stocks tend to outperform non-quality stocks when volatility rises.

Figure 5: Quality/Non-Quality in the different volatility environments

Companies with strong economic moats and stable financial conditions usually more resilient. In the current environment limited exposure degree to import/export matters, too. While no company is immune to market downturns, current conditions may present a buying opportunity. Companies that were previously expensive are now trading at a discount relative to their historical valuation levels.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.