Every year, we thoroughly review our portfolios with the intention of improving decision-making and minimizing flaws in the investment process. Here is a list of factors we would like to particularly emphasize this year.

Trends are important, but…

Does anyone remember Clubhouse? This was an extremely fast-growing yet short-lived social network, which aimed to create a kind of discussion club. It gained 10 million users and a valuation of 1 billion USD in just eight months, largely boosted by COVID-related isolation.

Trends are widespread phenomena that exert a significant influence on our lifestyles and, even more so, on investing. Assessing the strength and longevity of trends, which may result in a one-time boost to outcomes, is a crucial task for each investor. To a great extent, trends are shaped by external factors. Classical examples include COVID-19 and high gas prices and then, they are short-lived. Numerous companies in healthcare and the sports goods sectors benefited greatly during the global pandemic: Moderna, AstraZeneca, DiaSorin, Lululemon. When relevant trends faded away, the companies faced pressure as their inflated results and stock prices normalize. Similarly, companies offering solar energy solutions saw increased demand during periods of high gas prices, but now results are returning to normal.

Some trends are imposed by regulation and, in this case, the trends are relatively artificial, lasting only as long as the regulation requires. A vivid example would be companies striving to become greener, better employers, or more significant contributors to society. Surely, for many companies becoming more sustainable in its operations is a natural development, though in many cases it translates into significant financial burden. Some trends are being naturally developed by the society and then, they are more sustainable and long-term. Theу are the so-called mega-trends such as digitalization, mobility, ageing, which are giving long-term support to the IT companies as well as to health care firms, which performed exceptionally well during more than a decade.

Figure 1: Current mid-term trends

Mega-trends are well-known to everyone, serving as global tailwinds for businesses and economies. Mid-term trends, which provide a substantial boost to companies’ results, should be familiar not only to marketing experts but also to asset managers. We have compiled a list of current trending topics (Fig. 1), which should be monitored carefully to detect any signs of exhaustion, allowing stock positions to be exited in a timely manner.

Unjustified valuation

Determining the “right” valuation is perhaps one of the most difficult tasks for an investor, as no universal rule applies. Ultimately, however, a company’s valuation is always tied to its quality and growth prospects. High-growth companies require particular caution, as any challenge to their outlook can result in a sharp reduction in their price premium. Conversely, a company may not be regarded as high-growth, yet it may still command a significant premium due to its perceived quality, market leadership, and business stability. Over time, however, issues can arise that fundamentally alter its operating environment.

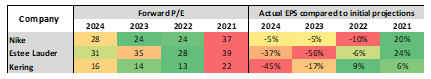

Competition is one such factor, as seen with Nike, whose dominant position is being challenged by smaller sneaker brands appealing to younger consumers who want to stand out from the crowd. Other companies may begin to face deeply rooted brand perception problems, as evidenced by Kering’s Gucci, which has lost some of its allure amid the “quiet luxury” trend.

Or flaws in the business model may become apparent when key markets or sales channels are disrupted by external forces, as was the case with Estée Lauder, which was heavily dependent on Chinese shoppers and travel retail—areas that have yet to fully recover after the pandemic.

Figure 2: Valuation squeeze due to fundamental deterioration of business model

Regardless of the reasons behind valuation compression, the strategy to avoid such pitfalls lies in diligent, forward-looking analysis of the investment case and associated risks, along with careful assessment of the margin of safety. A simple rule of thumb is: if a company is valued at a premium but faces considerable uncertainties about its future, it is wise to remain on the sidelines. While this approach may lead to missed opportunities, prudent risk management should always come first.

Corporate Governance once again

We have always been advocates for a strong corporate governance culture, and we integrate this factor into our investment decisions. Our research team is located in Latvia, where the added value of corporate governance is clearly evident, as companies in developing countries gradually adopt best practices to be in line with OECD principles. This shift has contributed to improved financial and equity performance over the last 10–15 years.

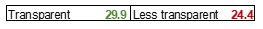

Corporate governance and transparency are equally important when investing in developed countries. We particularly want to highlight Japanese companies, where more transparent firms tend to attract greater investor attention and achieve higher valuations compared to their less transparent peers. Currently, the price-to-earnings (P/E) ratio is 22% higher for more transparent Japanese companies.

Figure 3: Valuation gap between transparent and less transparent businesses

In markets where transparency is not a primary issue due to the scrutiny provided by market participants, attention should instead be focused on management communication. When adjectives like “incredible” appear frequently in an earnings call transcript, yet the results are mediocre or barely meet expectations, suspicions of hyped valuations can arise. The communication style of the management team, especially its conservativeness regarding outlook provision, should be monitored and critically assessed. This approach helps investors avoid painful stock declines when the market ultimately takes off its rose-colored glasses.

Cognitive bias – the hardest to handle

Behavioral economics is an important consideration when investing. Cognitive biases are extremely difficult to overcome, especially given the degree of uncertainty that is pronounced in the short term. Almost every investor in individual stocks has faced the dilemma of whether to sell a stock that has already been beaten down (reminder: the bottom is always zero!) or whether to buy a stock now that has already doubled in value this year. In such situations, hard facts should guide the decision-making process. Is the valuation adequate given the company’s growth level? How strong is the economic moat? What are the probabilities of the associated risks? While understanding these factors will not provide a 100% foolproof basis for decision-making, it can substantially decrease the influence of cognitive bias and help investors at least partially tame their emotional responses. If coupled with a strict investment process, the effects of cognitive biases should be minimized.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.